- The market has gained ground on Friday following yesterday’s pullback that halted the uptrend that started on Monday

- Fantom, alongside other altcoins, is seeing modest gains

Crypto analyst Altcoin Sherpa has shared in a series of tweets his short-term predictions for Bitcoin (BTC), Fantom (FTM), and Near Protocol’s native token NEAR. Sherpa, an advisor for the decentralised cross-chain liquidity aggregator Atlas, has previously made a number of right calls on various alts.

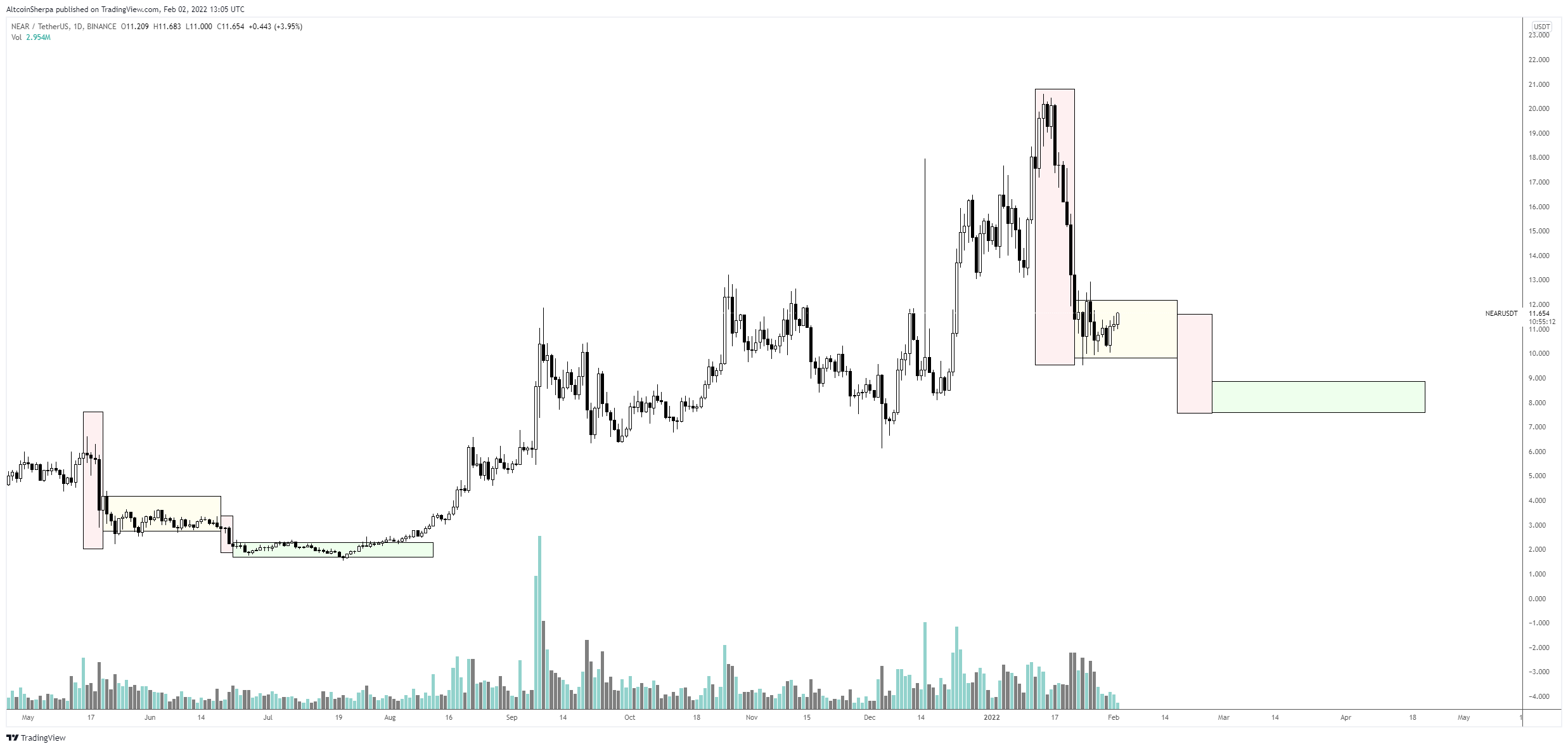

NEAR/USD

NEAR posted an all-time high slightly above $20 just a little over two weeks ago. The surge was propelled by several factors, including Near Protocol’s successful completion of a $150 million funding round led by Three Arrow Capital.

Since then, NEAR/USD has lost over 40% of its value and is currently trading at $11.26. The pair attempted to breach $12 earlier this week before seeing a dip alongside other tokens yesterday.

