Best Crypto Staking Platforms of 2025

Crypto staking platforms let you deposit tokens and earn more of them in the form of staking rewards. The platforms will take care of the staking on your behalf, and provide an accessible way to earn a passive income on idle crypto holdings.

We’ll be looking at some of the best crypto staking platforms based on a range of important factors. Keep reading for in-depth reviews and to find the platform that is right for you.

Best Crypto Staking Platforms - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 recommended crypto staking platforms to use for staking cryptocurrency.

Top 6 Crypto Staking Platforms Reviewed

Here’s more information on our top five recommendations for crypto staking platforms, as well as their advantages and disadvantages.

1. eToro – Best Overall

eToro is the top social investing platform for crypto and other assets such as stocks and ETFs, with access to collective wisdom to help you expand your knowledge and experience—as well as the innovative and popular copy trading feature.

eToro’s dedicated staking service is secure, easy to use, and enables users to earn crypto rewards without any effort. Customers can stake ADA, TRX, and ETH, with eToro taking 10-25% of the yield as a fee for protecting staked assets from additional risks.

Pros

-

Simple to use

-

Earn staking rewards without doing any work

-

Secure

-

Transparent

-

Assets protected from additional risks

-

Compound staking rewards

-

Range of crypto and other financial services available

-

Help centre and customer service

-

Mobile app

Cons

-

Staking only available for a very limited number of coins

-

eToro retains a percentage of the yield as a fee

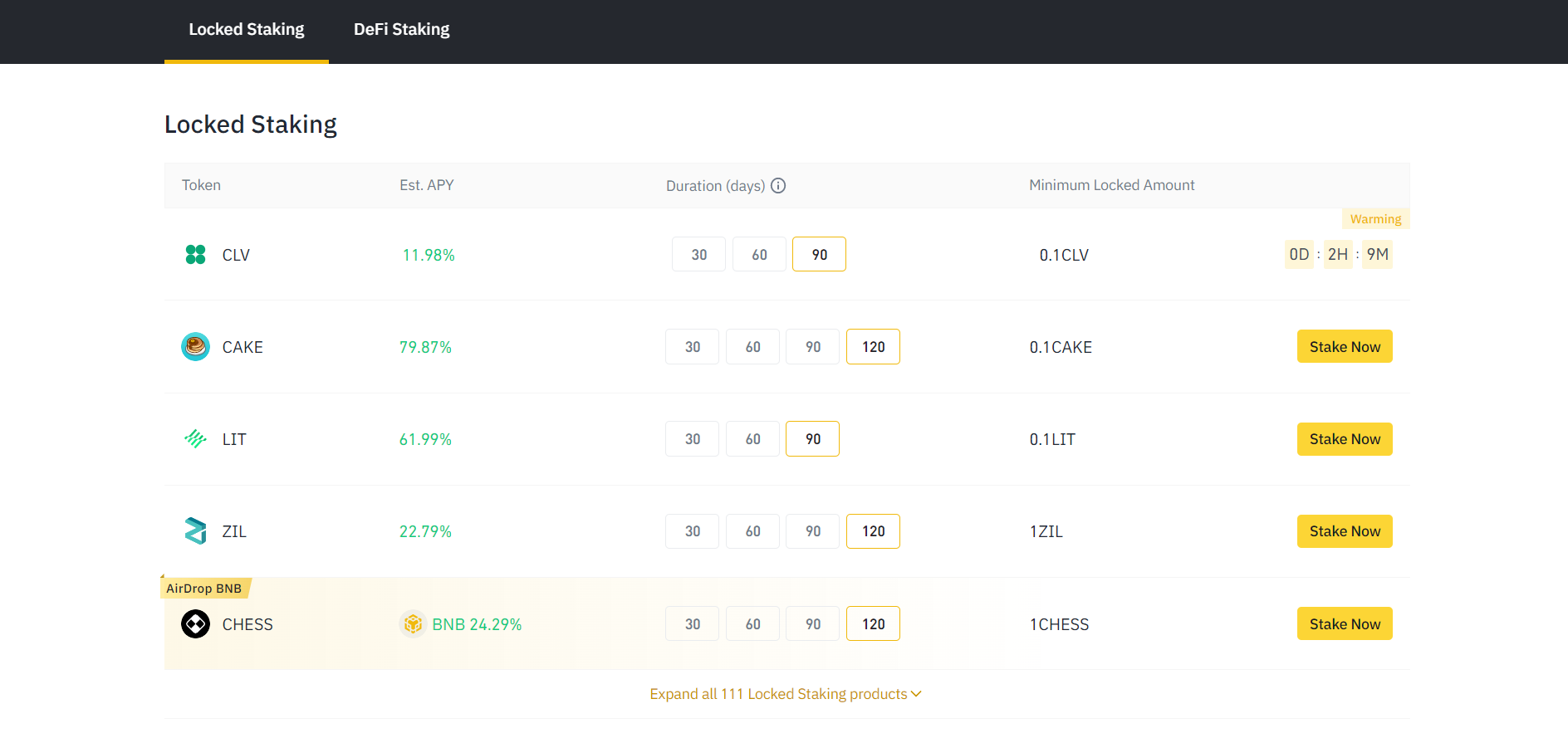

2. Binance – Best For Traders

Binance is our top choice of platforms to earn staking rewards on due to the wide range of staking opportunities. With over a hundred coins that can be staked, and a choice of lock-up periods, there is something for every investor who wants to passively grow their crypto holdings.

Users with a higher risk tolerance can also take advantage of Binance DeFi Staking to earn higher rewards. The wide variety of other services Binance offers, from spot and derivatives trading to loans and NFTs, means users can meet all their crypto needs in the same place.

Pros

-

Staking services for 100+ cryptocurrencies

-

DeFi staking services

-

Choice of lock-up periods

-

Low staking minimums

-

No fees for staking

-

Stake at the click of a button

-

Staking rewards distributed daily

-

Early redemption possible (minus distributed interest)

