Bitcoin fees have significantly decreased over the past few months, especially since the lock-in of the Bitcoin Core development team’s scaling solution and transaction malleability fix Segregated Witness (SegWit) and the proposal of SegWit2x.

Leading bitcoin wallet platforms including Blockchain, the second largest non-custodial bitcoin wallet application behind Coinbase, currently recommends a $0.88 fee for a median-sized transaction and a $1.1 fee for urgent transactions that need to be confirmed by miners within 60 minutes.

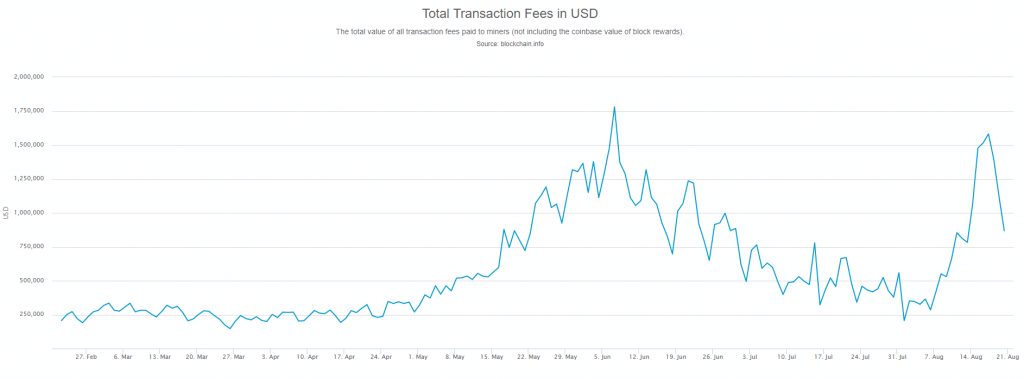

In contrast to the median fee of around $3 in June, bitcoin transaction fees have substantially decreased. Prominent experts and analysts including Nick Szabo revealed that a series of spam attacks clogged the bitcoin blockchain in 2016, which ultimately led the bitcoin mempool, the holding area for unconfirmed transactions, to bloat and transaction fees to rise at a rapid rate.

The debate on whether transaction spam attacks continued throughout this year is still ongoing, however, almost immediately after the industry agreed to activate SegWit through BIP 91, bitcoin fees abruptly dropped. Oxt Developer, Laurent recently speculated that spam attacks on the network bloated and clogged the blockchain for at least 18 months:

“Considering that the published elements are the result of an exploratory analysis, I would say that I’m 95% confident. 100% confidence will require an in-depth analysis which is currently outside what my financial resources allow me to do.”

Today, bitcoin transaction fees are significantly lower. Users can easily process median-sized transactions with a fee less than $1, which was not possible three months ago. More importantly, with SegWit, which will activate this week, it is expected that fees will likely decrease by 75 percent. Core developer, Luke Jr recently explained that the implementation of Lightning, a two-layer solution designed to facilitate micropayments, is expected to decrease block size by 90 percent.

“All legitimate uses of the blockchain currently amount to approximately 750k/block average. If inefficient and micro transaction usage is put aside, likely below 500k would be sufficient. No block size increase is likely to be needed in the near future. Before we reach the point that 1MB is insufficient, we are likely to have the Lightning protocol working in production. This improves the efficiency of blockchain usage by magnitudes, possibly reducing 1 MB block usage to ~10k,”

However, the 90 percent optimization of bitcoin blocks is dependant on the adoption of Lightning. If businesses integrate Lightning at an exponential rate, then it may be possible for bitcoin blocks to optimize at the rate mentioned by Luke Jr.

Recently, a $44 million transaction was processed on the Ethereum network with a $0.13 fee. That is merely 10 percent of the transaction fee for median-sized payments on the bitcoin blockchain. If a $44 million transaction was processed on the bitcoin blockchain, it most likely would have required a significantly larger fee than the Ethereum transaction, as bitcoin transaction fees are proportional to the size of transactions.

According to Social Minds founder and Reality Keys developer Edmund Edgar, the block size of Ethereum grows naturally through an automatic adjustment period, which allows the network to prioritize flexibility and process transactions with lower costs:

“The good news is that Ethereum is in a much better position to scale to handle substantial numbers of payments than Bitcoin. Bitcoin’s block size has been stuck at 1MB for years. Most bitcoin people say they support an increase in capacity, but Ethereum’s grows naturally through an automatic adjustment,”

The Ethereum community has been praised for its proactive approach to scaling and this month, Ethereum co-founder Vitalik Buterin and Lightning’s Joseph Poon announced a new joint project named “Plasma” which aims to improve Ethereum’s scalability by integrating zk-SNARKs, the cryptographic system used by anonymous cryptocurrency Zcash.

Essentially, Plasma eliminates unnecessary data by only broadcasting merkelized information to the main Ethereum blockchain. Because zk-SNARKs enable the Ethereum blockchain to hide certain information and conceal sensitive data, Buterin and Poon noted in their paper that Plasma will also drastically improve privacy for users.

“As only merkleized commitments are broadcast periodically to the root blockchain (i.e. Ethereum) during non-faulty states, this can allow for incredibly scalable, low-cost transactions and computation. Plasma enables persistently operating decentralized applications at high scale,”

Previously, experts including Coinbase co-founder Fred Ehrsam explained that for Ethereum to scale and power decentralized applications with 1 to 10 million users, it needs to implement two-layer solutions. Plasma, which in concept is similar to SegWit, is expected to provide sufficient scalability for large-scale applications which will further decrease the fees when buying Ethereum.

“We propose a method for decentralized autonomous applications to scale to process not only financial activity but also construct economic incentives for globally persistent data services, which may produce an alternative to centralized server farms,” Buterin and Poon added.

When Plasma is integrated and the new Ethereum hard fork Metropolis focused on scalability and privacy is successfully executed, the scalability of Ethereum will likely improve significantly within a relatively short period of time.

In order to match the transaction fees of Ethereum and other leading blockchain networks, bitcoin will also need to scale appropriately. Bitcoin Core developers and the vast majority of the industry believe that two-layer solutions will further enhance bitcoin’s scalability.