The Best Altcoin Exchange in 2025: Reviewed & Compared

If you’re looking to buy cryptocurrencies other than Bitcoin, there are many cryptocurrency exchanges that offer a variety of altcoins. Each platform comes with different features, fees, and pros and cons.

This page will take a detailed look at the best altcoin exchanges, what kind of users each one might be best for, and what to consider when picking one. By the end, you should have all the information you need to find the altcoin exchange that’s right for you.

Best Altcoin Exchanges - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 recommended altcoin exchanges to use for buying and selling altcoins.

Best Altcoin Exchanges - Key Metrics

The 11 Best Altcoin Exchanges in 2025

Altcoin Exchanges vs Brokers

The terms “broker” and “exchange” are often used interchangeably or simply lumped together as “crypto platforms”. There are, however, technically some differences, as we’ll discuss below.

Altcoin Exchanges

An altcoin exchange is a place where you can exchange one asset for another—fiat for crypto or crypto for another crypto. Buyers are typically matched with sellers in an order book and the equilibrium price is set by the balance of buyers and sellers. The cryptocurrency exchange facilitates this process, for which it charges “maker” and “taker” fees. If there is sufficient liquidity, trades can be settled instantly.

Altcoin Brokers

An altcoin broker acts as an intermediary between traders and the crypto market, and the broker sets the price. Users, therefore, trade with the brokerage, rather than with other traders. Brokers typically make their money from spread, which is the difference between buy and sell prices. The broker may also charge a commission on trades.

Settlement is more flexible on a brokerage platform so users don’t need to have the necessary funds in their exchange account when they initiate a trade. Crypto brokers don’t necessarily provide ownership of actual cryptocurrencies. They may instead provide trading of crypto derivatives such as contracts for difference.

Key Things to Consider When Choosing an Altcoin Exchange

Altcoins Available

If there are specific altcoins you want, it’s important to check whether they are actually available on a prospective platform. If you’re interested in new and obscure coins, you might want to use a platform with a large selection, such as Binance or KuCoin. If you’d prefer to buy more well-known and better-established cryptocurrencies, you might prefer a platform that has a smaller selection but offers other features you want.

You can check the website for a particular platform to find out what its coin selection is. It might also be worth checking which trading pairs are available. This will sometimes just be each available coin paired with your local currency, while other platforms may offer a choice of crypto to crypto trading pairs.

Geographical Availability

Clearly, a broker or cryptocurrency exchange is of no use to you if it is unavailable in your country. You can check the website for a list of countries where it operates. Some platforms may have a separate subsidiary to serve some countries (Binance and Binance.US, for example) while others may offer different services in different countries (like restricting the trading of derivatives in certain places).

Safety and Security

The security of your assets is one of the most important things to consider when choosing an altcoin exchange—you don’t want to be at risk of losing your crypto to a hack. Find a platform that secures access to your account through features such as encryption and two-factor authentication.

You also want to know your assets will be safe if someone attempts to hack the cryptocurrency exchange. Good security practices to look out for include offline cold wallet storage of cryptocurrencies and crypto insurance.

Reputation and Regulation

You want to find a platform that is reliable, and this will most likely be the case for well-established cryptocurrency exchanges that have built up a strong reputation and earned a large number of satisfied customers.

Check whether a prospective platform is regulated in your country. Regulated platforms provide the best security and an unregulated one could be unsafe to use.

Fees

You’ll want to know upfront what costs you will incur so make sure to check the small print. Some platforms charge a trading fee for each trade, while others charge a spread and maybe a commission.

You can also check whether there are deposit and/or withdrawal fees. How much these are may depend on the payment method you use. Other potential fees include account management and inactivity fees.

Features

Different platforms may offer different features and you should check that a platform offers everything you want before creating an account. Most of the platforms reviewed here provide charting tools and indicators, which are useful for traders.

Platforms such as Binance and OKX support margin and derivatives trading, as well as products for earning interest, like staking and savings accounts. You may decide that you want access to a more specific feature, like eToro’s CopyTrader.