-

Wide range of exchange and other services

-

24/7 chat support

-

Mobile app

Cons

-

Minimum lock-up period for most staking products

-

Regulatory issues in some countries

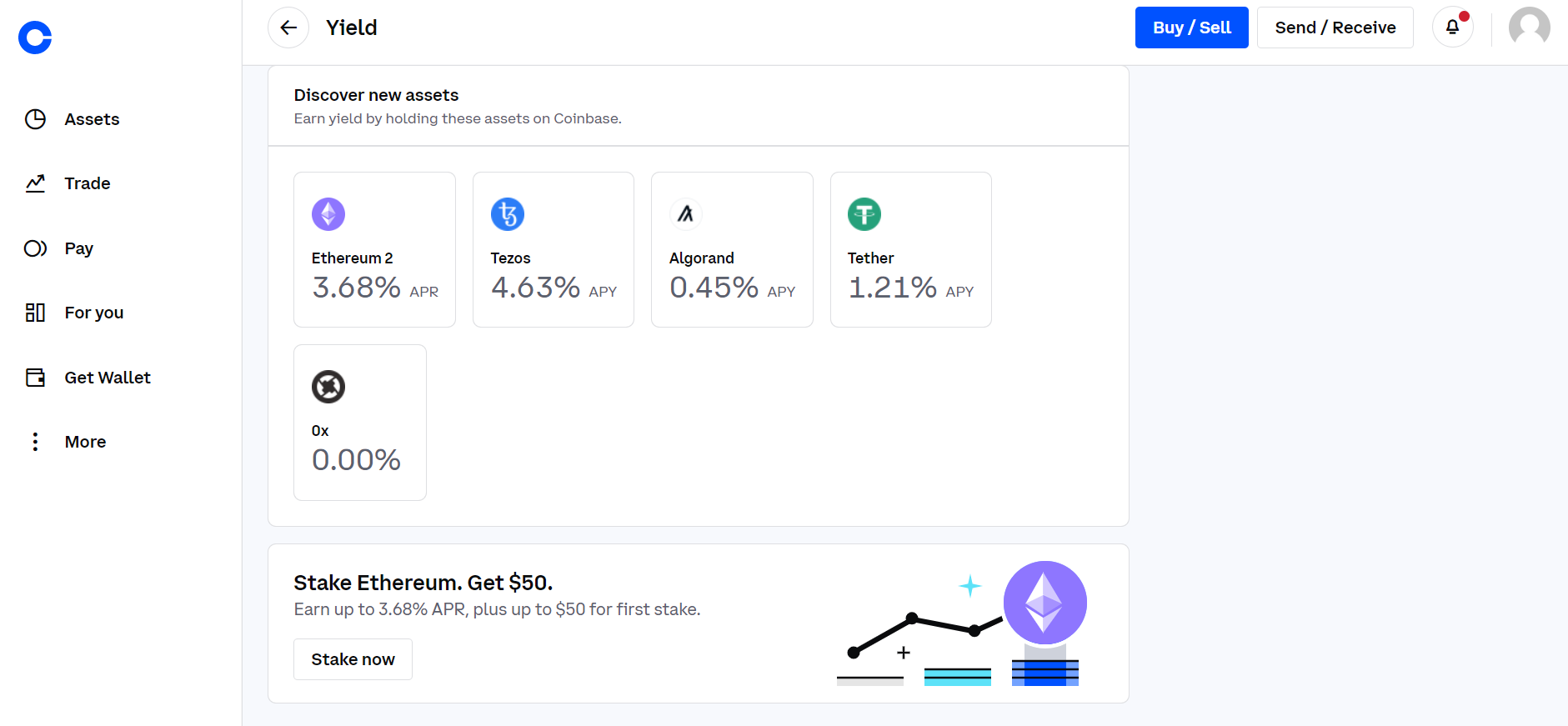

3. Coinbase – Best for Beginners

Coinbase is a great place for those at the beginning of their crypto journey, with its clear interface and easy-to-use features. You can earn up to 5% APR through staking a handful of popular cryptoassets with Coinbase.

Users who have verified their identity can start staking on Coinbase with as little as $1. It only takes a couple of clicks to get started, after which you will start receiving rewards automatically.

