Bitcoin price has declined by about 4% in the past 48 hours, dropping from highs of $11,780 to lows of $11,079

The latest pullback for Bitcoin has seen its price drop from around $11,780 to $11,079, with the technical picture suggesting bears might push it to major support levels around $10,900.

BTC/USD has traded in the $11,000-$12,500 range for the past month but attempts to establish a footing above the $12,000 mark have all met violent rejections.

Yesterday’s decline to lows of $11,100 curtailed bulls’ attempts to retake $11,800 – crucially meaning that bulls lost support at $11,650, and $11,500.

Struggles against the US dollar above these levels suggest that bears are likely to aim at the area below $11,000

According to crypto trader “DonAlt,” Bitcoin’s price is likely to rebound as bulls find comfort around $11,200. However, the bears might have it easy invalidating that, especially as whales appear to be taking profits at prices above $11,600.

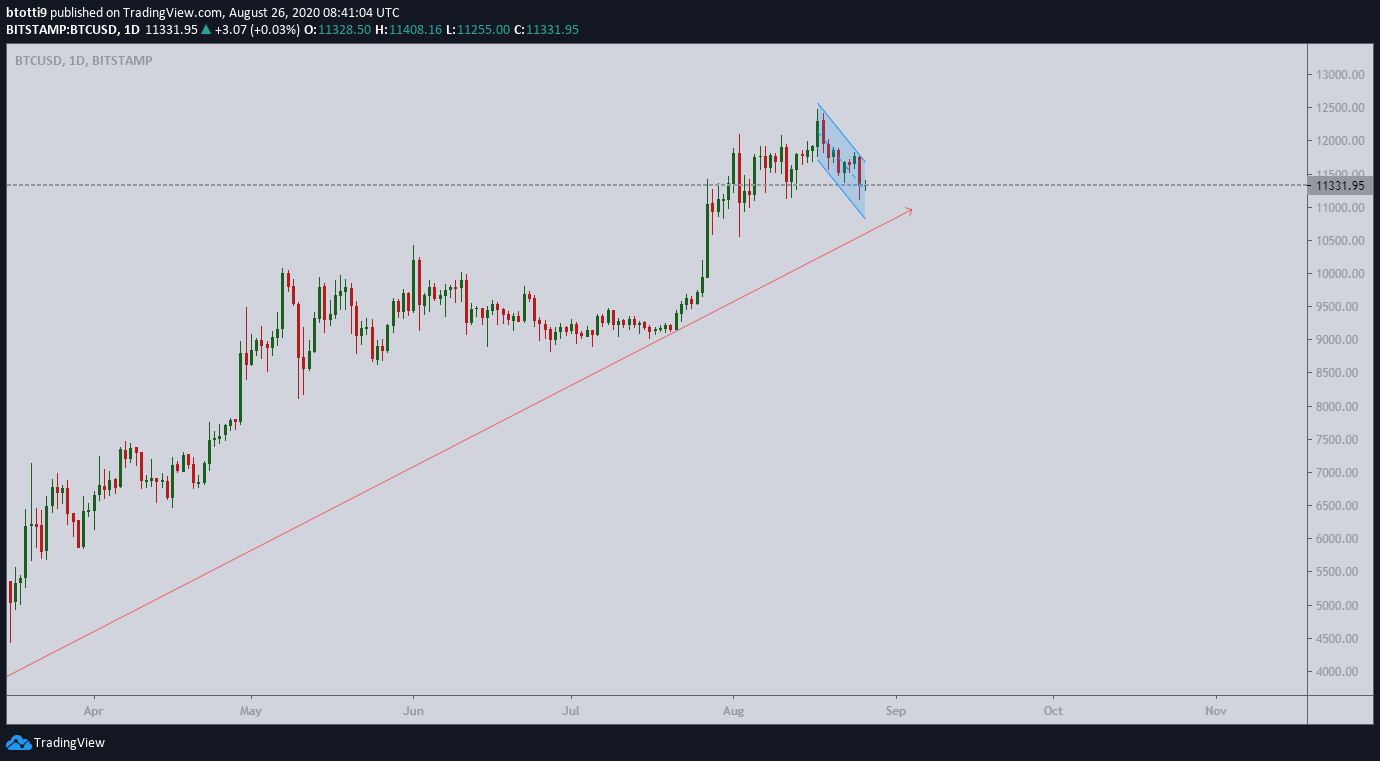

Via a chart shared on Twitter, the trader noted that Bitcoin taking out $11,760 at close would make it possible for higher moves. But until that happens, BTC/USD would likely see further losses.