Payment Options

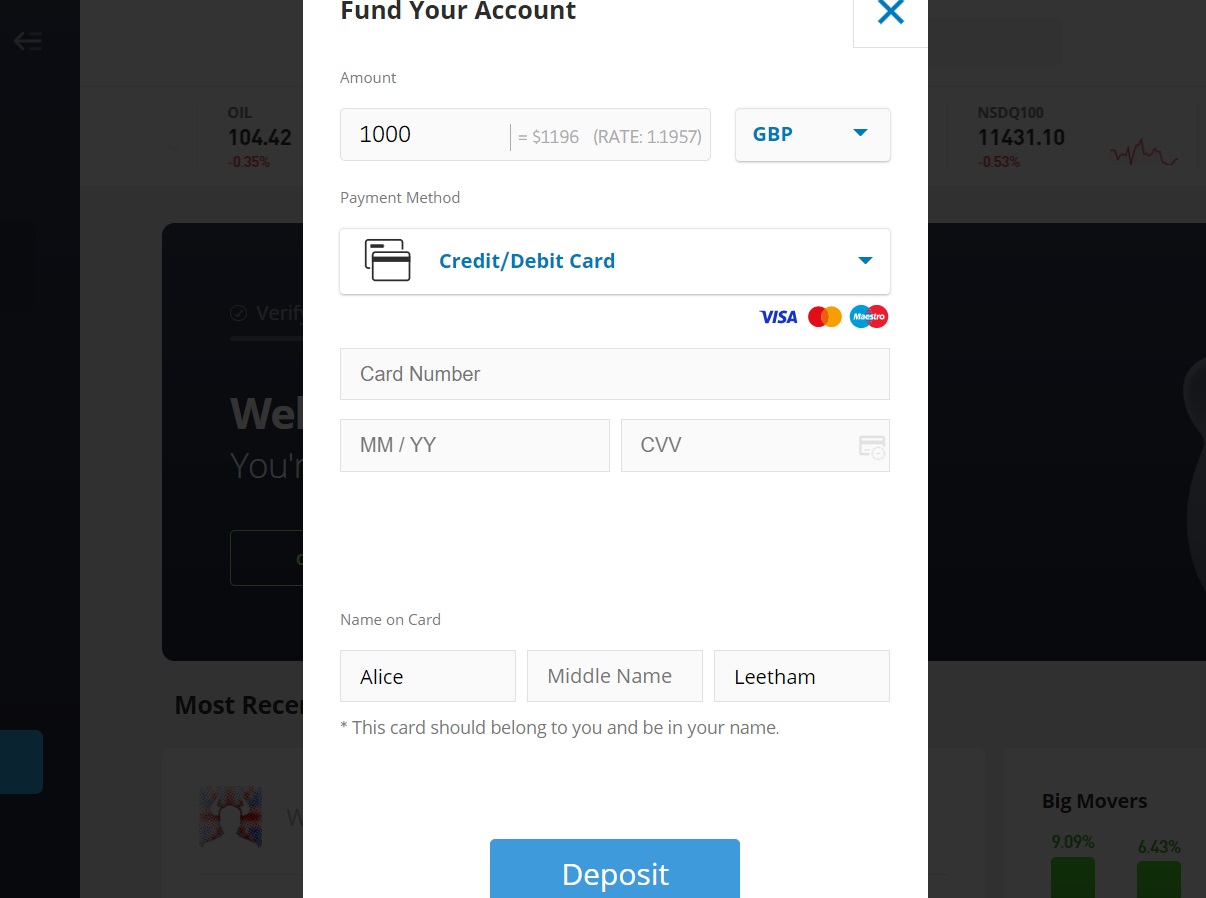

Most platforms accept deposits via bank card and/or bank transfer. You may be limited in which platforms you can use if you wish to use a less common payment method. The fees may vary for different payment methods and on different platforms, so this is worth looking into. eToro supports a variety of payment methods and doesn’t charge any deposit fees.

Ease of Use

You want to find a platform that you feel comfortable using. For experienced traders, this might mean a responsive platform with lots of clearly labeled advanced tools. A beginner, on the other hand, might prefer a simple platform without any complicated features.

Platforms ought to provide clear instructional resources on how to use them. If you use a platform that provides a demo account, you can trade virtually without risking any money while you familiarize yourself with the platform.

What is one of the most important things to look out for when choosing a crypto platform to sign up to?

"Trading fees and spot price used during swaps/trades. These can sometimes be overlooked, however, certain exchanges claim to have zero fees but when using their swap/trading functions you realize that the spot price used in the trades is a few percentage points higher than other exchanges."Paolo Ardoino

CTO of Bitfinex

How to Buy Altcoins From an Exchange

Follow these simple steps to purchase altcoins on eToro .

