How to Invest in Cryptocurrency UK (2025) - Beginner's Guide

Cryptocurrencies have been around since 2009, when Bitcoin was launched as a decentralised means of peer-to-peer value transfer. Since then, many thousands of other cryptocurrencies have been created to serve a wide variety of purposes.

They represent a wealth of investment opportunities, and this guide will take an in-depth look at how to invest in cryptocurrency in the UK. We’ll discuss the best UK platforms, which coins to invest in, which strategy to use, and everything else you need to know before investing.

The Best Crypto Exchanges - Our Top 3 Picks

Looking for a quick answer? Here are our top crypto exchanges to buy and sell cryptocurrencies.

The Best Crypto Exchanges - Key Metrics

Top Crypto Exchanges - Why They Made the Cut

The Best Crypto Exchanges Reviewed

How to Invest in Cryptocurrency in the UK

A regulated online crypto exchange is the simplest and safest way to invest in cryptocurrency in the UK. You can use your computer or smartphone to buy and sell coins quickly and easily. Just follow the steps below to get started with one of our recommended platforms.

-

Choose a platform

You’ll need to start by finding a platform that is available in the UK and meets your needs. A reputable and regulated platform is the safest choice, and we’ve discussed some of the best options in detail in the next section. If you want to get started now, you can click on one of our top 3 recommendations from the table below.

-

Create and fund your account

Click on the sign-up button and provide any personal information requested on the registration form. Regulated platforms have a KYC process, meaning you will likely need to upload an image of your photo ID, and possibly a proof of address, like a utility bill. Then you can go to the deposit page and choose a payment method to fund your account.

-

Buy cryptocurrency

Search your platform for the cryptocurrency you want. Purchasing it may be a case of just hitting a “Buy” button, or your platform may use trading pairs (e.g. BTC/GBP), and you’ll need to create a buy order. If there isn’t a GBP trading pair for your chosen coin, you’ll need to buy another coin first to trade for it (usually BTC or USDT). Enter the amount you want and hit “Buy”.

What is Cryptocurrency?

Cryptocurrencies are a form of digital currency that can be exchanged peer-to-peer through a computer network. Their decentralised nature means that they aren’t operated by or reliant upon a central authority, like a government or bank.

Cryptocurrencies have been around since 2009, when Bitcoin was launched, created by the pseudonymous Satoshi Nakamoto. In the early years, Bitcoin was mainly used by programmers and as a currency on black markets.

Its dramatic price rise in 2013 brought Bitcoin to wider attention, and some governments started to regulate or even ban virtual currencies.

In 2015, Ethereum was launched. Its programmability meant that applications and other cryptocurrencies could be created and hosted on the Ethereum network. This opened the floodgates for the launch of many more crypto projects and tokens.

The rise of decentralised finance (DeFi) since 2020 has seen the development of many cryptocurrencies and applications that enable people to invest, trade, lend, borrow, and earn in a peer-to-peer system on the blockchain that doesn’t require access to traditional financial services, or even a bank account.

As prices across the crypto market surged dramatically in 2021, crypto became a mainstream topic, regularly covered in the news and discussed by politicians. During that year, El Salvador became the first country to make Bitcoin legal tender.

By now, most countries have started establishing regulations around cryptocurrencies and crypto services, with many even developing their own virtual currencies, known as central bank digital currencies (CBDCs).

Many, many thousands of cryptocurrencies exist today, serving a wide variety of functions and industries. These include layer 1 blockchains, stablecoins, privacy coins, DeFi, CeFi, memecoins, oracle networks, NFTs, and decentralised gaming.

How Do Cryptocurrencies Work?

Cryptocurrencies use a form of distributed ledger technology (DLT). All transactions and coin ownership are recorded, but instead of this information being stored in a physical ledger book, it is kept in a computerised database secured using cryptography.

Some cryptocurrencies, like Bitcoin, are secured by a proof of work system. This involves computers known as “miners” doing “work” in the form of solving cryptography problems to win the right to process transactions and earn cryptocurrency as mining rewards.

Other cryptocurrencies use a proof of stake system where people have to “stake” their crypto in order to become validators. This means putting their coins up as collateral to guarantee they will do a good job.