Pros

-

Easy to use

-

Automatic reward distribution

-

Start with as little as $1

-

Cash out at any time

-

Industry best security

-

Email and live phone support

-

Mobile app

Cons

-

Limited number of cryptocurrencies available for staking

-

Coinbase takes a commission on staking rewards

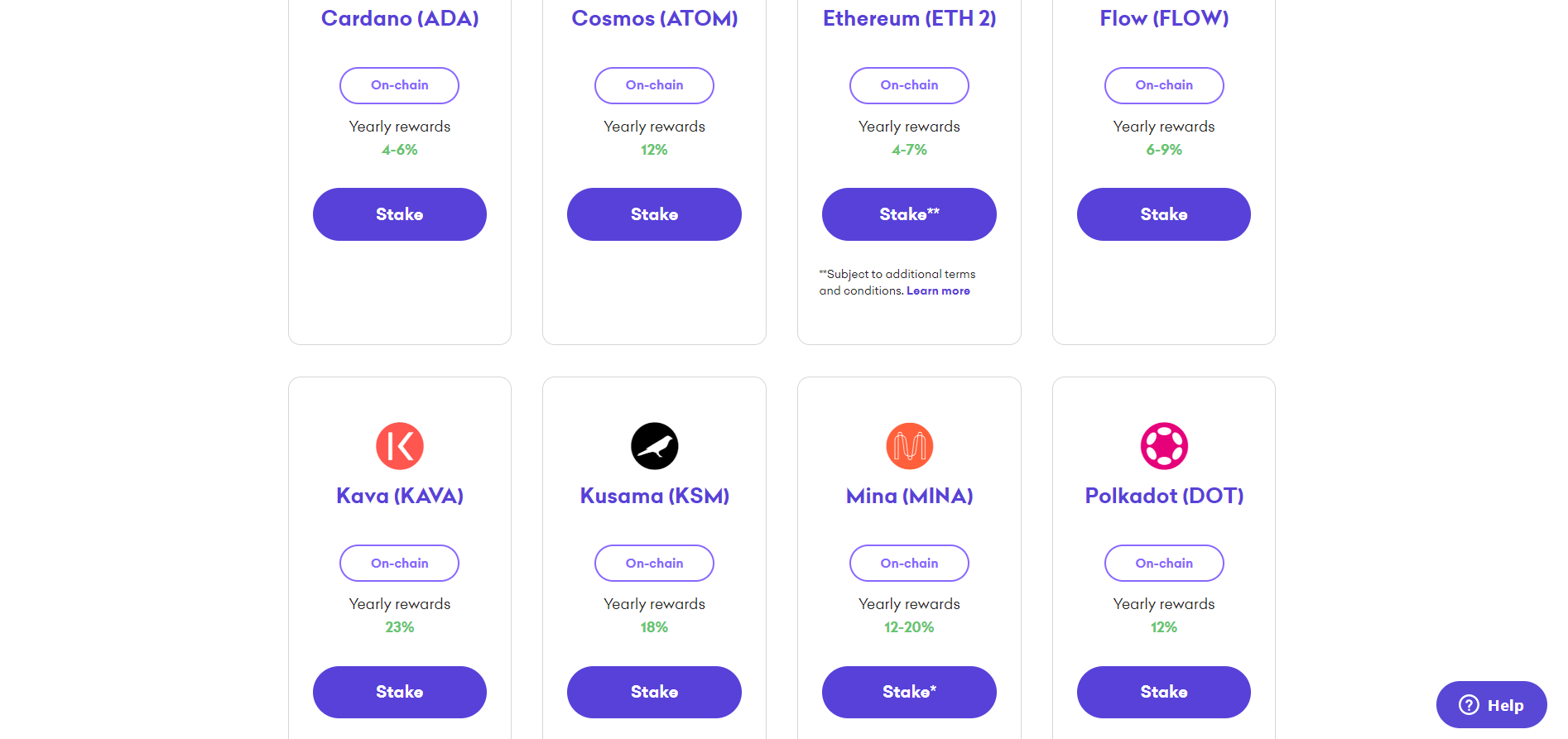

4. Kraken – Best for Support

If you need help navigating staking and the crypto world, Kraken is a great platform to use. They offer web chat, phone, and email support around the clock, as well as in-depth articles and educational resources to help you expand your knowledge.

You can start staking more than a dozen cryptocurrencies on Kraken, with yearly rewards of up to 23%. It’s a simple process and you can unstake your coins whenever you like without facing any penalties.