1. Open an account

Bring up the registration form by clicking on the “Join Now” button. Then you can fill in your email address, username, and password, or sign up with Google or Facebook. Tick the boxes to accept the terms and conditions and click “Create Account”.

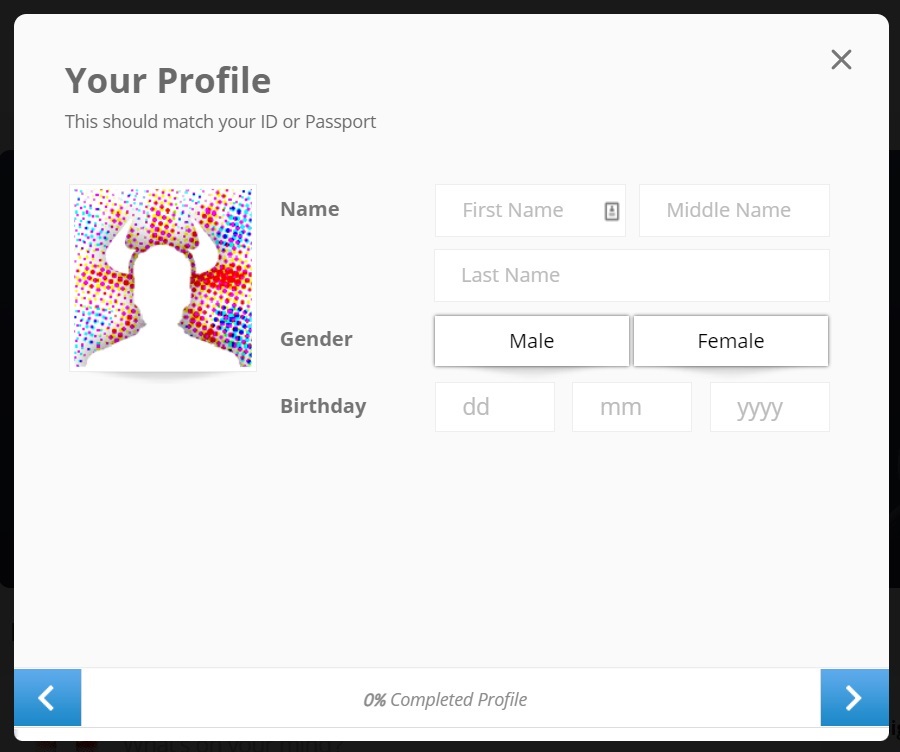

2. Verify your account

Click the link in the email you receive to verify your email address. You will then need to complete your profile by providing your full name, date of birth, phone number, and some form of photographic identification. After that, you’ll need to answer some questions about your investing experience.

3. Make a deposit

Hit the “Deposit Funds” button and enter how much you want to deposit. Use the dropdown lists to select your local currency and preferred payment method. Fill in any payment details requested then simply click “Deposit” to transfer the funds.

