Key Takeaways

- We spoke to a five-person panel of experts on the topic of cryptocurrency trading addiction

- Experts agree there is almost no difference between crypto trading addiction and gambling addiction

- Worst affected demographic for gambling addiction is young males – the very same demographic that is most likely to pursue crypto trading

- Influencers promoting crypto to their followers were unanimously criticised

- Heightened volatility of crypto a big allure for addicts, experts agreed

- Regulators must do more to prevent addiction; obligation to act more responsibly

- Only 1 of our 5 experts said the world would be a better place without either gambling and/or crypto

I love cryptocurrency. I think Bitcoin can make this world a better place. I believe the innovation happening in the wider cryptocurrency industry can impact a lot of sectors, economies and lives in a positive manner.

But crypto has a dark side too.

We have seen with the recent market crash people losing college funds, life savings, and money they borrowed from friends and family. There are sombre tales of people self-harming; there are mental health fallouts and there is a lot of pain.

Addiction is a very serious illness that not only affects the individual but also their friends and family. We wanted to assess addiction to crypto trading, a topic which is relatively under-covered in mainstream media, and how close the similarities are to gambling.

Meet our experts

Not only did we look into the data for this, but we also interviewed a panel of experts. Their bios and qualifications are as follows.

- Dr. Mark Griffiths – Chartered Psychologist and Distinguished Professor of Behavioural Addiction at the Nottingham Trent University

- Dr. Jeremiah Weinstock – A professor in the Psychology department at Saint Louis University, focusing on addictive behaviours with an emphasis on gambling disorder and exercise as an intervention.

- Dr. Lia Nower – Professor and Director of the Center for Gambling Studies at Rutgers University

- Dr. John McAlaney – Chartered Psychologist, Chartered Scientist and Professor of Psychology at Bournemouth University.

- Tony Marini – Lead crypto therapist at Castle Craig Addiction Rehab Clinic

Similarities to gambling addiction

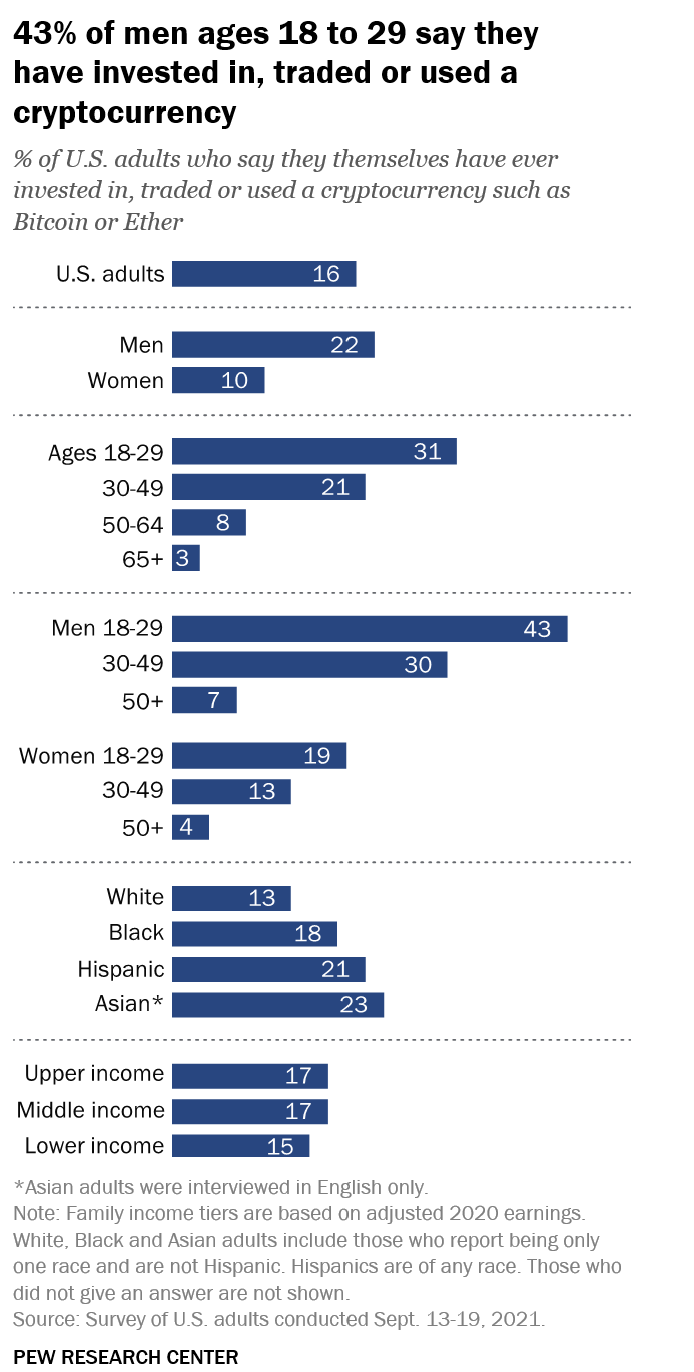

Firstly, according to much research on the topic, the demographic most at risk of developing gambling addictions is typically younger males. When looking at a study conducted by Pew Research, this correlates with the most popular demographic of crypto investors. A chunky 43% of men aged 18-29 had invested, traded or used crypto, compared to 16% of the overall population.