Pros

-

Up to 23% yearly rewards on 16 cryptocurrencies

-

Get started with a couple of clicks

-

Automatically earn rewards twice a week

-

Instantly unstake at any time

-

Choice of on-chain and off-chain staking

-

Extensive customer support and educational resources

-

Mobile app

Cons

-

Somewhat limited choice of coins to stake

-

Not covered by insurance

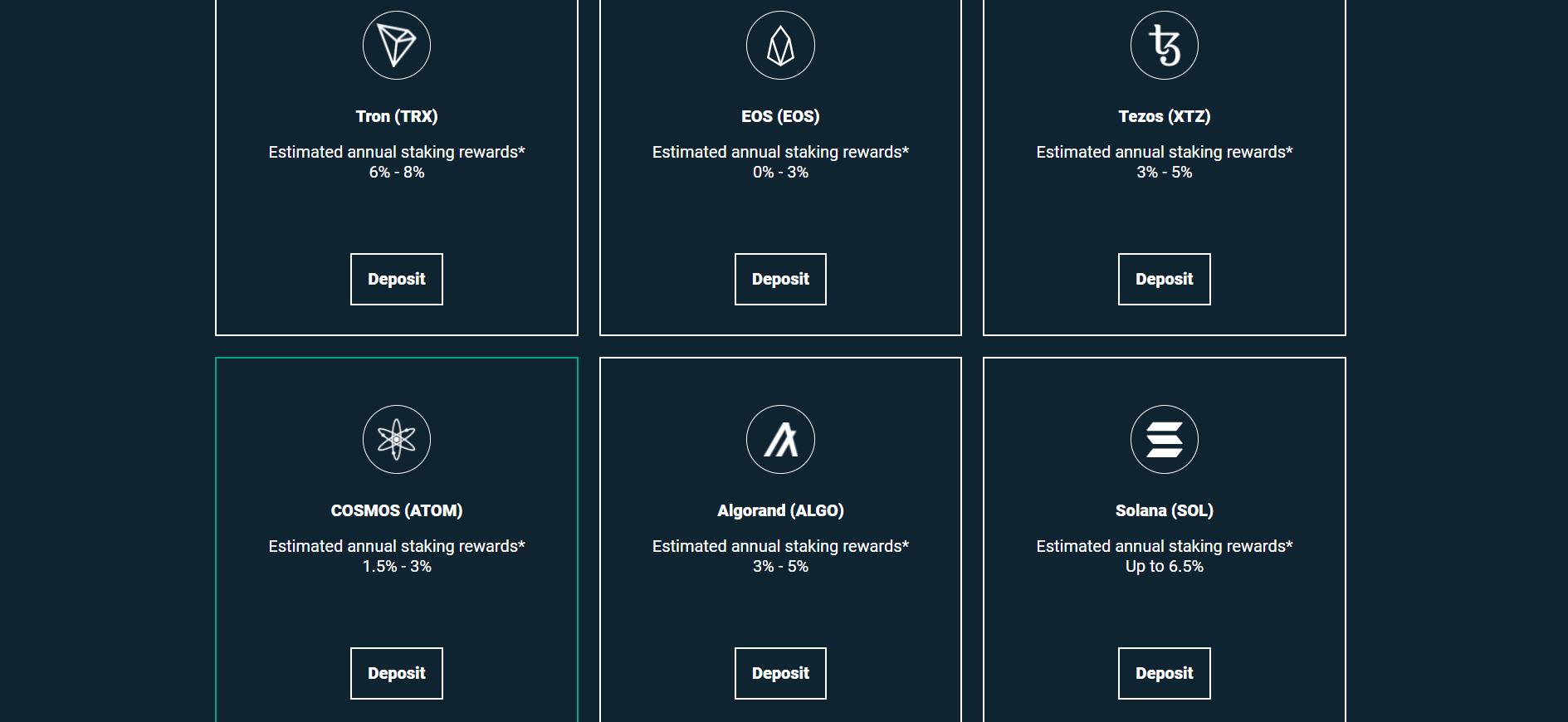

5. Bitfinex – Best for Security

Bitfinex is one of the safest places around for storing and staking crypto, as staked assets never leave Bitfinex’s cold (offline) wallets. The platform only stakes a portion of the tokens it holds to be able to accommodate withdrawals and help mitigate risks such as slashing.

The staking process is simple on Bitfinex and you can earn rewards of up to 16% per year on several of the most popular staking coins. Rewards are distributed automatically on a weekly basis.

Pros

-

Earn up to 16% yearly rewards on 11 cryptocurrencies

-

Hassle-free staking

-

Weekly rewards

-

Automatic distribution

-

No minimums

-

Strong security

-

Advanced trading tools

-

Customer support

-

Mobile app

Cons

-

Somewhat limited choice of cryptocurrencies to stake

-

Bitfinex keeps a small portion of staking rewards

6. Nexo – Best for Percentage Returns and Stablecoins

An excellent alternative to traditional banking, Nexo is an ideal choice for people who want to earn a passive income from their cryptocurrency holdings. A fully regulated blockchain, this Switzerland-based company allows individuals and businesses to borrow and lend crypto and fiat currencies without the need for a traditional bank.

Lenders who provide liquidity are rewarded with some of the best APY and APR interest rate returns in crypto. For more cautious people worried about losing money because of the volatility of cryptocurrencies, there is also the option to stake stablecoins—crypto assets pegged to fiat currency such as USD—and enjoy a steady return.

Pros

- Up to 17% APR returns on crypto – paid out daily

- Fully insured and audited

- 34 supported cryptocurrencies and more than 40 supported fiat currencies

- Borrowing at 0% interest when certain conditions are met

- Has its own Nexo Mastercard

Cons

- Certain benefits are only available when holding Nexo tokens

- Limited number of cryptocurrencies

Why we chose Nexo

