How To Buy HyperCash | Ultimate Guide To Buy HC

HyperCash (HC) is a decentralised digital asset that currently trades on multiple platforms across the globe. The project combines blockchain’s security protocol with Directed Acyclic Graph (DAG) technology for high throughput and has a fixed supply of 84 million tokens that will be generated via a hybrid PoW and PoS mechanism. The project has formerly been known as both HCash and Hshare (HSR).

The HC price today is $1.75, with $23 million’s worth of the token traded in the past 24-hour session. The market cap currently stands at $78,775,176, with about 45,071,909 HC coins in circulation.

Do you want to buy HyperCash? Read this comprehensive guide for all the steps, tips and FAQs.

5 Steps to Buy Hshare Instantly!

Visit our recommended platform to buy Hshare by clicking the button below.

Enter your details in the required fields to create a new account.

Fund your account using your preferred payment method and confirm your new balance.

Choose Hshare and select a "Instant/Market Order” to buy it instantly.

Enter the amount you want to buy (you’ll see the equivalent in HSR) and confirm your order!

Where to Buy HyperCash in 2025

If you want to buy the coins and believe their value will appreciate as adoption increases, then a cryptocurrency exchange is where you’ll go to complete the purchase. A good exchange not only allows you to buy the underlying asset of a cryptocurrency like HyperCash, but it also provides for high liquidity and built-in wallets make it possible to hold some of the coins to trade for other assets – a strategy that you can adopt to enlarge your portfolio.

You might not want to go into the hustle of creating a crypto wallet or spending money to buy an offline storage device. This means you could be looking to “buy” HyperCash for trading, targeting the returns that can come with speculating on the cryptocurrency’s price movements. As noted above, CFDs allow you to do just that. This type of investment is best undertaken on an online cryptocurrency broker. Some of these professional brokerage platforms will allow you to buy the actual/physical coins (mainly the major cryptocurrencies), but for the most part, they provide easy access to investing in the token without having to own it.

Although this method of investing in HyperCash is easy, you still need to understand the market and the specific dynamics of the coin. More importantly, you need a regulated broker, with a trading system that allows you to manage risks.

In our tutorial below, we will focus on how to buy HC with a broker and with an exchange.

How to Buy HyperCash with a Broker

As noted above, you will need to find an online broker if you hope to make income on the price movement of HyperCash. But before you buy HyperCash with a broker, you need to understand that using a regulated platform greatly increases your chances of having a secure experience.

Find as much about the platform as you can, including reviews and user testimonials. Remember to consider a brokerage based on factors like user interface, fees, security, and customer service. Once you settle on a particular platform, here’s how to proceed.

Register with the Broker

The first step is to sign up for an account, which takes very little time on most broker platforms. You will need basic information such as name/username, email, and phone number to create an account.

If you are using eToro, for instance, you’ll need the above details, a strong password, and an agreement to the Terms and Conditions of the platform. Remember to set a unique password for the account.

The process is similar to other broker platforms like Plus500 and Forex.com. You can also sign up for an account using your Facebook or Google account details.

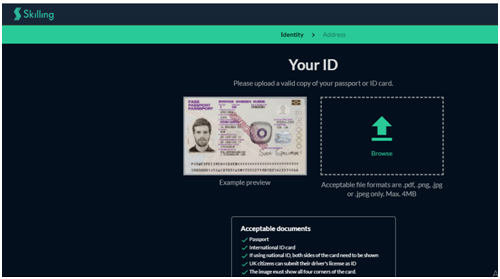

Verify your Identity (KYC Process)

You will need to go through a KYC (Know Your Customer) check before you begin using any regulated broker. A standard verification process involves uploading official documents like a national ID card, passport, or driver’s license. You may also need to provide proof of residence through a utility bill.

The importance of ensuring users go through KYC is that it allows for user protection as well as preventing the likely scenario of the platform being used for money laundering. KYC and AML processes on online brokers have contributed to wider adoption in the crypto sector as more people feel protected.

