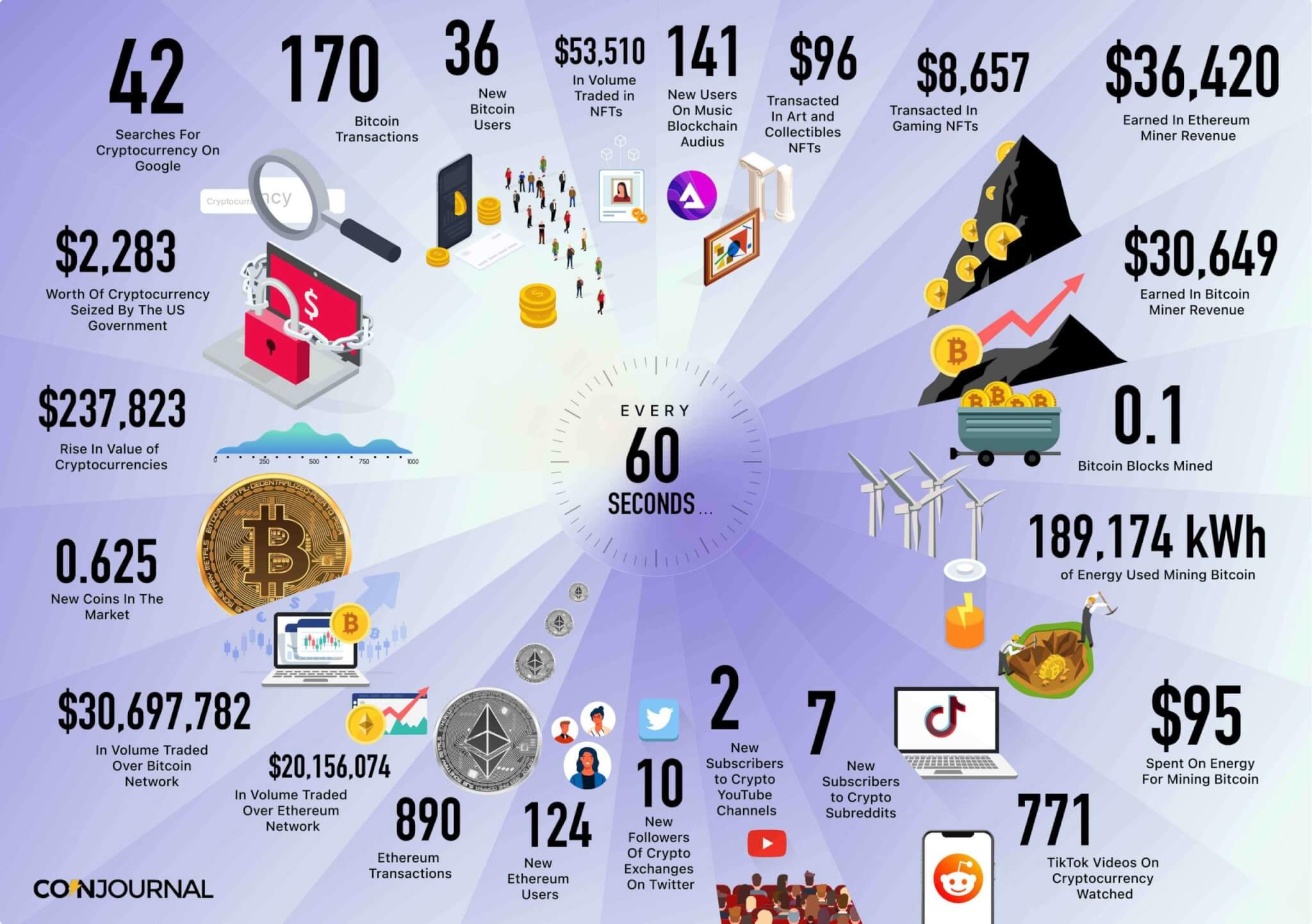

Every 60 Seconds in Cryptocurrency...

The cryptocurrency market has become well known as a fast-paced environment. While the stock market is only open during regular business hours, crypto never sleeps.

Moving money around in the traditional financial system might take days of wire transfers and rely on intermediaries such as banks, but crypto transactions are borderless, intermediary-free and can take place in seconds.

It’s clear just how many people are taking advantage of these benefits as a staggering $30 million in Bitcoin and $20 million in Ether are traded each minute. As well as the speed of value transfer, prices also change quickly — and sometimes dramatically. The crypto market is famous for its volatility. Traders can potentially make huge profits — or huge losses — in the blink of an eye.