After hitting a new weekly low, BTC/USD has in the past hour corrected higher, currently trading at around $11,320. However, the bulls are finding resistance at $11,400 steep to suggest a retest of the area marked by the 23.6% Fibonacci retracement at $11,122.

The technical picture also suggests a bearish trend line, with prices likely to struggle at the 50% Fibonacci retracement level near $11,400 and above it, $11,500.

Bulls will need to break above these price zones to keep the bears off. As noted, failure would likely first see a retest of $11K and below it, the major support area between $10,000 and $10,900.

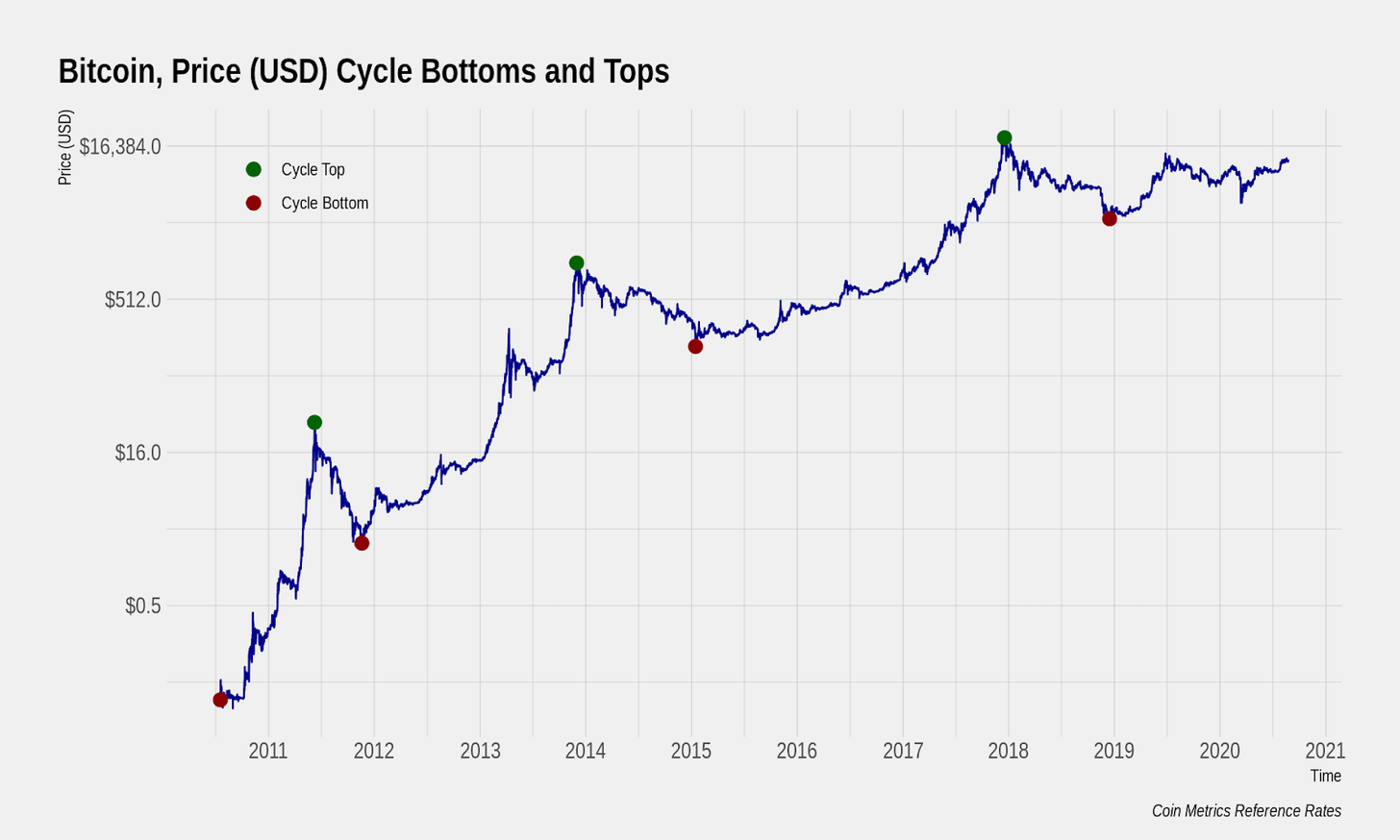

Positive for the crypto is that the uptrend is still there, with prices 58% up year-to-date. The bull run is still on, likely halfway into a fourth major cycle.

Analytics and research firm CoinMetrics says that Bitcoin’s cycle from the last bottom is now more than 600 days in. if the market witnesses a repeat of the 2015 cycle, then Bitcoin is “at least several hundred days” away from a new all-time high.