IQ Option vs Plus500: Which Platform is Better in 2025?

Plus 500 and IQ Option are premier online brokers offering a big selection of financial investment instruments via CFDs. IQ Option came into being in 2013, five years after Plus 500 had been in operation. The two now boast of a clientele base of millions of people, having become a preferred choice for many people looking to invest in the capital markets.

While both are reputable and dependable online brokers, they differ in the way they operate. However, they are both regulated and fully licensed to operate. Let’s see how the two compare.

IQ Option vs. Plus 500: Security

To know whether your money and shared personal information are safe, you will want to know the security measures the online brokers put in place. Both IQ Option and Plus 500 have enabled the 2-factor authentication to add an extra layer of protection on clients’ accounts. The measure is designed to protect against unauthorised access at a time when hackers are upping their game.

IQ Option boasts of a CySEC license that ensures clients within the European Union are well protected in case the company files for bankruptcy. On the other hand, Plus 500 received the license from CySEC to operate in the European Union in 2020.

Additionally, both brokers have added support to reputable deposit and withdrawal methods that also ensure people’s money is well protected. Credit/debit cards and bank transfers offer extremely secure processes for transferring money.

KYC/AML

A credible broker is as good as the measures put in place to curb money laundering activities while also ensuring it only deals with legitimate clients. For this reason, IQ Option and Plus 500 adhere to Know Your Customer (KYC) and Anti Money Laundering (AML) regulations to verify the identity of clients and prevent any illegal activity.

Therefore, both brokers require clients to upload proof of identity documents in the form of passports or government-issued identity cards to prove their identity. In addition, they also require proof of address documents such as recent utility bills and bank statements.

Supported Countries and Location: What’s the Right Broker for You?

Countries worldwide come with different regulations that online brokers must adhere to for licensure. For this reason, IQ Option and Plus 500 are available in some countries and not in others.

For instance, Plus 500 has offices in the UK, Cyprus, Seychelles, Singapore, and Australia conversely able to offer investment services and products in many countries. IQ option also maintains offices in the UK, Australia, and Singapore, from where it also provides financial services.

Plus500 countries

Plus500 is available in the following countries at the time fo writing: Andorra, Argentina, Australia, Austria, Bahrain, Bulgaria, Chile, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, French Guiana, Germany, Gibraltar, Greece, Guadeloupe, Hong Kong, Hungary, Iceland, Ireland, Isle of Man, Israel, Italy, Kuwait, Latvia, Liechtenstein, Lithuania, Luxembourg, Macau, Malaysia, Malta, Martinique, Mexico, Monaco, Netherlands, New Zealand, Norway, Oman, Panama, Poland, Portugal, Qatar, Reunion, Romania, Saudi Arabia, Seychelles, Singapore, Slovakia, Slovenia, South Africa, South Korea, Sweden, Switzerland, Taiwan, United Kingdom, Uruguay. Notably, Plus500 is not available in the US and Belgium.

IQ Option Countries

IQ Options is available in Anguilla, Argentina, Bahamas, Belize, Bolivia, Cayman Islands, Chile, Colombia, Costa Rica, Cuba, Dominica, Ecuador, El Salvador, Fiji, Gambia, Ghana, Guatemala, Honduras, Kenya, Lesotho, Liberia, Malawi, New Zealand, Nicaragua, Nigeria, Pakistan, Panamá, Papua, Peru, Paraguay, Puerto Rico, Philippines Seychelles, Sierra Leone, Singapore, Solomon Islands, South Africa, St. Lucia, Swaziland, The United Kingdom, Uruguay, Venezuela, Zambia and Zimbabwe at the time of writing.

Regulation

Regulatory agencies worldwide regulate online brokers to protect investors from unlawful practices and in case of insolvency. However, it is important to note that most of the bodies regulate the brokers within their jurisdiction. While dealing with a regulated broker, one gets to know in advance the risks involved as well as the process of financial compensation in case a broker goes bust.

Plus 500 is regulated by the UK’s FCA and Australia’s ASIC. On the other hand, IQ Option is regulated and licensed to issue investment products by Cyprus CySEC and UK’s FSA.

What this means is that the brokers are under constant scrutiny by some of the biggest financial regulators to ensure they play by the rules and protect customers’ money and information.

