The leading cryptocurrency has set a new all-time high close to $65k as the market eyes Coinbase’s listing on NASDAQ later today

Bitcoin is up by over 5% over the past 24 hours, setting a new all-time high above $64k yesterday. The leading cryptocurrency could rally further over the coming hours and break past $65k as the market gets ready for the Coinbase stock listing later today.

The BTC/USD pair successfully broke past the main $61,120 resistance zone yesterday after spending the past few days trading around $60k. This allowed bulls to push higher, and BTC recorded more gains above the $62,000 resistance point.

Bitcoin went on an extended rally, clearing past $63,000 and setting a new all-time high at $64,889. The BTC/USD pair retraced a bit and now trades just below $64,500 on most cryptocurrency exchanges.

BTC price outlook

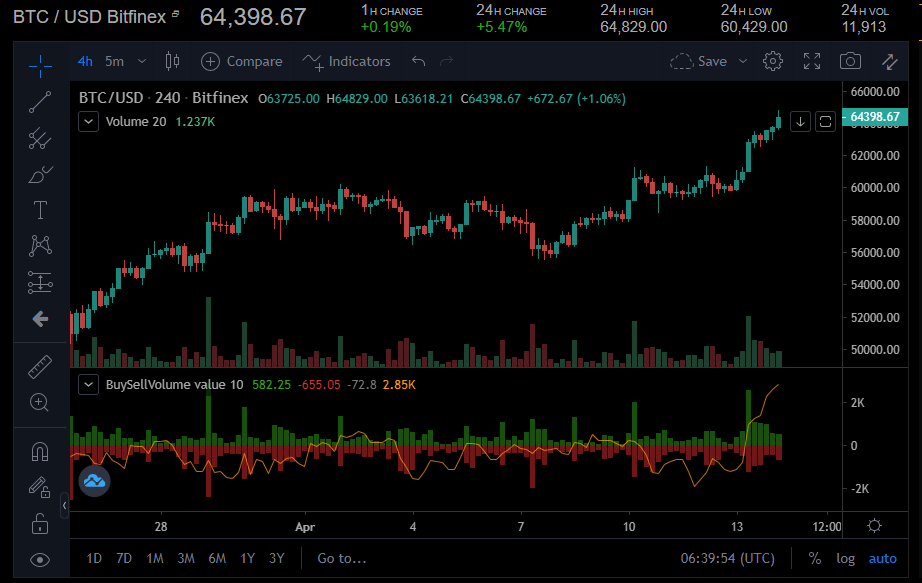

Bitcoin is targeting a new all-time high above $65k as the cryptocurrency market gets ready for a Coinbase listing on the NASDAQ stock exchange later today. A look at the BTC/USD 4-hour chart shows it has established support at $62,944. This allowed it to bounce back from its slight slump a few hours ago and rally towards its current trading price of $64,492.

If the rally continues, BTC could break the $65k barrier and test resistance above $66k before any potential pullback. The Coinbase public listing today is expected to generate a lot of interest in the cryptocurrency market, with most of the attention on Bitcoin.

Popular crypto trader and investor Scott Melker has predicted in a tweet that Bitcoin’s price is going to $75K soon.

BTC/USD 4-hour chart. Source: Coinalyze

If the leading cryptocurrency can capitalise on the attention from retail and institutional investors, then it could rally beyond $65k and set a new all-time high. However, failure to break past the $65k level could lead to a decline below $63k. BTC has set strong support at $62,944 and $61,120. If bears could tear them down, the BTC/USD could be heading towards $60k again.

At the moment, Bitcoin’s technical indicators are all bullish. Its RSI at 78.01 is in the overbought (OB) region, while its MACD is gaining momentum in the bullish zone.