What is the Blockchain?

A blockchain is the DLT that cryptocurrencies run on. When people send cryptocurrencies, those transactions are grouped together into bundles called “blocks”. Each block also contains a timestamp and information about the previous block. Because these blocks are chronologically ordered, they effectively form a “chain”.

Blockchains are generally operated by a peer-to-peer network of computers and adhere to a consensus protocol, making them decentralised. As the transaction ledger is generally public and immutable, blockchains are secure by design.

How to Invest in Cryptocurrency - Easy Step-by-Step Buy Guide with eToro

If you want to invest in cryptocurrency, just follow the steps below to get started with eToro.

-

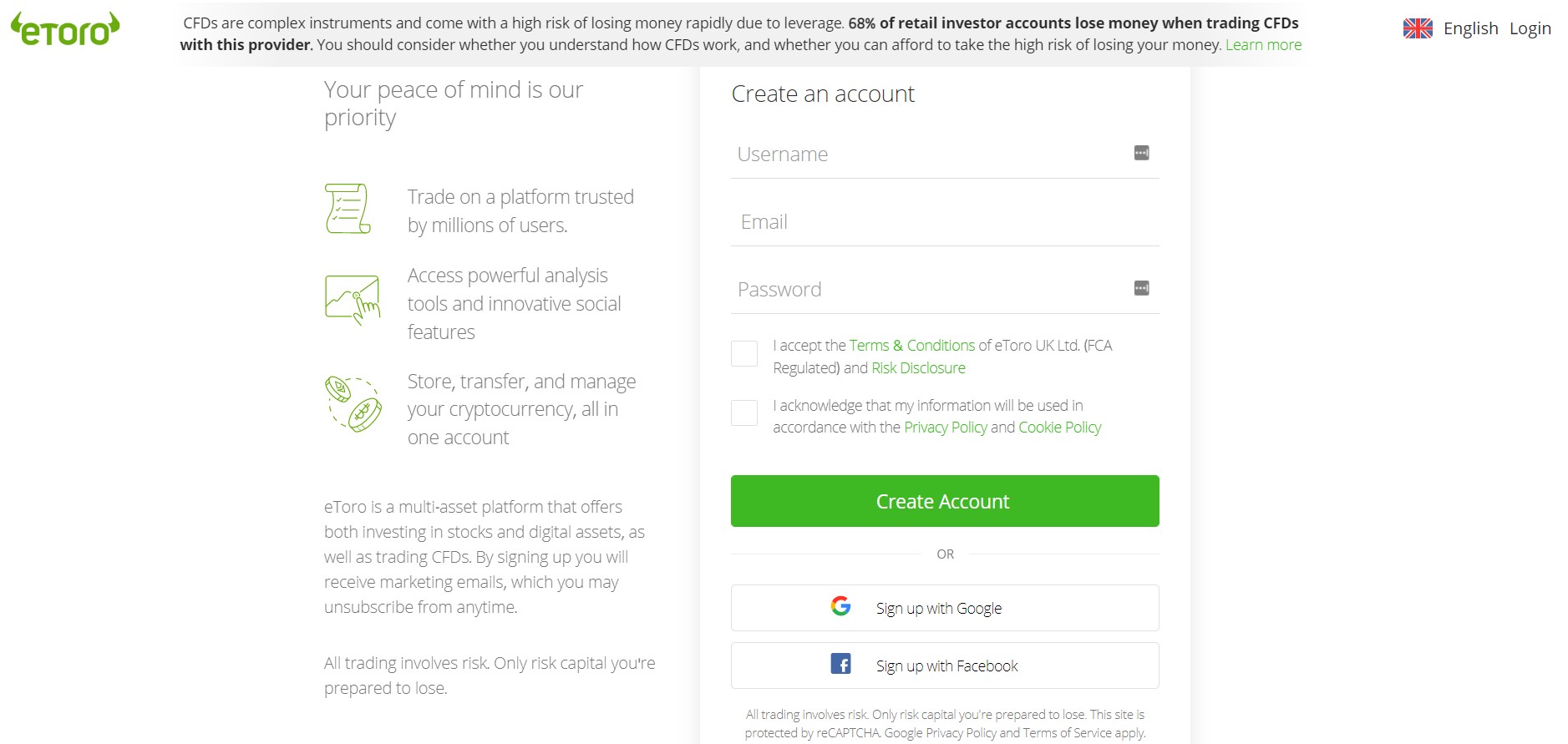

Open an Account

Go to the eToro website and click on the “Join Now” button to bring up the registration page. You will need to provide a username, email address, and password, and accept the terms and conditions. Then click “Create Account”.

