-

Bitcoin’s adoption is at an early stage, according to Wells Fargo

-

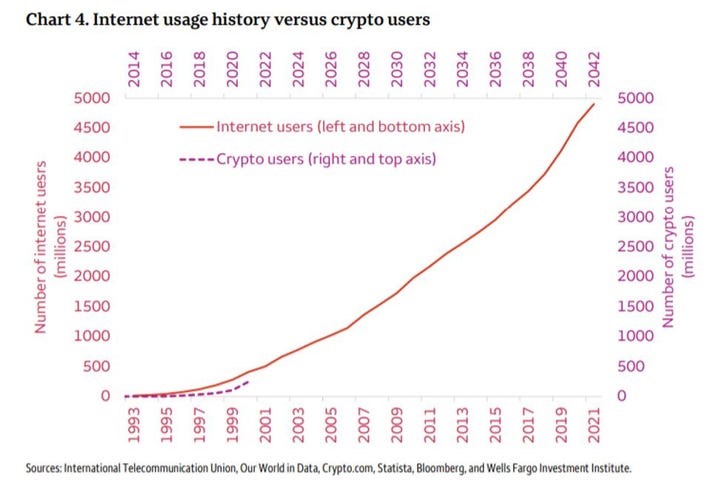

Like the 1990s, when the internet saw an explosion in mass adoption, crypto is set on a similar trajectory

-

Marcus Sotiriou, an analyst with London-based digital asset trading platform GlobalBlock, says “it’s only a matter of time” before major banks and companies still on the sidelines join the crypto bandwagon.

Multinational financial services firm Wells Fargo this week published a report that was highly bullish on cryptocurrencies, suggesting that it’s only a matter of time before we see an explosion in crypto adoption.

The banking giant looked at the adoption of the internet in the 1990s and the current trend for Bitcoin and other digital assets to conclude that crypto is on a path to exponential growth and adoption.

According to the company, crypto’s “adoption percentages” today mirror those recorded during the nascent years of the internet. With use cases in the digital asset space getting the recognition that they deserve across the globe, Wells Fargo predicted that people are quickly embracing the technology.

But at just 3% of the global population, or about 221 million people, the future is bright for crypto should the trend hold and reflects that seen with the internet, the report added.

Chart showing internet usage compared to crypto user growth. Source: Wells Fargo

Chart showing internet usage compared to crypto user growth. Source: Wells Fargo

While Wells Fargo expects crypto to “hit a hyper-infliction point” not far in the future, its call also includes a warning that many projects will likely also fail.

Sotiriou: Just a matter of time

Some of the world’s largest banks still hold a negative outlook for Bitcoin and other cryptocurrencies.

But Marcus Sotiriou, an analyst with UK-based GlobalBlock digital asset trading firm, believes this won’t be the case for long.

According to him, the likes of Bank of America will soon take a different stance on crypto as did JPMorgan, led by its CEO Jamie Dimon.

Institutional investors are already increasingly interested, the analyst points out. This week, KPMG Canada became the lasted when it revealed it had added Bitcoin and Ethereum to its treasury.

Bitcoin price

Bitcoin could be a primary beneficiary of the massive adoption, GlobalBlock's Sotiriou noted on Friday.

Bitcoin’s retreat from highs of $45,500 this week means bulls are facing prospects of further weakness. The outlook, according to Sotiriou, is likely to be exacerbated by the broader sentiment across markets following yesterday’s hotter than expected US inflation data.

He also notes that the rejection after BTC/USD jumped nearly 40% since its January lows suggest bulls need will to bounce above this week’s intraday highs and hold off sellers to confirm a bullish continuation.

BTCUSD was trending around $43,643 at the time of writing.