Wanchain Guide | Learn Everything About WAN

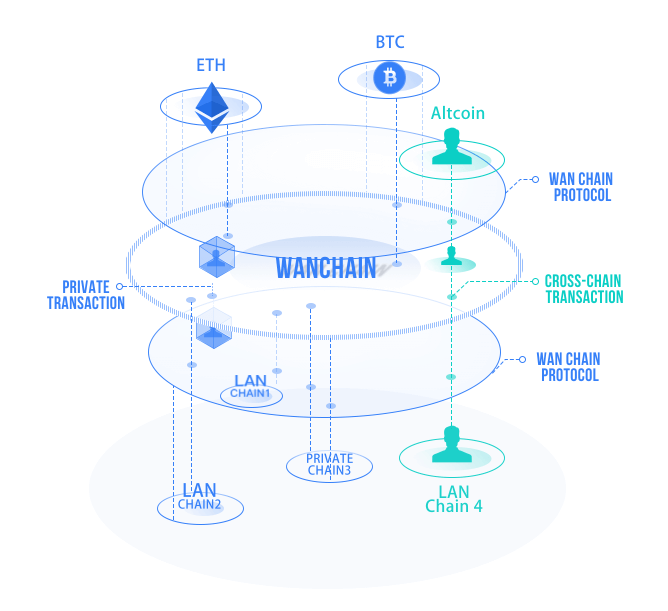

Wanchain is a blockchain and cryptocurrency that’s trying to act as an intermediary between other digital assets. In theory, any organisation or individual can develop and provide their own financial services based on Wanchain, but the first item on the agenda is connecting existing major cryptocurrencies like Bitcoin and Ethereum.

Like the early internet, the lack of interoperability between cryptocurrencies, is a bottleneck on blockchain innovation. Wanchain is a promising solution and exciting investment opportunity that seeks to overcome this.

What is Wanchain?

At its core, Wanchain is a ledger based on the Ethereum network that is designed to support programmable smart contracts. Through a proof of stake consensus algorithm and a three different types of nodes, the network can initiate cross-chain transactions. Wanchain is a speculative altcoin. It’s token sale was only completed in October of 2017. In January, the team launched the mainnet, and in March it was listed on Binance. (This is why Coinmarketcap.com only has Wanchain prices since March) So how exactly does Wanchain bridge the gap between two blockchains? Assuming that both assets are integrated with Wanchain, so they can be uniquely identified, a user can initiate a cross-chain transactions request, using the Wanchain wallet. This sets up a transaction on another digital asset’s network. Let’s use Ethereum as an example. Upon receiving the request, an Ethereum transaction send ether. The recipient is a locked account. A validator node will then verify that the transaction was sent before creating a smart contract token that represents the locked Ethereum on the Wanchain network.

Sending the Ethereum asset back to Ethereum is a similar process, but the whole thing is done in reverse. Since the transaction is initiated on the Wanchain network, we are already dealing with an ETH asset and not actual Ethereum. This time it is the ETH asset that is locked up and verified by the validator node, and then using something called a threshold secret-sharing mechanism an Ethereum transaction is created that moves an equivalent amount of ether from the locked account to the recipient’s account. “In our cross-chain transaction solution, the account locking mechanism doesn’t use two-way anchoring, and doesn’t need additional script extensions to identify and verify the Simple Payment Verification (SPV) proof. All transaction data is transmitted into the node network of the original chain after reconstruction and integration on the Wanchain validator node. The format of the validator node is in line with the transaction type requirements. This enables certain operations and computations of cross-chain transactions to be completed within the Wanchain network, without the need to modify the various original chain mechanisms. This allows existing public and private chains, based on other platforms, to be integrated with Wanchain with a low integration threshold, thus reducing the cost of cross-chain transactions.” Wanchain Whitepaper