-

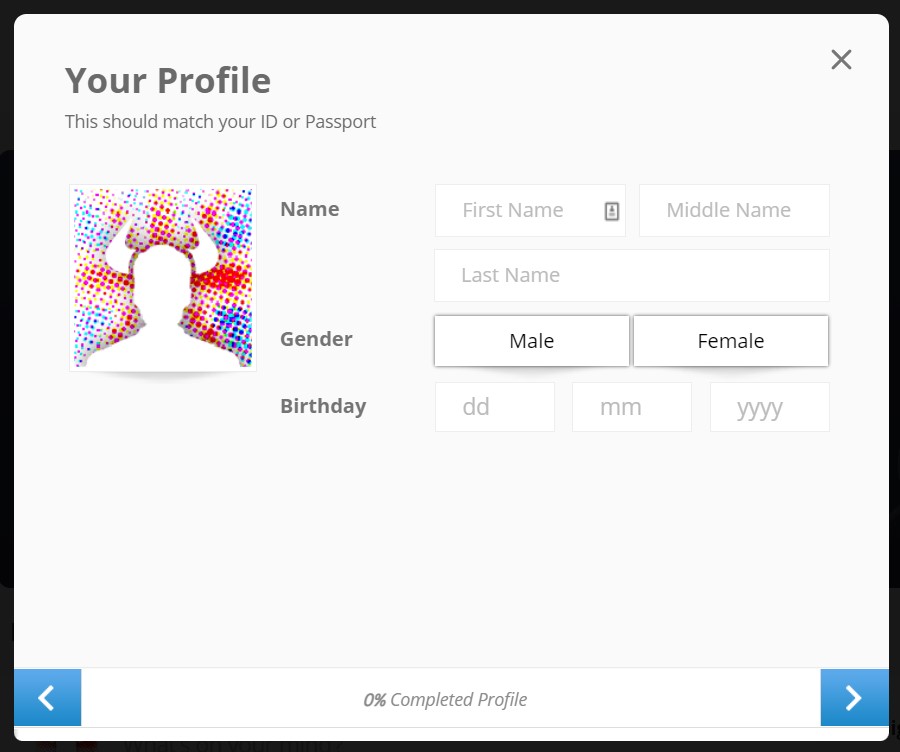

Verify Your Account

Click the link you receive by email to verify your email address. Then you will need to complete your profile by providing details such as your full name, date of birth, address, and National Insurance number. You’ll also need to answer a few questions about your experience with investing, before verifying your phone number with a code that will be texted to you.

