A young startup named Menachain Solutions DWC-LLC is building a cryptocurrency and blockchain-based payment platform targeted at the Middle East and North Africa (MENA) region and its large population of unbanked.

Based in Dubai, the United Arab Emirates (UAE), Menachain says it is focusing on developing “the most commonly used cryptocurrency in MENA” with the purpose of supporting the region’s digital transformation and serving its large population of unbanked.

84% of MENA’s population are unbanked, according to the company, totaling 440 million people. It aims to provide consumers and businesses in the region with a fully Islamic Finance compliant and convenient payment solution, allowing users to transfer money and pay for daily purchases in a secure, fast and decentralized way.

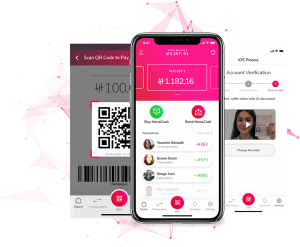

More precisely, the startup is developing the MenaPay ecosystem which comprises three key components:

- MenaPay: a payment gateway for online and offline money transactions;

- MenaCash: a USD-backed stablecoin built on a private blockchain to be used on the MenaPay payment system, and;

- MenaPay token: a utility token.

MenaPay counts amongst its board members the princess of the Kingdom of Saudi Arabia (KSA), princess H. H. Hanadi Ahmed.

Princess Hanadi underlined the potential of MenaPay and how it fits with the Saudi Vision 2030 program, a long-term development plan that seeks to diversify the economy and promote the development of the nation.

“The vision of 2030 of Saudi Arabia aims for the best in all fields. His Highness Crown Prince Mohammad Bin Salman tries to provide the best opportunities for Saudi Arabia to be on the top of leading nations, this is why I expect MenaPay to achieve a huge success, as it goes along with Islamic religion instructions, and as long as its value backed-up by the US Dollar,” Princess Hanadi said.

“MenaPay is what people and companies needed not only in the KSA, but also for the whole Islamic world in MENA. We strongly believe that MenaCash is going to be the most holistic currency in the Saudi Arabia. It will also be the solution for 84% unbanked population in MENA by decreasing transaction time and costs while being transparent and secure at the same time.”

MenaPay is targeting to reach 10 million users in 2019 and claims that more than 50 merchants have already signed up to the service.

The MenaPay project joins other initiatives aimed at introducing cryptocurrencies in the Middle East. These include for instance Arabcoin, a cryptocurrency initiative for the Arab world launched by UAE-based Arabtizor Holdings Inc., and OneGram, a sharia compliant cryptocurrency backed by gold.