Ensure you provide the correct documents to have your ID verified, and as quickly as possible.

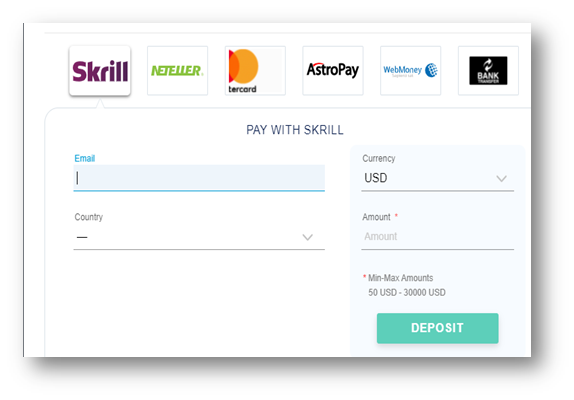

Deposit Funds with your Preferred Payment Method

Depositing funds into your account can be done via any of the supported payment methods on the platform. Although different brokers may list various methods, you can choose your preferred method based on three main factors:

- Speed

- Cost/fees

- Availability/supported methods

For example, if you want faster and convenient deposits and don’t mind paying slightly higher fees, then Visa or Mastercard will be a good choice. You may also fancy the convenience of PayPal, but not all brokers support this method. As such, choose only when you feel the payment method suits you.

Apart from credit card and PayPal, other options include bank transfer, e-wallets like Skrill and Neteller, and payment using another cryptocurrency.

Open a Position to Long/Short HyperCash

Trading on a broker will often require that you decide whether you think the price of the asset will go up or fall. Understanding this is important as it informs the nature of your trade – whether you will buy to go long or sell to go short.

In the market, a long position is taken by a bull while a short position is taken by a bear, who believes the price is set to fall. A good understanding of these approaches to trading HC should see you adopt either or both depending on your investment goals.

Whatever approach you take, you need to enhance your trades by adopting the right risk management settings. This usually is the case when traders manage risks via tools such as stop loss and take profit orders.

Remember that an online broker like eToro offers a great product called copy trading where you can learn from seasoned traders by mimicking specific trades from them. The social trading aspect has the potential to see you earn a decent passive income with relative ease.

Close your Position

You can close your trading position manually or have it automatically closed through the use of risk management tools such as those mentioned above. While the automation part is a great option for set scenarios during the trading sessions when you might not have the opportunity to close a position, you can still close a trade regardless of the stop loss or take profit settings. To have a better understanding of these mechanisms, find out as much from market experts and through educational materials.

How to Buy HyperCash with an Exchange

Apart from a broker, buying HC on exchanges is the most popular avenue for investors who wish to hold the crypto-asset in their wallet as a long-term investment. Most often, people who take this route believe in the future of the network, mainly as related to mass adoption.

We’ve highlighted above that exchanges allow you to buy HyperCash and other cryptocurrencies directly into a wallet. You can then trade the cryptocurrencies for others – like HC for ETH or HC for ADA. You could also sell your holdings on the exchange for fiat. The growth within the sector means exchanges have significantly improved in terms of ease of use, with institutional interest driving the need for a secure environment.

It is therefore important that you endeavour to use not only an exchange that is reputable and regulatorily compliant but one that provides for a higher level of security. In addition, it is advisable to compare platforms for features such as costs and fees, user-friendliness, and customer support.

So, how do you buy HyperCash on an exchange? Here are the steps to take.

1. Set up a HyperCash Wallet

You need a crypto wallet to store the coins you buy on an exchange. This means that you must set up a secure wallet first before you buy HC. The process might appear a bit daunting if you are completely new to the sector. However, you are likely to find it simple and pretty straightforward. The entire process shouldn’t take you more than 30 minutes.

