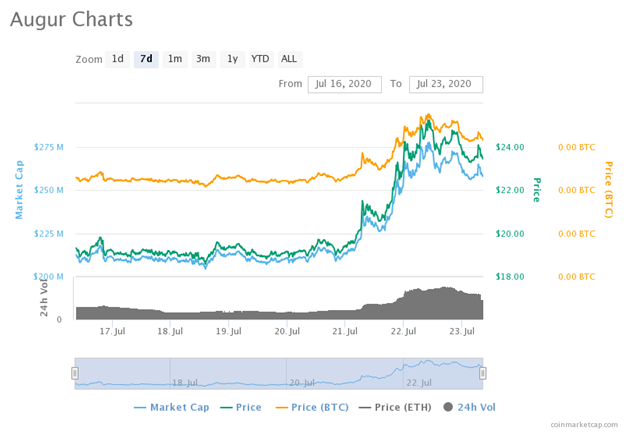

Ethereum-based Augur is down 7% in the past 24 hours to trade at $23 after hitting a 52-week high of $25.30

Augur is one of the biggest losers in the past 24 hours, with the price of its token REP down more than 7% in the past 24 hours.

Yesterday’s price surge to $25.30 took the token to its 52-week high. The price is 20% up in the past week and over 16% since July 8. However, this downswing sees it still 85% down from an all-time high of $99.80 reached on January 11, 2018.

The REP/BTC pair is trading at 0.00246311 to BTC, bringing it down by 7.06%. The token is performing far worse against Ethereum however, at 0.08898195, which represents a massive drop of 12.52%.

REP/USD will pump to $30

Ryan Scott, an analyst with the crypto platform Blockroots, has said that the price of Augur hitting above $25 suggests a run to $30 is possible in the short term. After gaining more than 24% in a week, the analyst forecasts another 40%-50% pump could be around the corner.

According to Blockroots, the release of Augur v2 will contribute to the hype and help prices soar. V2 of the decentralized oracle platform is scheduled to go live on July 28 and will add Dai denominated markets and a new price auction feature.

DeFi tokens could be in their consolidation phases

Over $3.3 billion is locked up in decentralized finance protocols; Maker, Compound, Aave and Synthetix all have more than $500 million in total value locked up in DeFi. However, some of these tokens are seeing significant downswings as the rest of the crypto market pumps.

Aave has dropped the most alongside Augur in the past 24 hours. LEND/USD is trading 6.4% in the red as of writing at $0.304. Kyber Network has slipped 1.5% to trade around $1.66, while the Synthetix Network is trading at $3.52 after dropping 1.2% in the past 24 hours.

Compound and Maker are up 2% and 3.6% respectively.