IQ Option Vs. Plus500: Which One Has a Broader Crypto Portfolio?

A growing number of online brokers are increasingly adding support for cryptocurrency trading. While selecting a broker, it is important to settle on one that offers the broadest exposure in terms of cryptocurrencies supported.

IQ Option offers one of the widest pools of cryptocurrencies made up of large, mid and small-cap cryptocurrencies. The number of cryptocurrencies supported differs from time to time. Plus 500 also offers the top six cryptocurrencies via CFDs.

IQ Option currencies

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Dash (DASH)

- Ripple (XRP)

Plus 500 currencies

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Stellar (XLM)

- Bitcoin Cash (BCH)

- Cardano (ADA)

Additionally, Plus 500 offers the ETH/BTC pair as well as a Crypto 10 index for tracking the performance of the 10 largest cryptocurrencies by market cap.

Comparing purchasing methods

Both IQ Option and Plus 500 offer a good number of options to purchase cryptocurrencies on their platforms. One of the options involves purchasing cryptocurrencies paired with fiats such as the British pound, US dollar, Japanese Yen and Euro.

The fact that the cryptocurrencies are traded with Contract for Difference (CFD) means you can open a position, either short or long, using native currency.

Buying and selling Crypto on Plus 500 vs. IQ Option

Trading fees

Trading fees are the fuel that enables online brokers to offer financial instruments, among other services. It is through the trading fees that they also make a profit. While fees eat into profits that one makes on trading, it is important to settle on a broker that charges the lowest fees. To settle on the right broker, it is important to compare all the different fee structures levied by brokers.

Fee Flat Fee

Plus 500 charges a flat $10 fee as an inactivity fee whenever an account is left dormant for several months. The broker also charges a 0.5% currency conversion fee. It also charges overnight funding fees for the position left running overnight.

IQ Option also charges an inactivity fee if an account is left active for 90 days. A swap fee of up to 1.7% may be levied for a position left running overnight.

Deposit and withdrawal fee

IQ Option and Plus 500 don’t charge any fee on deposits. Additionally, they don’t charge any fees on withdrawals.

Broker trading fee

While both brokers are commission-free, most of the fees one is likely to incur arise from the opening and closing of positions. The bid/spread, which is the difference between the buying and selling price, accounts for the biggest fees levied by the two brokers.

The spread levied by the two brokers depends on a number of things, including the underlying market liquidity and volatility. Plus 500 charges some of the lowest spreads on Bitcoin trading; as low as 0.3%. IQ option charges a varying spread that can reach highs of 7% for Bitcoin and 12% for Ethereum.

Payment Methods

Both Plus 500 and IQ options let clients fund their accounts using multiple options, including credit/debit cards, bank transfers, and third-party payment processors like Skrill and Neteller. For withdrawals, one can use the same options used to make a deposit.

Start Trading with our Recommended Platform

Comparing the User Interface of Both Platforms

Trading platforms are at the heart of all the trading that takes place in the capital markets. Therefore, it is important to select a broker while paying close watch to the platform on offer. While analysing a broker, it is important to analyse the features on offer and whether it is user-friendly.

The platform should also come with a simple layout, be simple for anyone to navigate with ease. It should also be possible to customise the platform to meet a given trading regime. Additionally, it is important to pay attention to the user interface.