-

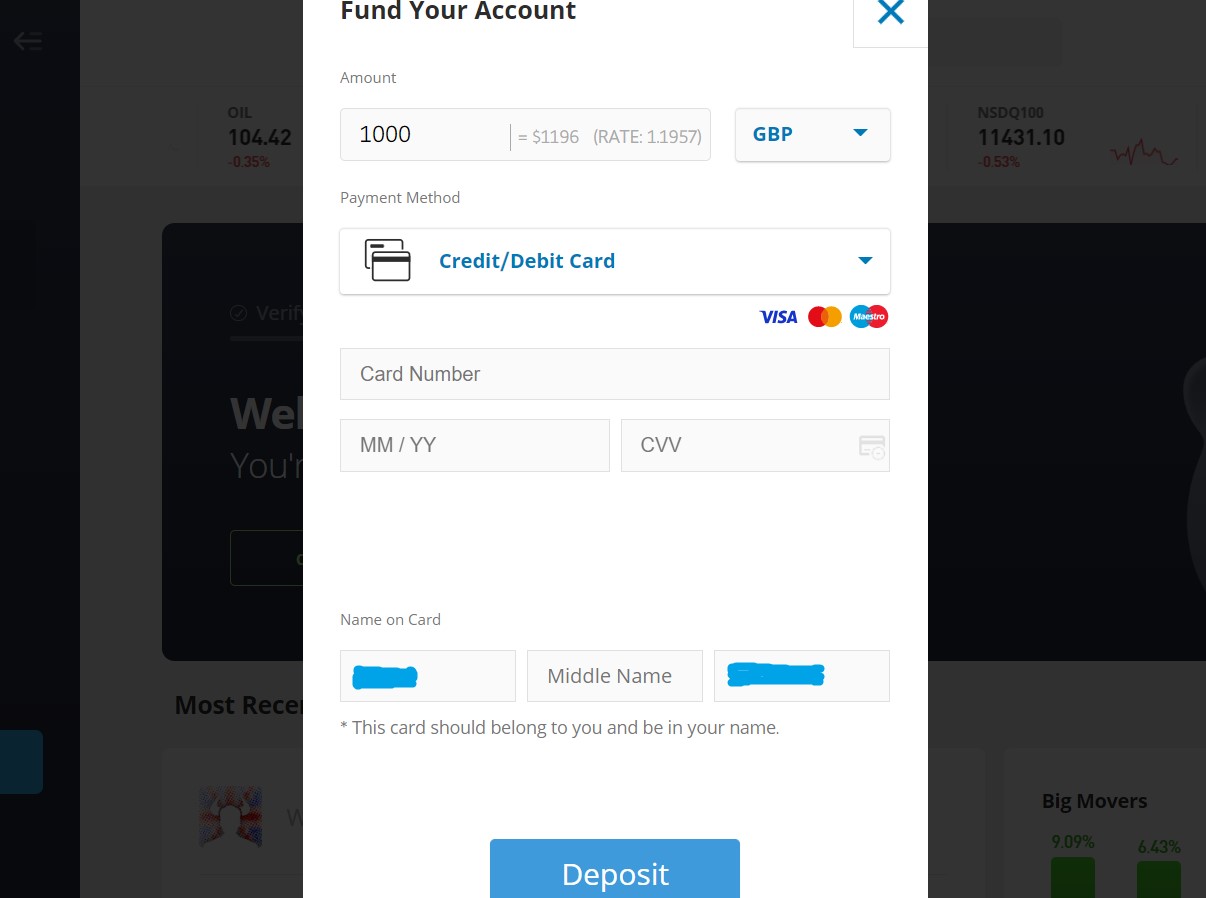

Make a Deposit

Click the “Deposit Funds” button and make sure the currency is set to GBP in the box that pops up. Enter how much you want to deposit and select a payment method. The payment options available in the UK are bank transfer, bank card, Neteller, Skrill, Trustly, or Rapid Transfer. Complete the deposit by providing any payment information required.

