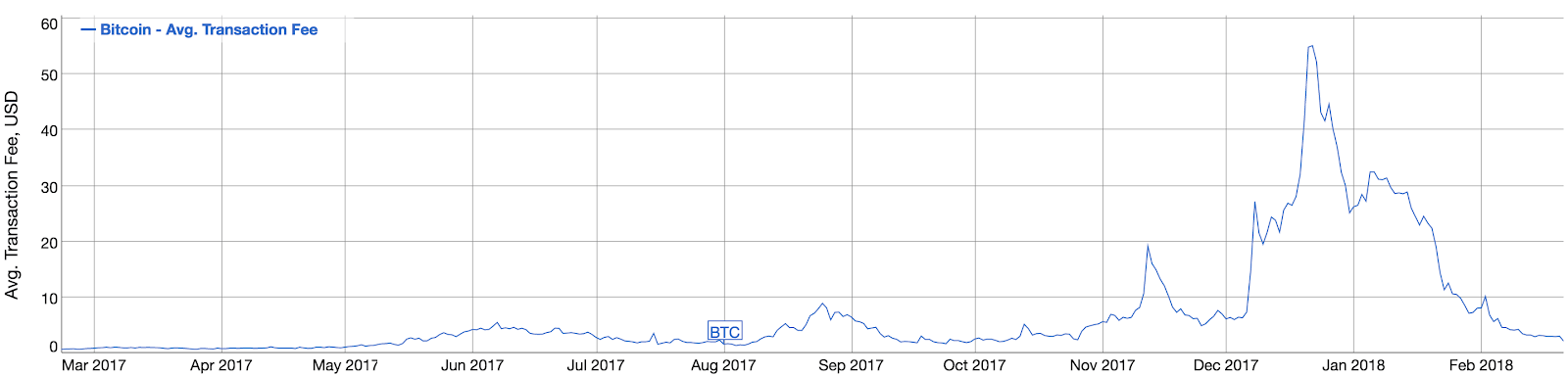

To many regular participants in the Bitcoin economy, there may have been a sense that in the final months of 2017 transaction fees were rising quite significantly. There was a noticeable increase in transaction traffic across the latter part of the year, with an initial spike of high fees in late November preceding a huge rise in mempool activity throughout December. This high traffic results in upwards pressure on required fees; as transactions with lower fees fail to confirm, wallet fee selection pushes users to higher and higher fees in order to get a transaction confirmed promptly. This feedback effect resulted in a significant backlog of unconfirmed lower-fee transactions through December and January which have only recently cleared.

Stories circulated citing extreme examples of high bitcoin fees, with certain cases claiming fees exceeding the total funds sent. The growing costs prompted increasing community discussion of best-practice for fees, segwit adoption, transaction batching, and some debate over the practices and responsibilities of the largest Bitcoin companies. We also began to see first glimpses of the developments with the Lightning network, which has been touted as a future solution for handling greater transaction volume without high fees.

The last period of high mempool activity coincided with Bitcoin prices reaching all-time highs, resulting in the equivalent fiat-cost of transactions skyrocketing. As an example, at the height of the high traffic in December, fees of over 1000 satoshis per byte were required for inclusion within the next block. For a standard, non-segwit transaction with minimal inputs and outputs that would result in a fee of ~0.005BTC. With Bitcoin prices around $15,000 as they were at that time, those fees were ~$75. As fees are paid in Bitcoin the dollar-cost of transactions is unavoidably linked to the current exchange rate.

bitcoin transaction fees are pushed up by demand and some participants will always be willing to pay greater and greater amounts in order to ensure their transaction is confirmed in a short period of time. Total transaction value doesn’t directly impact the fees paid (transaction fees are linked to the size of the transaction in bytes) however, participants sending transactions of greatest value are likely to be willing to pay the most to prioritise their transactions. This effect will likely only increase further if Bitcoin prices continue to rise in the long term, as the utility of Bitcoin as a means for larger settlement develops. Increasing sophistication in wallet fee selection can make a huge difference for users, and the growing number of tools available to help manually select an appropriate fee make navigating the developing fee market a great deal easier.

Blockspace on the Bitcoin blockchain is a scarce resource by design; each block is capped at a few thousand transactions. This design feature is argued to be important in encouraging the development of a competitive fee market to ensure the long-term security of the network. In the distant future when the block subsidy is over, miners will solely be rewarded by transaction fees for their work securing the blockchain. Each “halvening” slowly increases miners reliance on transaction fees collected to boost revenue as Bitcoin steadily approaches the limits of its fixed supply.

Today it is once again incredibly cheap to transact with Bitcoin, even if disregarding the lower Bitcoin prices. At the time of writing, ~10sat/B are confirming within a reasonable timeframe; segwit adoption continues with some of the largest exchanges now utilising segwit-P2SH addresses and there are now over 800 mainnet Lightning nodes active with capacity increasing daily. Fees are an unavoidable part of using Bitcoin, but most of the time they continue to be incredibly good value in comparison to fiat-equivalents, and future solutions like Lightning will only increase this utility.