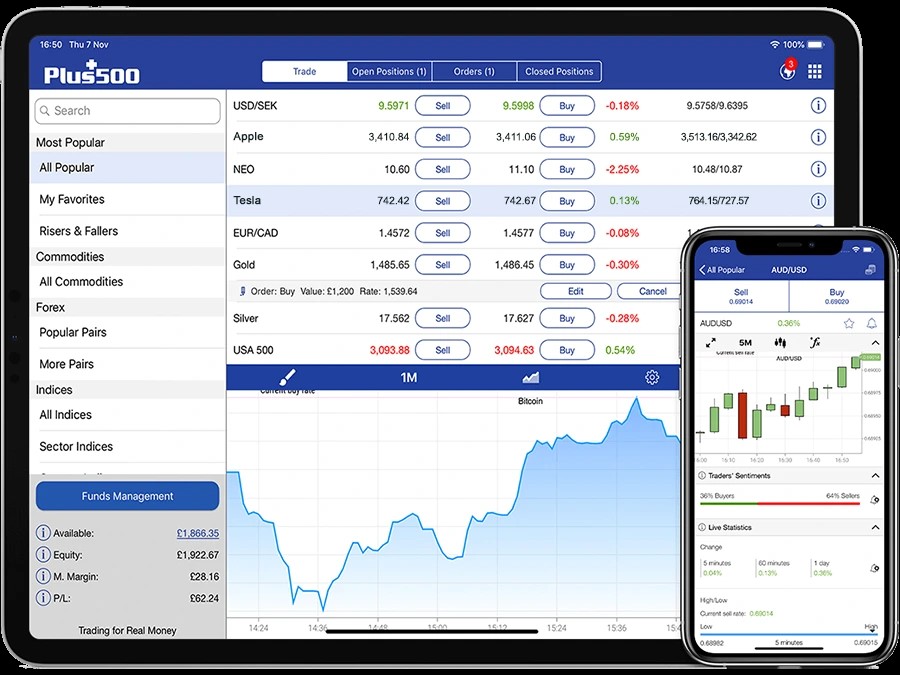

Plus 500 ease of use

Plus 500 offer a user-friendly trading platform with a sleek and more technical dashboard. Its layout is clear and easy to navigate, perfect for beginners to move around with ease. The trading platform landing page comes with trading pairs at the top.

Source: Plus500.com

Additionally, it is much easier to generate a price chart of the various financial instruments at the bottom of the landing page. In this case, one can conduct technical analysis with ease as the chart is highly functional, featuring all the necessary technical indicators.

IQ Option eases of use

IQ option offers an award-winning trading platform that is easy to customise to meet all the trading needs. The platform comes with several tabs for enhanced navigation between news, financial instruments, and portfolio.

Source: iqoption.com

The platform features intuitive tools that add a layer for efficiency and simplicity. A variety of indicators are also on offer for anyone looking to carry out technical analysis. One can also harness the power of a supportive community to make informed trading decisions.

Trading features

Both IQ Option and Plus 500 offer countless chart options and indicators that allow traders to conduct in-depth technical analysis of various financial instruments. Some of the indicators on offer include Moving Averages, Relative Strength Index and Bollinger bands.

Additionally, both brokers offer leverage that requires traders to only deposit a small amount of capital to borrow extra funds to place much bigger positions. Leverage can be an excellent tool for maximising profits with small capital.

IQ Option vs. Plus500: Liquidity and Volume

Liquidity in trading refers to how active a market is and is determined by the number of traders on a given platform. The higher the number of traders, the more the trading volume, and the higher the liquidity levels. The higher the liquidity and volume in a given broker, the easier it is to buy and sell instruments at desired price points.

With over 48 million registered users and over 1 million transactions per day, IQ option comes with some of the highest liquidity and trading volume. Therefore, it is much easier to buy and sell securities at the broker and at the desired price points.

Plus 500, on the other hand, does not require underlying asset liquidity as it mostly offers contracts for differences that track the price of the underlying assets. Spreads on assets such as Bitcoin tend to be tight in times of higher market volume.

Who Offers the Best Customer Support?

A reputable and dependable online broker is as good as the customer support they offer, highly needed to address the issues that clients might have from time to time. IQ option and Plus 500 have invested heavily in customer support teams.

Clients can contact the customer support teams through live chats, phone contact or email contacts. The customer support teams are available 24 hours a day, five days a week, as long as the markets are open.

IQ Option vs. Plus500: Conclusion

Choosing between IQ option and Plus 500 is sure to be an uphill task given that both brokers have been in business for years and have built an impressive track record in offering credible investment products and services.

Plus 500 may be well suited for advanced and veteran traders, given that its trading interface is more technically focused. Additionally, it stands out for cryptocurrency trading, given the tight spreads on offer. In addition, it offers cryptocurrencies through CFDs relieving one of the need of taking custody of actual coins.

On the other hand, IQ Option is a leading online broker for anyone looking to trade cryptocurrencies, binary options, CFDs and forex trading. It comes with a user-friendly trading platform ideal for carrying out in-depth technical analysis on cryptocurrencies and other instruments. It also comes with low trading costs on tight spreads, and zero charges on withdrawals and deposits.