The second factor of note is how similar gambling is to a lot of cryptocurrency investments. Once you move out on the risk spectrum into the realm of altcoins with low market caps, murky use cases and anonymous founders, returns can either be outsized (10X +) or zero (most of these coins eventually go under, some suddenly). This is the same payoff profile therefore as a conventional bet.

“Both cryptocurrency and gambling share a degree of risk”, said Dr McAlaney. “This is something that people can find exciting and can draw them into the behaviour. In addition, both gambling and cryptocurrency can involve a degree of skill, and in turn can result in profit” he added.

“In both cases, it is only a minority of people who are successful” he caveated – and therein lies the problem.

Dr Nower summed up the similarities in a succinct manner, asserting that crypto trading and gambling addictions are one and the same. “They are not different addictions. Trading cryptocurrency can be one form of gambling addiction” she said.

“Gambling is risking something of value (money) on an uncertain outcome with the hope of making a profit. People who frequently trade crypto (versus holding crypto as an investment) are gambling”.

Indeed, the consensus among experts was that there was not much distinction between gambling and crypto addictions. The psychological aspect, the risk profile, the uncertainty and the rush are all common themes in both.

The treacherous self-assurance that one can “beat the bookie”, or “beat the market” also holds a tight grip on the subconscious of participants in both industries.

Crypto addiction’s growth moving forward

Crypto, remember, has only been around for a few years – and only in the mainstream for a very short amount of time. It makes sense, therefore, that the dangers are not prominently covered as they are for gambling addiction. But as crypto continues to grow, can we expect the problems to grow?

The consensus appears to be yes amongst our panel of experts.

Dr Griffiths says that situational factors are also an issue. “Situational characteristics include things in the environment that might influence engaging in the behaviour. In the case of gambling, this would include things like the number of gambling venues in an area, the marketing and advertising of gambling, and easy access to gambling like being able to gamble on your smartphone”.

He sums up the problem with a neat analogy. “When it comes to gambling addiction, very few people become addicted to playing a bi-weekly lottery game (because there are only two draws a week and is a discontinuous form of gambling) whereas far more people become addicted to slot machines because if a person has the time and money, they can gamble again and again and again (and is a continuous form of gambling)”.

In the context of the above, it seems likely that as cryptocurrency continues to grow – which to date it has been doing at a rate similar to the Internet in its early days – addiction will also pick up alongside it. Exchanges are popping up seemingly daily, adoption is increasing and numerous derivative products and services are being created – this all combines to increase access to markets.

It also should be noted that cryptocurrency trading is 24/7. Unlike conventional finance markets, the crypto market never closes. Similarly, like in sports betting where one can only bet if an event is on, there are no “off hours” in crypto.

Influencers promoting crypto

With conventional wisdom being backed up by expert opinion here, something else struck us as curious. Why are influencers allowed to pedal obscure cryptocurrencies to their followers, promoting these coins for a fee?

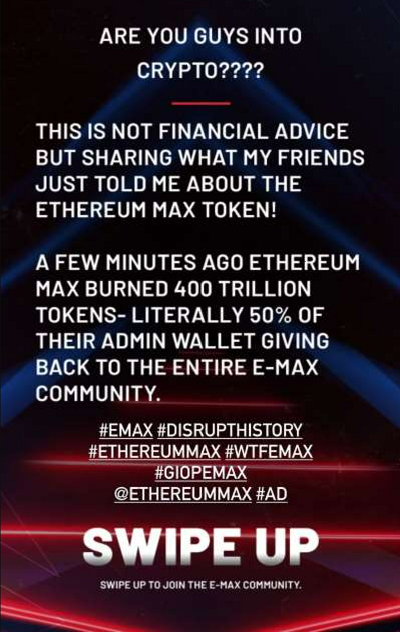

“Are you guys into crypto”, Kim Kardashian wrote in an Instagram post to her 228 million followers last June. She then proceeded to promote Ethereum Max, an apparent copy-and-paste cryptocurrency that has since fallen 99%.

At least one party wants repercussions for the reality star. A class action lawsuit has been filed against her for participating in a pump-and-dump scam, with the token falling 99%. Of particular concern is the demographic of Kardashian’s followers, many underage and impressionable.

The consensus among experts here was near-unanimous disgust that influencers are so ready to exploit their followers. Marini decried that influencers “only care about money and not people’s health”. Dr Nower said influencers “pray on the FOMO in the average person”.