In a tweet posted on Wednesday, Sherpa maintained that the rising community-run cloud computing platform is a solid project.

NEAR/USD trading chart. Source: Altcoin Sherpa

NEAR/USD trading chart. Source: Altcoin Sherpa

“I am still in my position but waiting for a bit lower potentially. I did add in the low $10s […] Still thinking this one is a solid project,” he wrote.

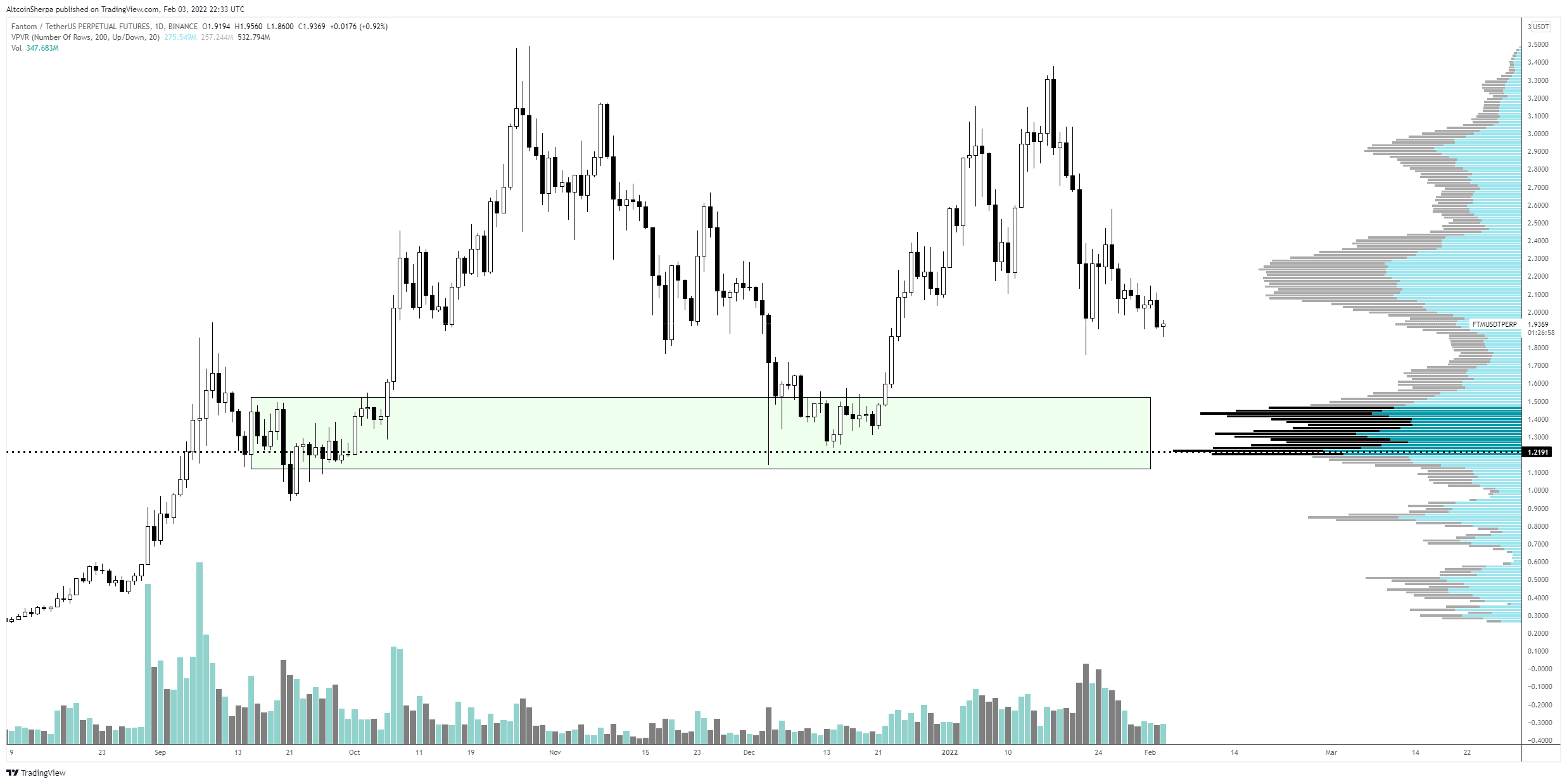

FTM/USD

Fantom’s FTM has re-entered the $2.00 zone for the third time over the last seven days following a series of pullbacks. Yesterday’s market recession saw the token drop to a 7-day low of $1.88. the token has since embarked on an uptrend towards $2.10.

