Bitcoin (BTC) broke out of the sideways trading channel and headed past $38,000 as the bulls confirm BTC’s position above the 23.6% Fib retracement level

The largest cryptocurrency by market cap managed to establish its position above the $34,577 mark on Tuesday, creating a great position for a price spike. BTC is currently pushing above the $38,000 mark, and is possibly aiming at the $40,000 level.

Bitcoin fundamentals and past price performance

Bitcoin’s overall outlook is extremely bullish, to say the least. Various on-chain analysis firms, as well as individual analysts, made six-figure price predictions for 2021. However, these predictions are actually based on various indicators and metrics, rather than just feelings or optimism.

BTC managed to post week-over-week gains of 19.66%, while ETH managed to gain 27.30%. At the time of writing, BTC is trading for $38,000 (and heading up), which represents a price decrease of 1.15% when compared to the previous month’s value. The largest cryptocurrency by market cap currently boasts a market value of $704,71 billion.

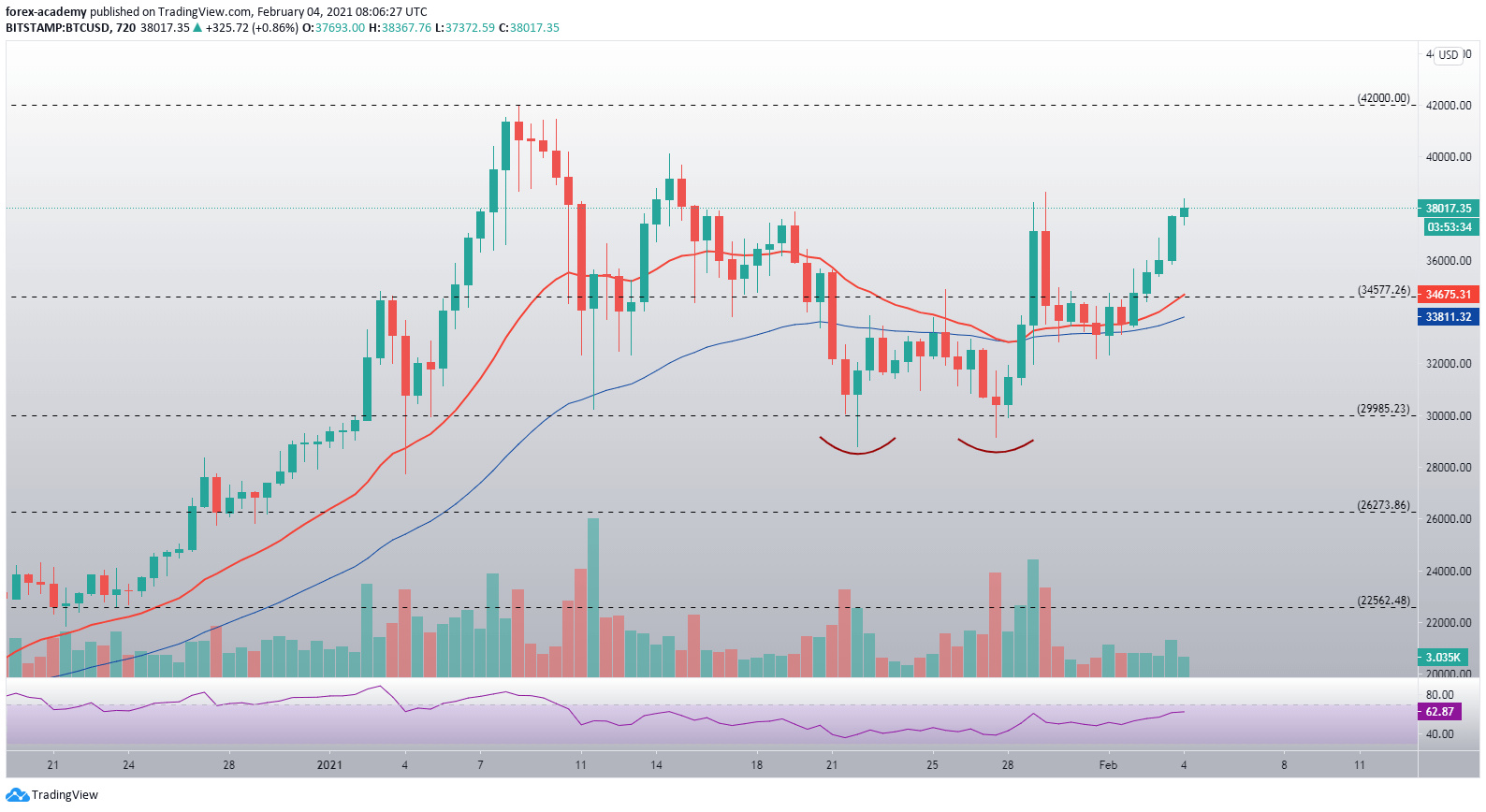

BTC/USD 12-hour chart price breakdown

The largest cryptocurrency by market cap’s short-term outlook changed to bullish ever since it created a double bottom formation at the 38.2% Fib retracement level. Its price is now trying to pass the recent highs of $38,620 after finding strong support in the 21-day EMA and the 23.6% Fib retracement level.