Nexo is one of the most trusted staking platforms available offering bank-beating compounded returns on deposited crypto. It also allows users to borrow money against staked crypto without triggering a taxable event through selling held crypto or converting it into a fiat currency.

For people who are wary of market volatility, there is also the option to stake any one of a number of stablecoins including USD, UST, USDT, DAI, GBPX and others for up to a 12% return. Staking is easy. Simply set up an account, deposit your preferred fiat or cryptocurrencies and start earning.

What is cryptocurrency staking and how does it work?

Staking is a fairly simple way to put any idle crypto you’re holding to work. It’s a bit like putting your money into an interest-bearing account. While your money sits there, it earns interest which is periodically added to the principal sum. Banks tend to add interest to an account on a yearly or monthly basis.

With staking, however, in addition to the percentage gains being much higher, those gains are often compounded daily. This compound process is something that Warren Buffett once described as ‘the eighth wonder of the world’. It means that each day, you can earn interest on your interest for as long as you keep your capital staked.

Typically, there are two types of staking. These are flexible staking and locked staking. The first means that you can withdraw your staked crypto at any time. The second is where you commit your crypto to a staking pool for a fixed period, during which you will be unable to access your funds.

The advantage of locked staking is that you will usually get higher rewards depending on how long you keep your funds locked up. If you want to get your crypto out quickly and easily, it’s best to opt for flexible staking.

What is a Crypto Staking Platform?

A crypto staking platform is any platform that allows users to deposit crypto, which is then staked and the rewards earned distributed back to the users. Staking is a method of securing a blockchain.

In a Proof of Stake blockchain, people are chosen to validate transactions based on how much and for how long they have staked. They are rewarded for this with more tokens, which they share with anyone who has delegated tokens to them. The staking platforms above simplify this process by validating or delegating on your behalf.

What are the different types of cryptocurrency staking platforms?