On top of that, new coins are emerging all the time, new people are always joining the crypto space, and trends, news and ideas are constantly changing and spreading through social media.

With so much happening and changing all the time, the crypto market can feel like a different place every minute. To see how much difference a short time can make, check out this data we gathered from a range of sources about the different activities that took place in the crypto space in just 60 seconds.

Since you landed on this page…

$891.83

In Volume Traded in NFTs

2.35

New Users On Music Blockchain Audius

$1.6

Transacted In Art and Collectibles NFTs

$144.28

Transacted In Gaming NFTs

$607

Earned In Ethereum Miner Revenue

$510

Earned In Bitcoin Miner Revenue

0.00166667

Bitcoin Blocks Mined

3153 kWh

kWH of Energy Used Mining Bitcoin

$1.6

Spent On Energy For Mining Bitcoin

12.85

TikTok Videos On Cryptocurrency Watched

0.116

New Subscribers to Crypto Subreddits

0.166

New Followers Of Crypto Exchanges On Twitter

0.033

New Subscribers to Crypto YouTube Channels

2.1

New Ethereum Users

14.83

Ethereum Transactions

$335934

In Volume Traded Over Ethereum Network

$511629

In Volume Traded Over Bitcoin Network

0.01041667

New Coins In The Market

$3964

Rise In Value of Cryptocurrencies

$38.05

Worth Of Cryptocurrency Seized By The US Government

0.7

Searches For Cryptocurrency On Google

2.83

Bitcoin Transactions

0.6

New Bitcoin Users

The Data Explained

Cryptocurrencies

- $237,823 Rise In Value of Cryptocurrencies

- 0.625 New Coins In The Market

- $2,283 Worth Of Cryptocurrency Seized By The US Government

- 42 Searches For Cryptocurrency On Google

The unique value proposition of cryptocurrencies and the potential of blockchain technology to revolutionise a range of industries mean that more and more money has been invested in crypto over the last decade. In January 2021, the total crypto market cap finally reached the historic milestone of $1 trillion, according to data from CoinMarketCap. Just three short months later, the total value invested in cryptocurrencies had doubled to $2 trillion.

The rise in value can partly be attributed to the growth in the number and variety of crypto investment opportunities. Innovative new projects are always appearing and creating new coins with a range of use cases. There are already more than 12,000 different cryptocurrencies listed on CoinMarketCap.

The dramatic growth of the crypto market hasn’t been ignored by authorities, though, with many trying to keep up with the latest blockchain advances in order to combat the criminal use of cryptocurrencies. The US government is no stranger to crypto, coming down hard on illicit activities on the blockchain.

No amount of enforcement can curb the rise of crypto, however, as it continues to grow in popularity. More and more people are discovering cryptocurrency every day, as evidenced by the number of searches it receives each minute (42 Google searches every 60 seconds).

Bitcoin

- $30,697,782 In Volume Traded Over Bitcoin Network

- 170 Bitcoin Transactions

- 36 New Bitcoin Users

As the first and most popular cryptocurrency, Bitcoin receives the most attention and holds a significant market share, meaning it has the power to move the entire crypto market. People often buy Bitcoin before investing in any other cryptocurrencies, which is why there is so much activity on the Bitcoin network.

The huge volume traded over the network each minute represents both traders and investors, and Bitcoin has the highest trading volume of any cryptocurrency except the stablecoin USDT.

Despite the huge amount of value traded in Bitcoin, the network can only handle a few transactions per second. Scaling solutions such as Lightning Network aim to vastly improve this figure, while also making Bitcoin transactions faster and cheaper.

The potential to make huge gains from Bitcoin constantly attracts new users, with a range of backgrounds, strategies and goals. These are mostly retail investors, but as Bitcoin becomes more mainstream and accepted, an ever-increasing number of institutions are starting to use Bitcoin too.

Ethereum

- $20,156,074 In ETH Volume Traded Over Ethereum Network

- 890 Ethereum Transactions

- 124 New Ethereum Users

Ethereum is the second-largest cryptocurrency by market cap behind Bitcoin, and its pioneering smart contract functionality means it can host decentralised applications (dApps). This has led to Ethereum becoming the home of decentralised finance (DeFi) and non-fungible tokens (NFTs).

The volume of ETH traded over the network is the third largest, behind USDT and Bitcoin. As well as the buying and selling of ETH, this figure includes the gas fees which must be paid in ETH when trading the ever-growing number of ERC-20 tokens hosted on the Ethereum network.