The key to setting up a good wallet is to understand the different types of wallets and how they are used. You also need to have decided whether you want to hold the coins long-term or for a short time. This factor can help you choose the best wallet for receiving the HyperCash tokens you buy.

With this in mind, let’s look at the different types of wallets you could consider.

- Exchange/Online wallets: These are also called hot wallets and are great for you if you want to have your coins ready for trading at a short notice. Note that exchanges are highly targeted by hackers and thus it is advisable to only store a small amount of HC on the exchange.

- Desktop wallets: Wallets that download to your desktop and therefore offer a little more security compared to online options. When looking for a desktop wallet, ensure you find one that has a good reputation in the market.

- Mobile wallets: They are more like the desktop options but these work on your mobile devices and are thus convenient. They might be compromised if you connect the device to the internet.

- Hardware wallets: Hardware wallets offer offline storage in devices that never connect to the internet unless you need them to do so. They offer the highest level of safety for your funds and are suitable if you plan to hold your coins and tokens for the long run.

As well as the specific security features of the respective wallets, you need to stay on top of your assets’ safety. Do not share passwords for different accounts and enable two-factor authentication (2FA).

2. Choose and Join an Exchange that Offers HyperCash

The next step in buying HyperCash online is to create an account at a cryptocurrency exchange that lists the token. There are several options to choose from, but the overall advice is to choose a reputable one. Some of the top exchanges that support HyperCash are OKEx, Huobi Global and ZB.

You might have to complete a KYC verification process on some exchanges, which might be a little demanding but, overall, is critical to your security.

3. Choose Your Payment Method for Buying HyperCash

Buying cryptocurrencies on most exchanges is easy as there is support for several payment methods. We recommend that you choose a payment method that gives you convenience and speed but more importantly is secure to use.

The credit or debit card is the most common payment method for buying crypto and is accepted across the marketplace. Other options include bank transfer, PayPal, and cryptocurrency. All these methods may be available or not depending on the exchange and your location.

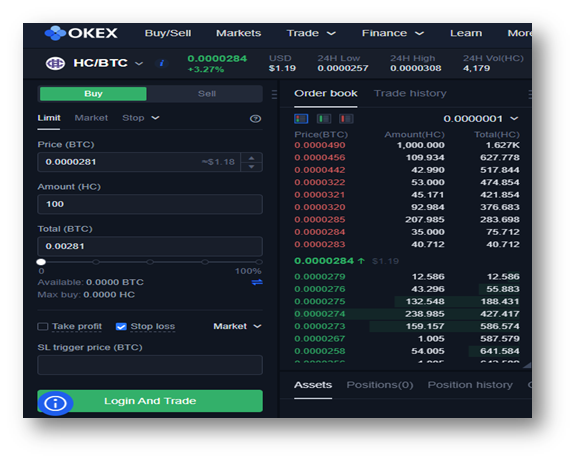

4. Place an Order to Buy HC

You may need to buy Bitcoin or Ethereum first before you buy HyperCash. This is because most reputable exchanges do not support direct fiat purchases for this token. So, how do you place an order to buy HC?

- Start by buying Bitcoin directly via credit card or bank transfer.

- The new BTC or ETH coins are now in your exchange wallet. Next, you want to buy HyperCash (HC), which means trading your Bitcoins for HyperCash.

- To place an order, select go to the basic or spot buying page of the exchange. Let’s say it’s OKEx, you will search for the trading pair.

- Go to “BUY” and enter the amount of HC you want to buy. The system will calculate the maximum you can buy based on your BTC balance and exchange transaction costs.

Once you are satisfied with the purchase, click on trade. After a short while, you’ll have HyperCash in your account.

5. Safely Storing your HyperCash

You might want to keep your new coins in your account if you plan on trading actively. However, the next best option is to transfer the coins from the exchange to your private wallet. You will take this step if you plan to hold onto the coins long term.