-

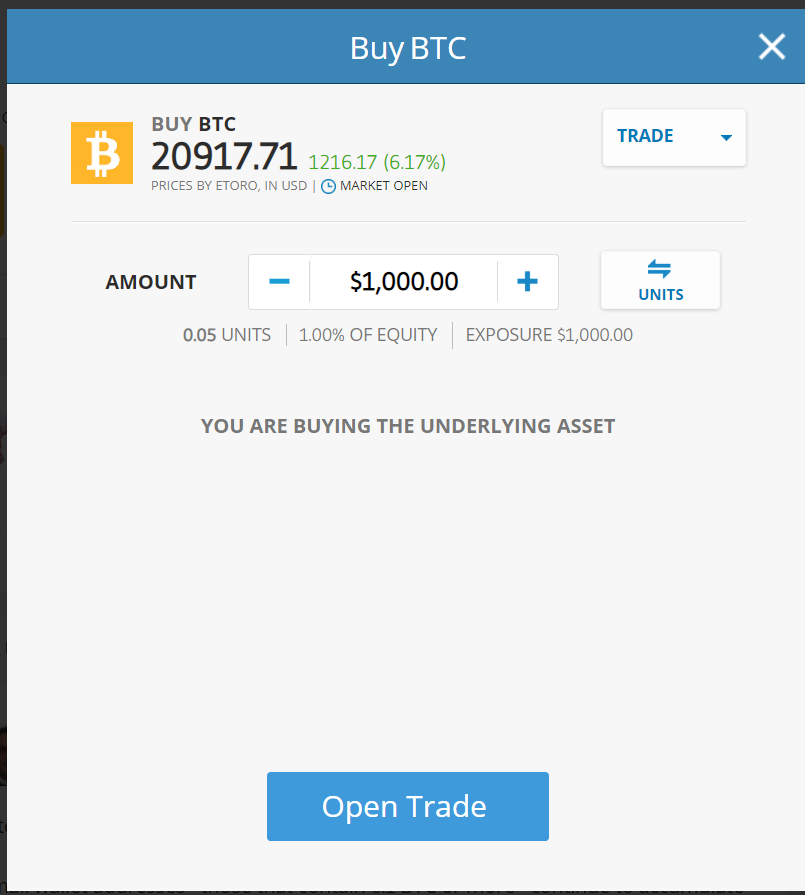

Purchase Cryptocurrency

You can look at the Discover section for inspiration on what to purchase, or use the search box to look for a specific cryptocurrency. Click the “Trade” button next to your chosen cryptocurrency and fill in how much you want to buy. Once you click “Open Trade”, you will receive your coins instantly.

All the Different Ways to Invest in Cryptocurrency

There are a number of different ways that you can invest in cryptocurrencies. The time, skills, and equipment they require differ, so the information below should help you pick the right method for you.

Buy and Hold Cryptocurrency

This is the simplest way to invest in cryptocurrency—you just have to make a purchase and hold onto your coins for the long term. It doesn’t require much skill or time as there is no need to constantly monitor and analyse the market.

Anyone can buy and hold by using an online platform like eToro to make a purchase and keeping their coins somewhere safe (like a Trezor or Ledger hardware wallet) until they’re ready to sell. You may also be able to earn interest on your coins in the meantime by staking them or putting them into a savings account.

Trade Cryptocurrency

If you buy and sell crypto frequently to generate regular profits, it constitutes trading. You could make trades based on factors such as the news or signals from technical indicators. This requires a much greater time commitment and skills such as technical analysis.

There are many different strategies and algorithms you can use to trade, and the frequency with which you trade could constitute swing trading, day trading, or scalping. Another way to trade is to speculate on the price of crypto without actually buying it, which is done through derivatives like futures, options, and CFDs. However, you can’t do this on a regulated platform as the FCA has banned crypto derivatives.

Mine Cryptocurrency

Mining cryptocurrencies is another way to earn crypto. Miners provide security and validate transactions on a proof of work blockchain in return for block rewards. The downsides to this method are time, expense, and effort.

In order to mine, you would need to buy, operate, and maintain expensive specialised hardware and pay fees to join a mining pool. This generally isn’t profitable for individuals, which is why they prefer the other methods detailed in this list. A more viable way of receiving mining profits is to buy a contract from a cloud mining company like CCG Mining .

Stake Cryptocurrency

Just as proof of work blockchains are secured by mining, proof of stake blockchains are secured by staking. Validators must stake their coins as collateral to protect the system from malicious or incompetent validators, and in return, they receive staking rewards.

Although the skill and technology requirements to actually become a validator can be quite high, on many proof of stake blockchains, anyone can delegate their coins to a validator to earn a share of the staking rewards.

This can be done with the click of a button on platforms like Binance and Coinbase. It is an easy way to generate yield and can be combined with a buy and hold strategy.

Invest in Blockchain or Crypto-Related Companies

If you believe in the potential of the blockchain sector but don’t feel comfortable with buying and storing actual cryptocurrencies, you may prefer to invest in shares of companies that are involved with crypto instead.

This could include companies that have crypto on their balance sheets, mining companies, ETF-like crypto trusts, or any company that is innovating in the blockchain space. It’s quick and easy to buy shares on eToro or Bitpanda .

Is Cryptocurrency a Good Investment? - What are the Positives?

Here’s a breakdown of some of the reasons you might want to invest in cryptocurrency.

Potential for Large Capital Gains Above Other Investment Assets

Although traditional financial assets are seen as a safer investment, they also only provide modest returns. Cryptocurrencies are higher risk because they are highly volatile, but this also provides an opportunity for much larger profits.