Ethereum has a higher capacity than the Bitcoin network, with the ability to handle tens of transactions per second. This is still quite low for a global network but the Ethereum 2.0 upgrade will bring much greater scalability.

The number of people using the Ethereum network is constantly growing. After Bitcoin, many institutional investors are beginning to buy Ethereum. What’s more, as ETH is required for gas fees, retail investors just discovering DeFi and NFTs are also buying it up.

NFTs

- $53,510 In Volume Traded in NFTs

- $96 Transacted In Art and Collectibles NFTs

- $8,657 Transacted In Gaming NFTs

- 141 New Users On Music Blockchain Audius

Talking of NFTs, they’ve really taken off in recent times. A few short years ago, these cryptographic tokens were the purview of blockchain nerds, and the average man in the street couldn’t even tell you what “NFT” stood for. Today, however, NFTs have seeped into mainstream consciousness, regularly making headlines and seeing the participation of celebrities.

The significant amount of volume traded in NFTs each minute is a testament to their popularity. People from all walks of life are getting involved — from casual buyers to shrewd collectors. Many platforms have emerged to facilitate the creation, buying and selling of NFTs, with some people lucky enough to see their purchases go from being worth hardly anything to millions of dollars.

The NFTs that most often make the mainstream news are those representing art, with Beeple’s record-breaking $69 million NFT being world-famous. This form of cryptographic art is quickly becoming accepted by the traditional art world, with prestigious auction houses like Christie’s and Sotheby’s selling NFTs.

NFTs can digitally represent almost anything and one sector that is taking advantage is the gaming industry. Representing virtual land and in-game items with NFTs fits perfectly with the play-to-earn model, and the success of projects such as Decentraland, The Sandbox and Axie Infinity proves the popularity of NFT gaming.

Music is yet another industry to benefit from NFTs, with more and more people turning to Audius for decentralised music sharing and streaming.

Mining

- 0.1 Bitcoin Blocks Mined

- 189,174 kWH of Energy Used Mining Bitcoin

- $95 Spent On Energy For Mining Bitcoin

- $30,649 Earned In Bitcoin Miner Revenue

- $36,420 Earned In Ethereum Miner Revenue

Blockchain networks couldn’t function without miners who solve cryptography problems in order to validate and process transactions, thereby adding blocks to the chain. The difficulty of these problems requires computers to solve, with many miners using computers specially designed for the job.

The network of miners is always growing, including individuals in mining pools and large corporations with huge mining farms. Powering these many computers takes a lot of power. In fact, the Bitcoin network uses more energy than some countries. All that energy costs a lot as well, which is what keeps the blockchain secure.

The cost and effort are worth it, however, as miners earn rewards. Currently, each time a Bitcoin block is successfully mined, the miner earns a reward of 6.25 BTC, which can be worth a lot of money — especially if sold at a market peak.

The current Ethereum block reward is 2 ETH, plus all the transaction and gas fees for the block. Once Ethereum transitions to a Proof of Stake consensus mechanism, it will no longer be mined, making the network far more energy efficient.

Cryptocurrencies on social media

- 10 New Followers Of Crypto Exchanges On Twitter

- 2 New Subscribers To Crypto YouTube Channels

- 7 New Subscribers To Crypto Subreddits

- 771 TikTok Videos On Cryptocurrency Watched

Given the innovations that blockchain technology has to offer a wide range of industries, and the potentially huge gains to be made from trading and investing in cryptocurrencies, it’s not surprising that people are talking about it.

Social media sites provide an important source of information for those interested in crypto, with many crypto-focused companies and exchanges sharing announcements and updates through platforms such as Twitter.

YouTube has also proved to be a popular hub for crypto information, with many people turning to the video-sharing platform for educational and entertaining crypto content. Some of the top crypto YouTubers now have over 1 million subscribers.

Cryptocurrencies are also becoming a hot topic on Reddit and TikTok, where ordinary people can share their thoughts and insights on crypto, and connect with like-minded individuals. In fact, both of these platforms have been the scene of coordinated crypto trends that have moved markets.

Conclusion

As you have seen from the data we gathered, a lot can change in the world of crypto in just 60 seconds.

This fast-changing environment can make some traditional investors nervous, but it can also be exciting and advantageous. Regardless of the state of the market right now, an exciting new project, a huge profit or the next big opportunity could be just a minute away!