The aforementioned $38,620 level could be considered a pivot point that will decide BTC’s short-term future.

BTC/USD 12-hour price chart. Source: TradingView

BTC’s RSI on the 12-hour time-frame is slowly ascending towards the overbought area as BTC pushes its price up. Its current value is sitting at the 62.87 mark.

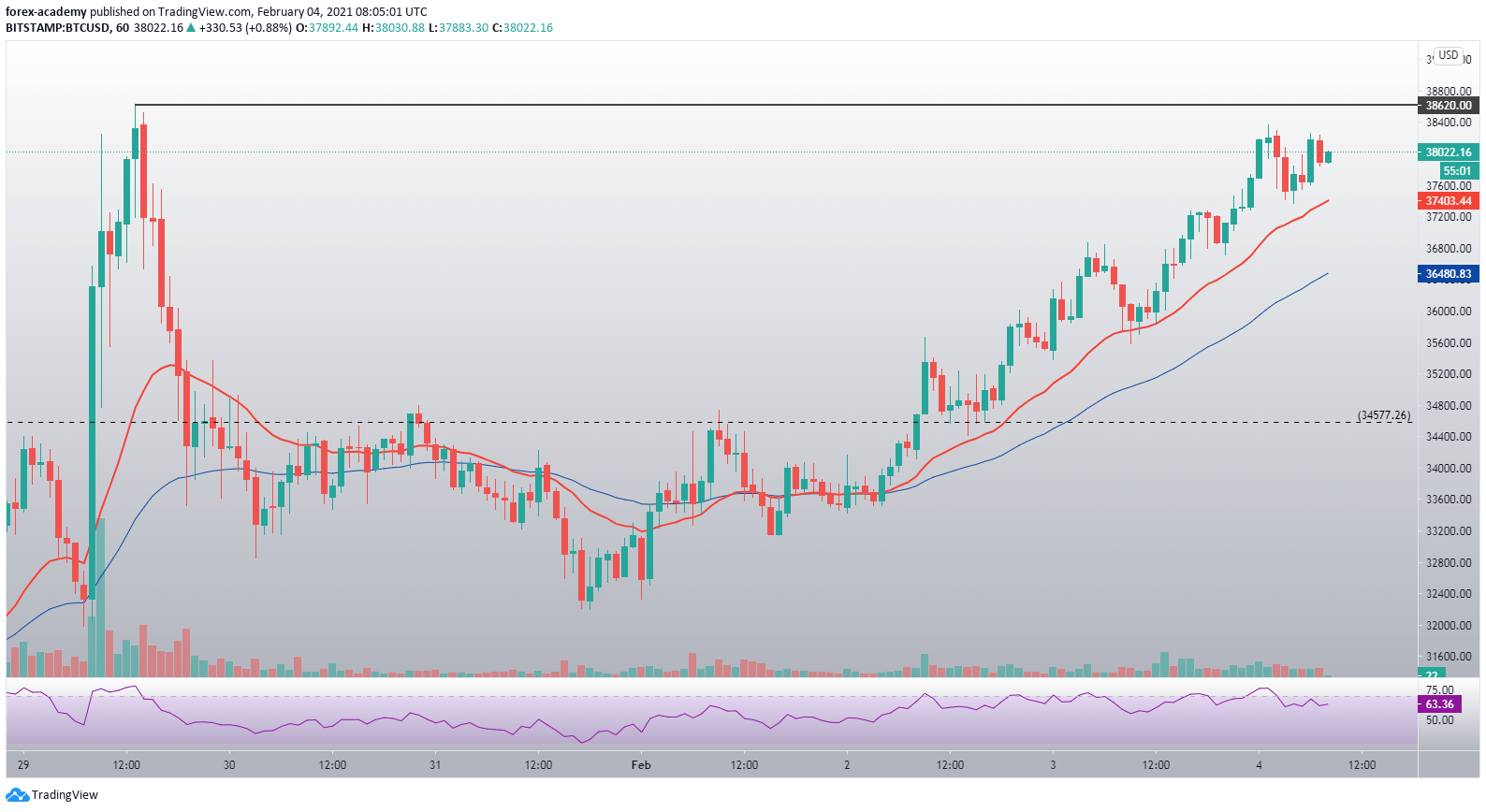

BTC/USD hourly chart price breakdown

Bitcoin’s hourly time-frame shows us the influx of buyers that took BTC above the 23.6% Fib retracement level, and then a steady push towards the upside that got supported by the 21-hour EMA. Bitcoin’s price is currently heading towards the recent high of $38,620, and a strong push above it will most likely be translated into a contesting of the $40,000 level. However, if BTC fails to reach past the recent high, it may spiral down and retest the $34,577 level.

While its downside is well-protected by the 21-hour EMA, its resistance is strong, and BTC has a solid chance of not reaching past it on such low (comparatively) volume.

BTC/USD 1-hour price chart. Source: TradingView

What’s next for Bitcoin?

While Bitcoin’s short-term outlook is not as bright as some other cryptocurrencies’, its long-term overview is incredibly bullish. With institutions pouring their money into BTC and using it as an alternative to cash reserve rather than a speculative asset, the cryptocurrency is bound to grow.