To send the coins to your private wallet, initiate a withdrawal transaction with the recipient address being your public key. Select the amount of HyperCash you wish to transfer and proceed to complete the transaction. As noted above, how safely you store the cryptocurrency depends on the type of wallet you choose and the additional security measures you take.

Should you Buy or Trade HyperCash?

If you are new to crypto, you might want to know whether you should buy or trade a given coin. The two terms are different, with buying mostly having to do with acquiring the actual coins. If you don’t want to have the coins and thus go through the hassle of storing them, then trading is a good option.

Note that buying and trading are two different things even when it comes to using an exchange as compared to a broker. Buyers are thinking further down the line, whereas traders aim to make quick profits from HC’s volatility.

What’s the Difference Between a HyperCash Exchange and a Broker?

An exchange differs from a broker in the sense that the former seeks to facilitate trading between two different cryptocurrencies. For instance, you may want to trade your HyperCash coins with another altcoin to add to your portfolio.

Buyers go to exchanges as they allow you to purchase the coins themselves and store them as longer-term investments.

That’s different on brokerage platforms where trading mainly works through CFDs and other derivative instruments. Here traders target profits from price movements and won’t bother about acquiring and holding the underlying crypto asset. A good broker should see you benefit from margin and leverage trading, significantly expanding your income potential. Note however that trading CFDs is risky and leverage and margin trading can amplify your risk.

HyperCash: Long Vs Short Term Investment

If you want to hold HyperCash as an investment over a long period, you would need to store it in a wallet. This will form part of your long-term investment. You take this position if you believe in the project and its eventual maturity and profitability.

People who have no interest in holding on to the coin long term, or don’t bother about its future gains, go for a short-term investment plan. For such a strategy, the best option is to register for an account at a recommended broker and speculate on HyperCash’s price movement.

3 Tips to Buy HyperCash

No doubt you can now safely buy, trade, or store HyperCash following our comprehensive guide. Is there something else to note? Yes. Three quick tips to consider as you buy your HC tokens.

1. Choose the Right Time and Do Your Own Research on HyperCash

Always take time to understand the market before you invest. Do some research into the given coin and, if possible, seek expert opinion from within the market. Remember, buying when markets are bleeding is better than selling. As such, have a goal and get in when you feel that timing suits your plan and strategy.

2. Comparing Costs to Buy HyperCash

A simple tip that can save you money and see you add to your overall purchase is comparing costs and fees on different exchanges and brokers. Understand what your overall cost is if you use this or that platform.

3. Safety and Security when Buying HyperCash

Safety and security are two aspects that many investors take for granted but which often count towards your investment’s performance. Using a regulated platform as well as setting and enabling all possible security features should be on top of your priorities before you invest your hard-earned money.

What is the Best Payment Method to Buy HyperCash?

- Buy HyperCash with Cash: Buying HC from a peer-to-peer platform is easy with cash

- Buy HyperCash with Credit Card: Globally accepted payment option for crypto

- Buy HyperCash with Bank Transfer: A convenient way of buying any cryptocurrency

- Buy HC with Bitcoin: Just buy another crypto and trade it for HC on an exchange

- Buy HyperCash with PayPal: Buy crypto and use it to shop at multiple major retailers and merchants.

Other Ways to Buy HyperCash

This tutorial focused on the two most popular ways to buy and trade HyperCash. However, that’s not saying there are no other ways. As we conclude on the available options, let’s mention two other ways you can use to get HC.

The first option is through a P2P (Peer-to-Peer) exchange. Here you can buy or sell cryptocurrencies directly to other users on the platform. These users are usually from your location or region thus you can buy with cash once the tokens have been sent to your wallet. Ensure you take time to research the seller via reviews available on the P2P platform, to ensure you are not being scammed.

You can also acquire HyperCash through mining and staking due to its hybrid PoW/PoS network mechanism. Both miners and stakers earn a reward in the form of new coins for their role in securing the network. You should be able to earn a decent amount of new coins if you join the network as there’s no hash power monopoly to lock smaller or newer participants out.