One day, Wanchain will be able to exchange all ERC20 tokens. It isn’t limited to tokens and cryptos either. When an unregistered asset is transferred from the original chain to Wanchain, Wanchain will create a new asset using a built-in asset template to deploy a new smart contract based on the cross-chain transaction information. When a registered asset is transferred from the original chain to Wanchain, Wanchain will issue the corresponding equivalent tokens in the existing contracts to ensure that the original chain assets can still be traded on Wanchain. This puts it into competition with altcoins like OmiseGo, Kyber network, Stellar and ICON. If you want more than a superficial understanding of the maths and cryptography at play, Wanchain has a yellowpaper, that goes into how technologies like threshold secret-sharing algorithm, ring signatures and elliptical curve cryptography all secure this blockchain. It is actually a great resource for understanding how blockchains hide themselves behind pseudo-random function inputs to NP problems.

How Does Wanchain Reach Consensus?

There are three different nodes responsible for maintaining the network through a proof of stake consensus algorithm Vouchers – Crosschain transaction proof nodes. Storeman – Locked account management nodes Validators – General verification nodes. Vouchers are responsible for confirming that users have transferred their Wanchain tokens or ethereum from the original to the locked contract. They are compensated for performing this vital network activity. (reward not yet released). What stops them from lying? Vouchers pay a security deposit, that is locked up in a contract. The more tokens a voucher stakes, the more likely it is that their proof will be adopted. This isn’t unlike pow mining where the more you invest in ASICs miners and GPUs the more often you get a block reward. It also means that your ability to attack the network is directly proportional to your disincentive not to do so. If a voucher acts maliciously, their stake is forfeit. “The Storeman, upon receiving a notice, is responsible for computing the signature shares according to its own part of the key and merging the signatures parts into a complete signature for the lock account. When this is done, operations related to the locked account are performed. The Validator informs the Storeman of operational actions related to the locked account and complete the record of operations on the Wanchain whenever a transaction proof reaches a consensus.” Reddit – FAQ

What Does Wancoin (WAN) Do?

Wancoin is the native coin to the Wanchain network. While other digital assets can be sent on the network, using Wanchain for cross-chain and inter-chain transfers consumers a certain amount of Wancoin. Wancoin also has value because a certain amount of them are required to stake on the network. Staking is a form of passive income. The more popular the network, the better the return for stakers. As this happens, the value of Wancoin will increase due to demand for this investment vehicle. Should I Invest in Wanchain? I think that Wanchain is an undervalued altcoin. It is only listed on a single exchange and rarely exceeds 15 million 24 hour trading volume. Considering the scope of the interoperability use case, this is nothing. When we talk about use cases, in this bubble, we are talking about a long term investment. Short term, Wanchain’s investment prospects will be a result of announcements, partnerships, and their progress towards funding ICOs. The team has shown aptitude towards forming partnerships and creating news worthy events. They have a partnership with the well regarded Kyber Network. It is a decentralised exchange and top 100 altcoin. Wanchain are also part of the interoperability Alliance. ICON, Wanchain and Aion have committed to a shared goal of promoting interconnectivity between isolated blockchain networks. An affiliation with ICON, a cryptocurrency that’s almost in the top 20, and Aion a top 50 cryptocurrency, could bring a lot of exposure to Wanchain.

Wanchain Team

The Wanchain team have headquarters in Austin, Singapore, and Beijing. They are a well connected, worldwide corporate bunch . Jack Lu, is the founder of Wanchain and another successful cryptocurrency called Factom. He is also Cofounder and CEO of Wanlu Tech, a Chinese blockchain chain technology enterprise. Before blockchain, Jack Lu was heavily involved in various IT industries.

Dustin Byington, is the President of Wanchain. He also has a rich history in blockchain. In 2014, he founded the Bitcoin college in Austin Texas. In 2015, he co-founded Tendermint and shortly after a company called Satoshi Talent. The Wanchain team consists of some of the most influential people in the blockchain space. They presented at the North American Bitcoin Conference 2018 if you want to see them in action, this is well worth a watch. It is a good thing that the team are trusted, because they are currently running all the nodes. In time they will decentralize their network, but there is no reason to do it before people are going to use it. https://www.youtube.com/watch?v=C6qeBt37750