Post-halving prices have stabilised below $8,700. The weekend before the halving, Bitcoin crashed 15% and touched $8,100 and has since struggled to breach $9,000

Bitcoin’s price crashed 15% in the days before the halving and appeared to be hovering below $8,700 afterwards.

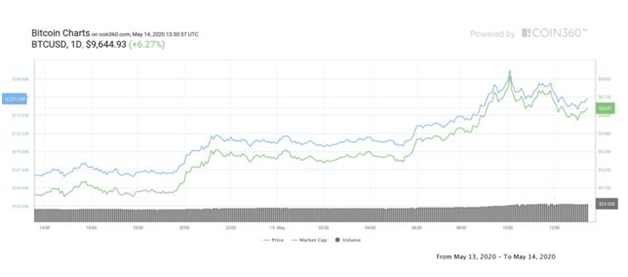

However, despite a grim outlook on the economy from the Federal Reserve Chairman, Jerome Powell, Bitcoin raced past several resistance levels to touch $10,000. Powell appeared to support the $3 trillion stimulus proposed by Democrats, but did announce any plans to introduce negative interest rates as President Trump suggested in a series of tweets on Wednesday.

Despite this, Bitcoin’s bulls took control and broke with the short-term trend of Bitcoin shadowing the S&P 500.

Bitcoin mini-rally fills the largest CME gap

Bitcoin’s push for a new May high saw bulls obliterate losses accrued last weekend as prices rose by 13% in intraday trading. On Wednesday, Bitcoin gained 5.78% to add over $516 to its value. The benchmark crypto’s price opened just above $8,700, rallying to close above the psychological level at the $9,200 hurdle.

Thursday saw the same trend before a slight pullback that has since returned Bitcoin to levels just above $9,700 as of press time.

However, Bitcoin’s brief rally to $10k meant the market erased its most recent crash, filling the CME (Chicago Mercantile Exchange) futures gap (the largest ever at $1,200) within hours.

As noted last week, there was a 77% chance the cryptocurrency would hit $10,000, and although gains have been clipped during the European trading session, the bullish outlook remains; a close above this important level provides the indication that Bitcoin will retake $10k.

Technical analyst, Michaël van de Poppe, says that today’s upside could put Bitcoin “in a bull market.” According to him, the last dump happened pre-halving and that the $400 drop witnessed in intraday trading on Thursday provides a “nice trading range.”

He puts Bitcoin’s downside at lows of $8,250-$8,400 and $8,600, with the potential to trade at highs of between $9,800 and $10,100.

Bitcoin’s gains on Thursday come as Gold (GLD) saw its price go up following Powell’s economic outlook. At the time of writing, the precious metal has pushed prices above $1,700, gaining 0.4% in the past 24 hours. According to jmbullion.com, Gold has added $6.28 per ounce at $1,727.

The Altcoin market is also seeing an upside, with Ethereum (ETH) up over 4% in a day, and is now trading above $205 USD. XRP has added 2.05% at press time to break above $0.203, as bulls target higher prices. BCH and BSV, which have seen their hash rate soar post-Bitcoin halving are also in the green, as are EOS and LTC.