Centralised staking platform (CEX) – The brokers and exchanges covered in this article are all centralised exchanges. These are established operations with a proven track record. Each provides either custodial or semi-custodial staking options for its users. The easiest way to look at this is ‘staking as a service’. The benefit of this is that staking is quick and easy.

Also, should anything go wrong, there will be a team working behind the scenes providing customer support. The only point for concern is that should one of the exchanges collapse for any reason, you could lose your funds. However, with established exchanges, this is highly unlikely. If this is a real concern, look for staking platforms, such as eToro, that provide insurance in certain jurisdictions.

Decentralised staking platform (DEX) – DEXs are pools of buyers, borrowers, sellers and lenders that earn rewards through staking their capital and providing liquidity. Know as automated market makers (AMMs), these platforms run autonomously through smart contracts.

Experienced traders and institutions tend to stake their crypto on DEXs because this allows them to maintain control over their crypto holdings. There is a saying, ‘not your keys, not your crypto’. With true decentalisation, crypto owners hold custody of their own validator keys. This mitigation of security risk is vital for those moving and staking large amounts of money.

How to use a Crypto Staking Platform

The crypto staking platforms listed on this page are easy to use and you can get started by following these three easy steps.

1. Choose a crypto staking platform

Firstly, you will want to find a platform that is safe and easy to use and charges fees that you are comfortable with. Click on the link to our top recommendation below to sign up with a secure and reputable platform.

2. Create an account and make a deposit

Fill in some details to create an account and provide a photo ID and/or proof of address in order to complete the Know Your Customer process. Then you can go to the deposit page and choose a payment method to fund your account.

3. Start Staking

Head to the staking page on your chosen platform and choose which coin(s) you want to stake. This will probably just take a couple of clicks and then you will start earning rewards that will be distributed to you on a regular basis.

How To Choose a Crypto Staking Platform

Depending on what’s important to you, there are a number of factors that you may want to consider. Here are some of them.

-

Staking rewards – You may find that different platforms offer different staking returns on the same coins. You can shop around to find the highest returns, or compromise based on whether platforms meet your other needs.

-

Staking flexibility – Some platforms may provide the flexibility to unstake your coins whenever you like, while others may have a minimum or fixed lock-up period. Which you choose is a matter of personal preference.

-

Fees – It’s always a good idea to find out whether you will be charged any fees before you get started. Find out whether there are fees for the staking service, as well as other actions such as deposits, withdrawals, and trading.

-

Security – You will want your assets to be kept safe while you’re staking them, so check what kind of security measures the platform employs. These might include cold storage or insurance.

-

Extra features – If staking isn’t the only thing you want to do with your crypto, check that the platform offers any other features you require, such as spot or margin trading, copy trading, charting tools, or crypto loans.

-

User experience – The “feel” of a platform is an important factor in whether you enjoy using it. Things that contribute to this could include the layout and ease of navigation.

-

Coins available – If there are specific coins you want to stake, a platform that doesn’t support the staking of those coins is of no use to you. There will be a list of coins that can be staked on the platform website.

-

Customer support – It’s useful to know that you will be able to turn to customer support should you ever run into any problems. Platforms may provide web chat, phone, or email support, as well as explanatory articles.

-

Payment options – You’ll need to be able to fund your account once you’ve opened it, so check which payment methods the platform supports. Many platforms will let you stake tokens that you have bought and transferred from elsewhere.

-

Privacy – Most platforms now have KYC requirements, which means you will need to provide personal details and documentation. Make sure your information won’t be sold to third parties by choosing a secure and reputable platform.

Methodology - how we test and compare crypto staking platforms

We decided which cryptocurrency staking platforms were best by first testing them individually. Things we looked for and questions we asked included:

-

How easy was it to sign up and start staking on the platform?

-

Was the exchange easy to understand with good signposting to the staking section of the site?

-

How easy it was to deposit money taking into account any fees charged?

-

How competitive were the staking rates?

-

How many cryptocurrencies were available on the platform to buy and stake?

-

Did the site offer different types of staking such as locked and flexible?

-

How easy was it to stake the crypto and how good was the information provided?

Once we’d rounded up our answers to these questions, we then pitted each staking platform against the other to see where each one’s strengths and weaknesses were and listed them in our pros and cons section. Find out more on how we test and how we fund our site.

Final Thoughts

Staking has become a popular way to support the operation of blockchain networks, and the platforms on this page let you participate and earn passive staking income without doing any of the work.

There are lots of potential factors to consider to find the platform that’s right for you, but once you have made your choice, any of the platforms above will enable you to start staking and earning rewards in a matter of minutes.