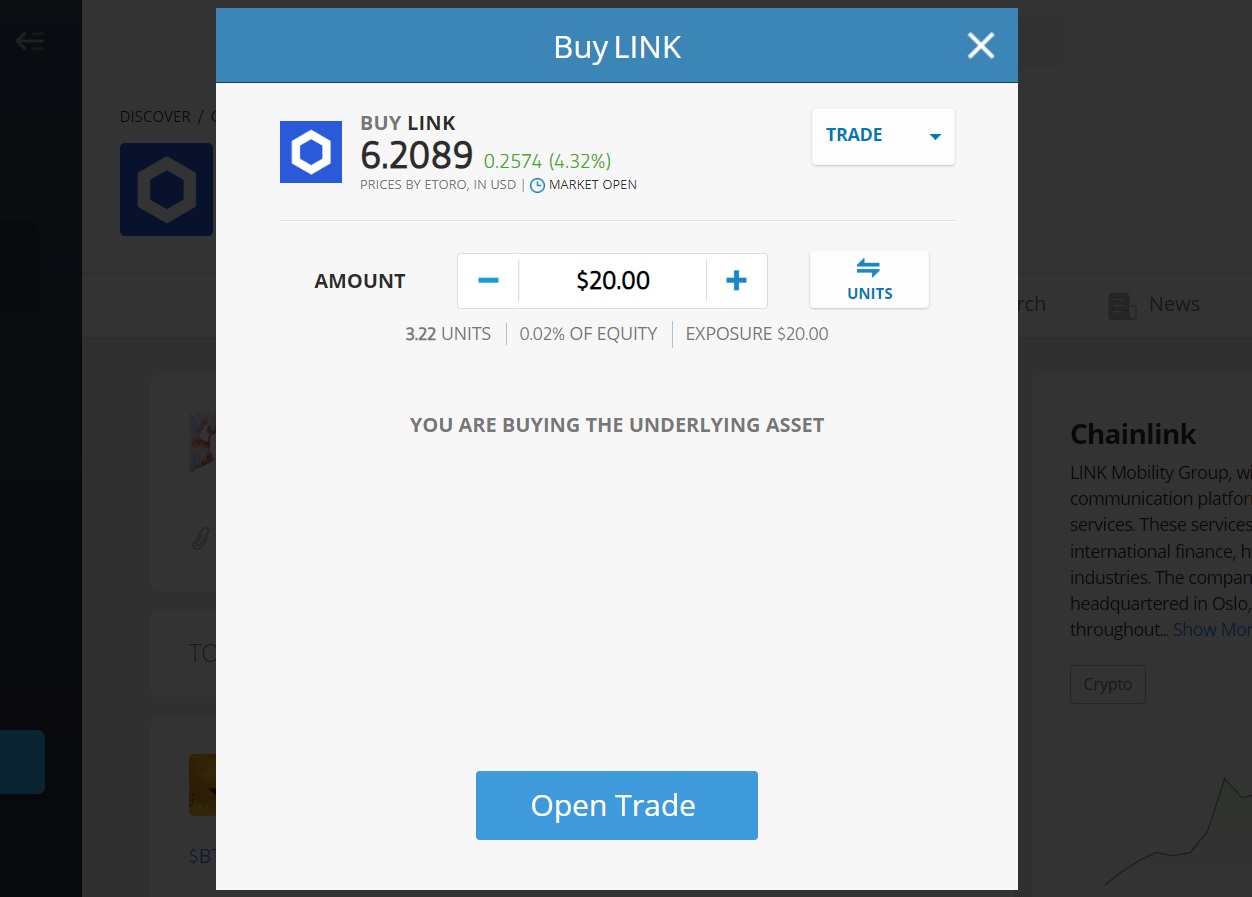

4. Buy altcoins

Use the search box to find the altcoin you want, or use the Discover tab for inspiration. Click on “Trade” and you will have the option to switch from Trade to Order if you want to buy at a future price with a limit order. Just fill in the amount and click “Open Trade”.

Where to Store Your Altcoins After Buying?

If you only purchase a small amount of altcoins or want to make regular trades with them, you may find it most convenient to store them in the free web wallets that most exchanges provide. Long-term investors with large holdings might prefer to buy a hardware wallet like Trezor, BitBox, or Ledger as they are the most secure type of wallet.

You could also download a wallet onto your computer or mobile and keep your altcoins there. Find out more about the best crypto wallets.

Final Thoughts on Altcoin Exchanges

If you want to branch out from Bitcoin, there are plenty of places where you can buy and sell altcoins. There are benefits and drawbacks to each and they often offer different features. As well as this, you’ll want to consider aspects such as the coins available, security, regulation, and fees.

Based on these considerations, we believe the best altcoin exchange is eToro, which is easy to use and has competitive fees, a range of free deposit options, and unique social trading features.

Methodology - how we test and compare altcoin exchanges

We first tested every altcoin exchange individually and then analyzed them against each other highlighting the good and bad points for each. These were then individually added in the pros and cons sections for each exchange.

In our analysis, the things we looked for included how long did it take to sign up. If the KYC took a long time, and there wasn’t a good security reason for it, we would mark it down.

We also judged the UX of each site assessing how easy it was to navigate to the parts of the exchange we wanted to reach. If this was tricky, or the right information was hard to find within a few seconds, we would mark the exchange down. Bonus points were given for clean, simple lines and a feeling of space without the loss of features and functionality.

We next looked at add-ons, in particular educational facilities that would help beginners learn more about crypto. Here, some were better than others with Binance and Coinbase standing out in this area.

Check out our why trust us and how we test pages for more information on our testing process.