Will Binance Coin finally reach the much-awaited $1000 price range this year or fall below the psychological $300 level?

Binance Coin (BNB), the native coin of the Binance chain issued by the world’s largest crypto exchange Binance has proven to be an altcoin one cannot miss after surging from around $16 last May to over $600 this year.

With a market cap of $59 billion at the time of writing, Binance Coin ranks fourth according to CoinMarketCap. Backed by Binance’s strong reputation, BNB is a utility based coin that is likely to witness immense growth as the trading volume on the Binance exchange increases.

Traders in the crypto market seek digital assets that offer high returns in the shortest time frame, a phenomenon that is possible due to the inherently volatile nature of cryptocurrencies. Despite being hampered by the recent financial crisis, Binance Coin’s potential for growth, past performance and credibility make it the cryptocurrency to watch out for in June 2021.

Launched in 2017 as a utility token for discounted trading fees on the Binance platform, BNB today has expanded its use case to numerous applications across platforms. Binance, which initially offered over 100 million BNB tokens in an Initial Coin Offering (ICO), has consistently used one-fifth of its profits from every quarter to burn tokens in its treasury.

The latest BNB burn happened on 15 April 2021 during which the platform destroyed $595,314,380 worth of tokens. The burn led to a massive price rally for the token as BNB surged from about $323 on 3 April to almost $600 by the end of April.

Binance Coin is an integral part of Binance’s future vision of becoming the infrastructure services provider for the entire blockchain ecosystem.

Binance Coin Price Analysis

The bull run in the cryptocurrency market and increased activity on the Binance exchange has led to higher interest in the Binance Coin since the beginning of 2021. BNB started the year exchanging hands for a mere $37.44. By 10 May, the token hit an all-time high of $690.93 with experts predicting that BNB might reach the $1000 mark by the end of 2021. However, the price rally was followed by a sharp decline in the second half of May as the BNB price went through a correction and plunged to $238.45 by 18 May, its lowest price since March. The 59% fall in BNB’s price last month is also being attributed to a sharp sell-off across the cryptocurrency market.

The coin has since shown improvement and is trading at $396.46 at the time of writing with an over 1% increase in value in the last 24 hours according to CoinMarketCap.

Binance coin price chart. Source: CoinMarketCap

However, several other factors are likely to influence the price of BNB in the coming few months. The fear, doubt and uncertainty caused by the recent surge in central banks’ resistance to cryptocurrencies are not helping BNB’s cause. From Derville Rowland, DG of financial conduct in the Irish Central Bank to ECB Chair Christine Lagarde, regulators have frequently issued warnings to crypto investors highlighting the volatile nature of the market. Further, the crypto market witnessed a crash after Elon Musk’s Tesla decided to stop accepting payments in Bitcoin, leading to several negative headlines against the industry.

This does not mean that all is gloomy for BNB as its credibility of being part of Binance’s long term vision continues to attract investors. Recently, in a Twitter exchange, Binance CEO Changpeng Zhao agreed with a tweet claiming that BNB will eventually grow to the heights of Apple and Amazon. The executive added that “the best performing crypto assets have outperformed all the best performing traditional assets in the last decade. The same will be true for the next decade”.

Where to buy Binance Coin (BNB) today

Binance Coin Price Forecast for June 2021

How will BNB perform in the upcoming months? Does BNB’s historical performance bear any hints and what factors will affect BNB’s market performance? What does the recent volatility in the crypto market mean for Binance Coin Price Forecast? This section will attempt to answer all these and more.

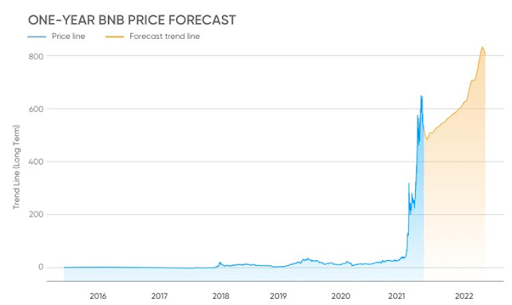

One Year BNB Price Forecast. Source: WalletInvestor

The performance for Binance Coin can be determined based on the price action at the descending trendline. A descending trendline is essentially a diagonal trendline drawn over price action that connects a series of lower-lows or lower-highs to predict where the price of a token is likely to go if the downturn continues.

For BNB, this means that if the token’s price breaks the descending trendline, the price could hit more than $400 with further price targets forming to the north. However, a rejection of the trendline can lead the Binance Coin price to fall below the $300 psychological price level.

As investors concentrate on buying altcoins, BNB’s price may fluctuate between $500 and $700 in June 2021 with the possibility of hitting the $800 mark by the end of 2021. WalletInvestor predicts that Binance Coin could grow by over 17% in the coming year with the price expected to consistently remain above the current trading price. DigitalCoinPrice agrees with this analysis and expects the price of BNB to reach $700 by December 2021. Analysts at Longforecast, on the other hand, have a more optimistic view and predict that the token might trend between $934 and $1159 this year.

While experts continue to believe that the market will rebound and still meet the long-term target of $1000, it is crucial to note that such development is dependent on the progress of crypto trading in general and the adoption of Binance products in particular.