Dr Weinstein also made the interesting point, linking to our previous section on situational factors, that “(influencers) promotion of these currencies does increase perceived availability. Availability is a necessary component of developing an addictive disorder”.

Dr Griffiths echoed this sentiment, highlighting that influencers are key in the acquisition process. “Influencers (in the outline of the different characteristics influencing addiction above) are situational characteristics that explain how individuals may start trading in the first place”

With the disdain towards influencers from those working with addicts every day palpable, it’s striking at the total lack of repercussions they face. While we mentioned the lawsuit against Kardashian above, it appears unlikely anything impactful will come from that, and a bevvy of posts could be seen from similar celebrities throughout the bull run.

Crypto volatility and mental health

It’s well known how volatile the world of crypto is. Prices can spike in an instant but also crash hard – as we have seen this year. We wanted to assess how much this volatility affects the extent of the addiction and the impact on mental health.

The consensus was that, while volatility is far from the only factor causing a mental health burden, it was an important aspect. “For some individuals the volatility will be exciting and they will chase the thrill of trying to “time” the market”, Dr Weinstock said. He further cautioned that “As individuals tie their crypto investment into their identity it affects self-esteem and contributes to depression and anxiety”.

Dr Nower cautioned the “addictive cycle” that volatility can foster, “preoccupation, feelings of withdrawal, tolerance (need to buy more to feel the same level of excitement), chasing (buying more to recoup losses). It can completely consume someone mentally such that they neglect people and responsibilities in their lives”.

It makes sense. The dopamine chase, the adrenaline rush, and the sense of engagement is all heightened when prices are moving a million miles an hour. In cryptocurrency, there is rarely a quiet day – meaning a rush can be easily obtained.

Legislation and crypto addiction

With the scourge of addiction so strong – and crypto far from immune – it is important to focus on some aspects that may prevent one from falling into addiction.

The first theme to emerge from experts’ answers was the responsibility of companies involved to do more. “Cryptocurrency industry should follow the lead of the NYSE and other stock markets in that they promote the idea that money in the market is an investment not a get rich quick scheme” Dr Weinstock pleaded. Dr Nower said, “I think they should be better connected with resources to help problem gamblers but, of course, they don’t want their product to be viewed as gambling”.

Another factor we were curious about was the age limit. Asking whether a minimum age requirement should be instilled for crypto trading, as it is for gambling, most experts were in favour.

Dr Nower said “Setting an age limit for these things could protect some younger people who tend to be more impulsive”, while even saying she would go as far as doing the same for risky stocks.

Dr McAlaney was also in agreement, but cautioned that “this is extremely difficult to regulate”, adding that “the type of person who becomes interested in cryptocurrency is quite often the kind of person who understands and knows how to circumvent computer systems”.

Dr Weinstock suggested that the “cryptocurrency industry should follow the lead of the NYSE and other stock markets in that they promote the idea that money in the market is an investment not a get rich quick scheme”, while all our experts pointed out the general lack of regulation across the market at large, not just around addiction. “It should be regulated to start with”, Marini put concisely.

Dr Griffiths pointed out that “Any service provider who has a product that can be potentially problematic and addictive has a duty of care to its clientele”. But it appears the consensus is that companies are not doing their part in this regard. “Obviously individuals have to have some responsibility for their actions, but that doesn’t mean gambling companies and trading companies should be absolved from their own responsibilities”, he added.

Interestingly, only one of our five experts asserted that the world would be a better place without either gambling or crypto – highlighting that we should be policing, regulating, helping and studying this problem, rather than outright banning it.

Conclusion

We believe the research here shows that cryptocurrency trading addiction is a very dangerous and real affliction. There appears to be almost no difference between it and gambling addiction. Yet despite this, the attitude among mainstream media, influencers and the public does not account for these pitfalls in the same way gambling advertisement or endorsement would normally be caveated.

With crypto exploding onto the mainstream and showing meteoric growth, even despite the fall in prices this year, the industry is not going anywhere. That means, unfortunately, that trading addiction is not going to disappear either.

It’s time that we acknowledge what a problem this is, and begin to try to address it.

The above is a summary of the interviews we held with five experts on the topic. For the full Q&A’s, please see the below links:

- Dr. Mark Griffiths -> here

- Dr. Jeremiah Weinstock -> here

- Dr. Lia Nower -> here

- Dr. John McAlaney -> here

- Tony Marini

If you, or anyone you know, is suffering from a gambling or crypto addiction, please reach out for help. There are a number of resources available online and numbers to call, depending on where you are located, including NCPG, health-tourism.com, problemgamblingguide.com, or please talk to someone you know. We hope this article goes to show how dangerous, but also common, such addictions can be.

Sources

Demographic of gamblers -> here

Crypto demographics -> here