The UK’s Royal Mint and CME Group have begun live testing the Royal Mint Gold (RMG), a blockchain-backed digital gold product aimed at providing a new alternative way to trade physical gold that is cost-effective, convenient and assured.

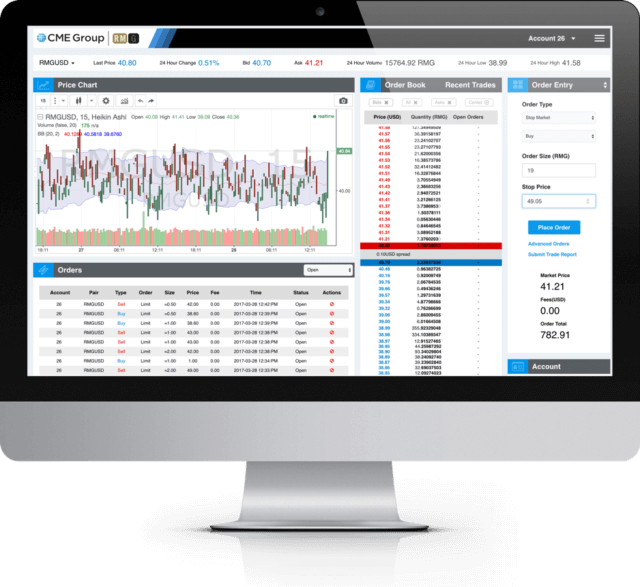

The CME electronic platform for RMG, powered by AlphaPoint, is being tested with institutional traders. It represents the first institutional trading platform for digital gold.

Vin Wijeratne, CFO of the Royal Mint, called distributed ledger technology “a game changer,” noting that the organization has been looking forward to supplying gold on a blockchain.

“Developing a trading platform with CME Group will satisfy customer demands for faster, cost effective and secure ways to buy, hold and sell gold and complement our existing products,” Wijeratne said. “This landmark partnership allows us to combine the world’s leading mint, the best commodities futures trading platform globally and best in class technology.”

Each RMG represents ownership and full title to 1g of physical gold bullion sitting in the Royal Mint vaults. Through the platform, investors and traders will be able to trade RMGs using their digital wallets as well as as redeem their RMGs for physical gold bars and coins produced by the Royal Mint, with physical delivery.

The Royal Mint plans to launch the product backed by up to US$1 billion in gold bullion later this year.

CME Group, which is responsible for developing and operating the RMG’s digital platform, has partnered with blockchain startup AlphaPoint to provide the trading platform. The group has also been working alongside BitGo, the developer of the blockchain code, to develop the architecture, rules and parameters of the platform.

According to Sandra Ro, head of digitization at CME Group, the new blockchain product offers an entirely new trading ecosystem for gold, providing speed, security as well as transparency of direct ownership.

Ro added that one of the key aspects of making this distributed ledger technology as effective as possible was to release it as open source code ahead of its launch.

“We are open sourcing elements of it but we don’t want to give the illusion that this is an open network. It’s not initially,” Ro said. “It’s a permissioned private network, and we’re going to be allowing for some of the source code – which is based on Bitcoin anyway and which is already open source – to be enhanced and modified.”

Early responses to RMG and the technology have been positive, Ro said. She added that a broad cross-sector of market makers were currently testing the system.

“For us to have that diversity of client base is going to be important,” Ro said. “What we need are people who are not only going to buy and hold RMGs from a long-term perspective, but we also need people who are going to help the secondary market grow.”