During a bull market, the prices of cryptocurrencies often increase by hundreds or even thousands of percent. This means that if you do enough research and time your trades right, it is possible to make life-changing returns.

Decentralisation

The decentralised nature of cryptocurrencies is something that attracts many investors. They are beyond the control of banks and governments, so their value isn’t affected by the economic decisions of those in authority.

As cryptocurrencies run on a peer-to-peer network, anyone is able to use or help run them. The public nature of the distributed ledger provides transparency, and the design is secure as there is no single point of failure.

Easier to Get Started than Other Investments

Trading traditional financial assets can feel inaccessible for many. You may need a large amount of capital to open a brokerage account and a lot of skill and knowledge to use a brokerage platform. Some assets are also too expensive for many investors as they are not fractional.

Meanwhile, the minimum requirements for signing up to a crypto platform are much lower. A lot of them have low minimum deposits and provide a simplified buying process for those who don’t know how to use trading tools. You can also buy tiny amounts of crypto if you want, as cryptocurrencies are fractional.

Ability to Earn Interest

Many cryptocurrencies make attractive long-term investments as they can be used to generate passive income. Proof of stake coins can be staked in order to earn staking rewards. In many cases, this is done through delegation and doesn’t require any further effort.

There are also many platforms that offer crypto savings accounts, which generally pay much higher interest rates than banks do on traditional savings accounts. Staking and saving can be done at the click of a button on platforms like Binance and Coinbase.

What Are the Risks When Investing in Cryptocurrency?

Now that we’ve covered the positives, here are some of the risks that you should bear in mind when investing.

Cybercrime and Hacking

The huge amount of wealth invested in cryptocurrencies means that they can be a target for cybercriminals. Hackers may target wallets and crypto platforms where large amounts of crypto are stored.

If you want to keep your crypto safe from criminals, you should consider keeping it secure in a hardware wallet (like Trezor or Ledger). You should also only use regulated platforms with strong security measures, such as cold storage, encryption, and two-factor authentication.

Fraud and Scams

Hackers aren’t the only kind of criminals that target crypto users. Fraudsters and scam artists may also try and steal your crypto by tricking you into voluntarily providing them with passwords to your accounts or private keys to your wallets.

If you receive an email asking for your password, it will be a scam, even if it looks like a genuine email from your platform. Never give your private keys or passwords to anyone. Also, be wary of cryptocurrencies being promoted on social media, even if they are endorsed by a celebrity, as people can be paid to promote fraudulent projects.

Losing It

Even if you protect your crypto from criminals, there are other ways that you can lose your investments. If you lose the private key and seed phrase for your wallet, you won’t be able to access your crypto. Also, if you send your coins to the wrong address or use the wrong network, they may be lost forever.

To avoid these possibilities, you should keep your private key and seed phrase somewhere safe and consider keeping backups in different places. Before sending coins to another wallet, triple-check the address and make sure both the sending and receiving wallets are using the same network.

Finally, even if you don’t lose your crypto, the volatility of the market means that it’s possible your coins could suddenly be worth a lot less. Make sure that you are prepared to ride out a bear market, and only invest in projects that you believe to have strong fundamental value.

What is the Best Cryptocurrency to Invest In?

As already mentioned, there are many, many thousands of cryptocurrencies in existence. There are so many options that the choices can seem overwhelming to new investors. To help you get started, we’ve provided some information about some of the most popular cryptocurrencies below.

Bitcoin

Bitcoin is the original and most famous cryptocurrency, and by far the most popular with investors. It is a proof of work blockchain that is secured by mining, and there is a maximum supply of 21 million BTC that will never be exceeded.

The finite supply means that Bitcoin won’t be devalued by inflation like traditional currencies. Many people therefore buy BTC as a long-term store of value, like Gold. A number of institutions have even started adding Bitcoin to their balance sheets.

Ethereum

Ethereum provided the next major innovation in the blockchain space with the introduction of smart contracts (self-executing pieces of code that make the blockchain programmable). This has enabled the creation of many Ethereum-based applications and tokens.

People may buy ETH to stake, to buy NFTs, or to pay fees for transferring ERC-20 tokens and using Ethereum-based applications. All this demand could make ether a strong investment, especially with the development of DeFi, which is largely built on Ethereum.

