YFL has risen by 1,677% in just two weeks. Can it trace some of YFI/USD’s 100,000% rally since July?

YFL is up 36% in the past 24 hours, with the token’s value likely to test the area above $800 following a spectacular few days. With the DeFi craze still ongoing, YF Link could rocket even further to hit prices above $1,000.

Trading at a low of $12.75 on Aug 17, 2020, YFL has surged over 1677.6% in the past two weeks and more than 360% over the last seven days to hit an all-time high of $745 on August 30.

The crypto market has witnessed massive demand for the token, with the value of the DeFi-backed token jumping from lows of $49 to $500 within a week.

After surging to highs of $295 on Saturday, YF Link soared 150% in 24 hours to touch a high of $745 on Sunday. Although the excitement did cool off somewhat to see it close around $521, the upside has seemingly picked up the pace again.

According to crypto trader and Blockroots.com co-founder, Josh Rager, the YF Link token looked massively underpriced around $500. He believes the token will surge in the next few days to reach $1,000.

“I see new highs w/ pullbacks as YFL breaks 4 digits – many will take profits but will later regret. After LINKSWAP is released – IMO $1000 will be the floor,” he shared.

As of writing, YFL/USD is changing hands around $701. YF Link has a market cap of $34.8 million, with a 24-hour trading volume of $8,762,354 against a circulating supply of 49,155 YFL tokens.

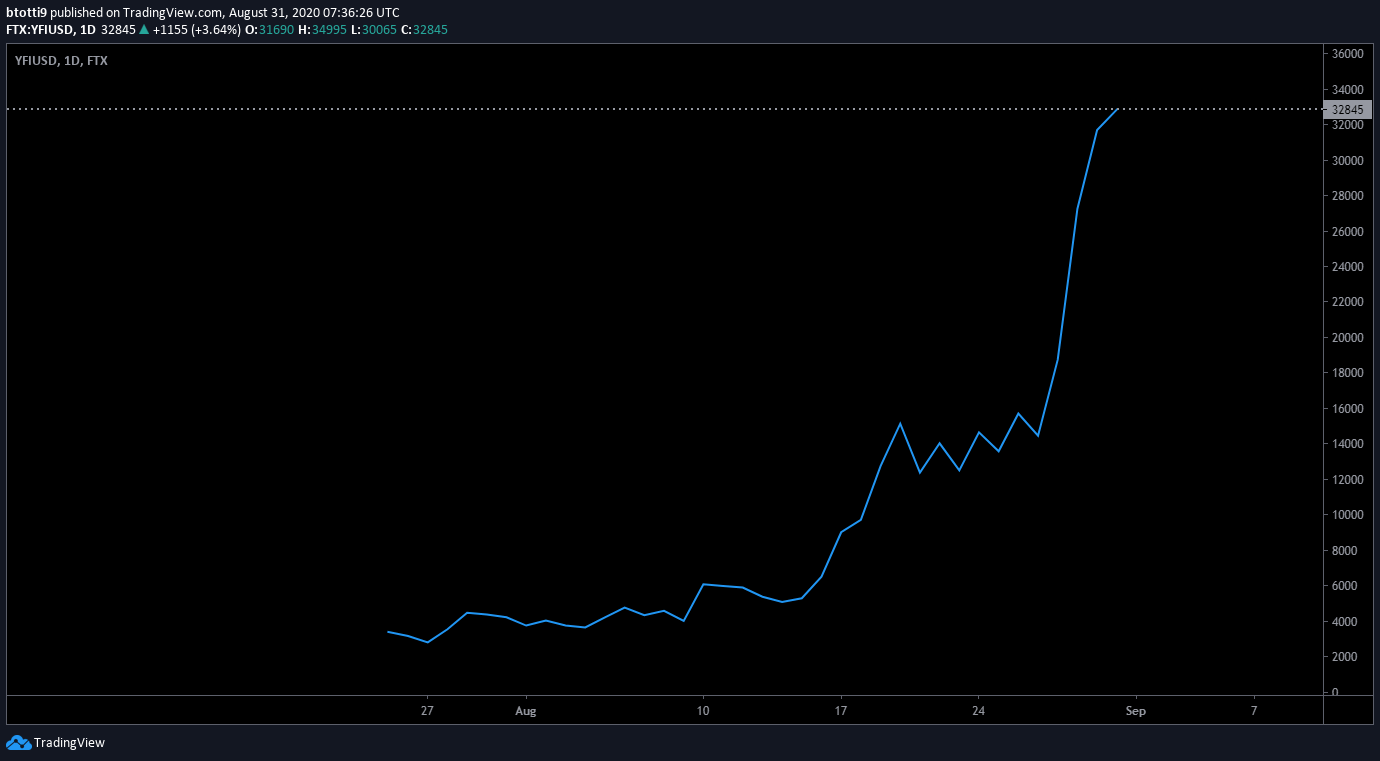

DeFi enthusiasts, in general, are banking on YF Link hitting the unprecedented highs, much like the Yearn.finance token YFI. Having traded at a low of $34 in July, the YFI/USD value has rocketed more than 100,000% since, with 80% of that coming in the past 24 hours on its way to hitting highs of $38,885 on Sunday.

According to CoinGecko data, YFL/USD price is up 5,110% since July 18, and although analysts expect pullbacks, the overall consensus is that Yearn.finance and YF Link aren’t done yet.

YF Link was forked from decentralized finance protocol Yearn.finance. Launched just this month, the DeFi-backed governance token is targeted at giving ChainLink marines direct access to yield farming.

The LINKSWAP platform promises to offer “a community-governed Automated Market Maker (AMM),” which according to this Medium post, will provide ChainLink holders protection against impermanent loss of liquidity.