Sherpa, however, sees FTM/USD sinking again, but this time as low as $1.50. He also advanced that it is unlikely that the pair will rally again any time soon.

FTM/USD trading chart. Source: Altcoin Sherpa

FTM/USD trading chart. Source: Altcoin Sherpa

“Still coming down to $1.50 eventually IMO,” he posted today. “It’ll take a while before it runs again IMO. Will need to chop and consolidate.”

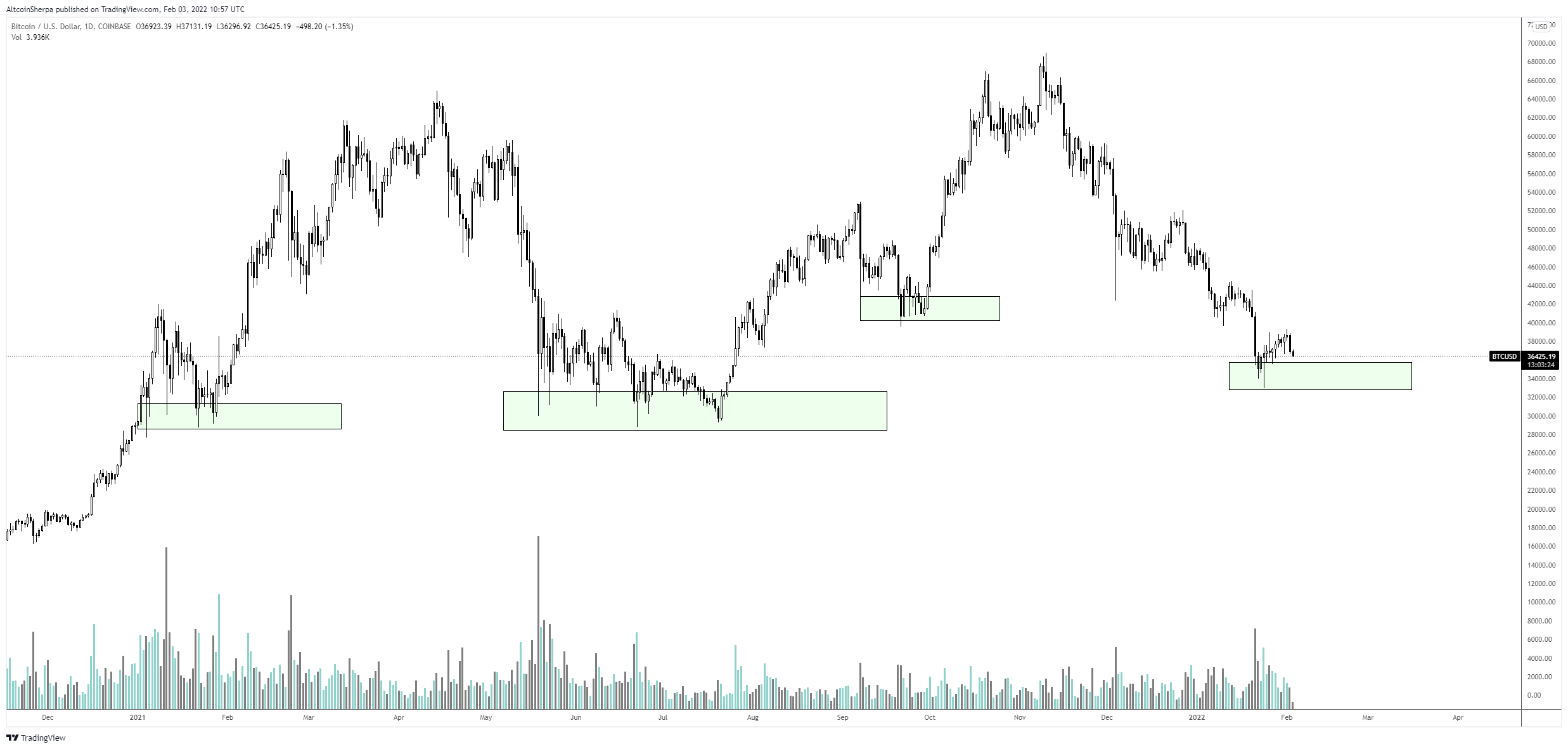

BTC/USD

Sherpa also gave his opinion on the leading crypto, which is currently on the verge of cutting above 38,000 – having seen approximately 2.80% gains in the last 24 hours.

In his Thursday analysis, the crypto strategist shared Bitcoin’s trading chart since December 2020, noting the asset might still slump to a demand area.

BTC/USD trading chart. Source: Altcoin Sherpa

BTC/USD trading chart. Source: Altcoin Sherpa