Binance Coin

BNB is a utility token launched by the Binance exchange. It is used to pay transaction fees on the Binance Smart Chain, and it also has a range of benefits for Binance users, such as fee discounts and access to exclusive token sales.

The fundamental value of BNB will likely correlate with the popularity and success of the Binance exchange. The deflationary nature of BNB could give it further value—regular token burns reduce the supply of BNB.

Ripple

XRP is a cryptocurrency designed to facilitate efficient cross-border payments. It runs on the XRP Ledger, a scalable and sustainable blockchain that allows for fast and cheap transactions. There is a capped maximum supply of 100 billion XRP, which was pre-mined at launch.

Cardano

Like Ethereum, Cardano is a smart contract blockchain that can host applications. The project has a strong focus on peer-reviewed research and development through evidence-based methods.

The blockchain is proof of stake and highly efficient, enabling transactions that are fast and cheap with minimal energy requirements. Cardano’s native cryptocurrency, ADA, is used for staking and paying network fees.

Things to Consider Before Investing in Cryptocurrency

As well as the topics covered in the section on whether cryptocurrency is a good investment, there are other things you might want to consider before making a purchase. The most important aspects are detailed below.

Cryptocurrency Fees

If you’re going to buy or trade cryptocurrency, you will need to pay some fees, and it is a good idea to think about these before you choose a platform to make sure they don’t eat into your profits.

Most platforms charge fees for deposits and/or withdrawals, and you will likely need to pay a trading fee or commission on each trade you make, which could be in addition to a spread. Some platforms have other costs, such as account management, overnight, or inactivity fees. You’ll need to consider all of these costs together if you want to find the cheapest platform.

Cryptocurrency Regulations and Tax

Cryptocurrencies are taxed in the UK, so you should bear this in mind when making investment decisions. There is no tax on buying crypto, but once you dispose of it, you will be subject to Capital Gains Tax. Income Tax could also be owed in the case of mining and earning from DeFi activities.

You will need to keep detailed records of all your transactions so that you can accurately report your profit or loss to HMRC. To find out more about how crypto is taxed and how to calculate your crypto taxes, see our Crypto Tax UK Guide.

Tips for Investing in Cryptocurrency

Starting Small

The number one piece of advice is to never invest more than you can afford to lose. One of the benefits of crypto is that it is fractional. This means you can start off by investing small amounts while you get comfortable with using your platform and develop your knowledge.

Dollar Cost Averaging

This is one of the simplest and most popular investment strategies. It involves making small investments on a regular basis regardless of price, in the belief that the value of the cryptocurrency will ultimately rise in the long term. You can easily automate this strategy on platforms like Coinbase.

Diversify

Diversification can make a portfolio stronger. If you are only invested in one cryptocurrency, you are at higher risk of making a loss if your chosen coin performs badly. You can diversify by buying various cryptocurrencies that serve different purposes within the crypto space. You can diversify even further by investing in assets outside of the crypto industry, too, which you can do on eToro.

Avoid Leveraging and Other High-Risk Methods

One of the main ways people lose money in crypto is by trading with instruments and methods that they don’t understand. Leverage can magnify profits, but it can also magnify losses, so it shouldn’t be used by people who don’t have the necessary knowledge and skills.

Final Thoughts

As we have seen, there are many considerations when it comes to investing in cryptocurrency, but one of the most important is finding the right platform. You need one that is user-friendly, reliable, and safe to use in the UK.

This is why eToro is our top recommendation—its unique social investing features are easy to use, it provides access to a wide range of asset types with reasonable fees, and it is an FCA-regulated platform with strong security. See our step-by-step walkthrough above or click the button below.

Methodology - How We Picked the Best Platforms to Buy Cryptocurrency

We have a duty to provide our readers with accurate and unbiased information you can trust. For this reason, we only recommend platforms that have a reputation for reliability and pass our rigorous testing methods.

When assessing a platform, we test a range of aspects, including the registration process, deposit and withdrawal methods, ease of use, asset availability, tools and features, fees, security, educational resources, and customer service.

To find out more about our testing process, see our why trust us and how we test pages.