Bitcoin (BTC)

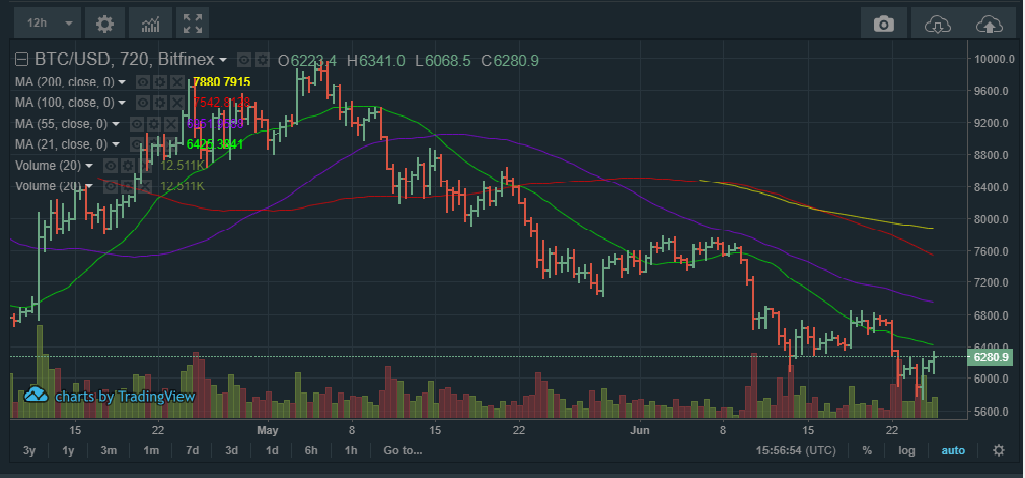

Bitcoin has started the week on a high note, having broken above $6000 in the last 24 hours. That’s an indicator that there is strong buying pressure around this price level, and it’s likely to hold as support for the next couple of days. Looking at the 12 hour charts, the short-term uptrend is fully confirmed, with bitcoin having cleared above the bearish candle that saw it drop to $5700.

This is a bullish signal that could see it test $6700 to the upside. A break above $6700 could see bitcoin test $7000. However, for a short-term entry, it is best to set an exit point at around $6500 – $6700.

That’s because in the weekly charts, bitcoin is still in bearish territory. It will only turn bullish if prices sustain above $6800. Such a break would see the price of Bitcoin (BTC) test $9000 in a few weeks.

To buy bitcoin with a 24-hour target, one also needs to watch the volumes. At the moment, volumes are rising, an indicator that bitcoin is likely to test $6500 in the next 24 hours. Therefore, an entry into bitcoin at current prices, offers a good risk/reward ratio, with minimal possibility of losses.

Tron (TRX)

Tron (TRX) is in the middle of some major fundamental activities, mainly the token migration and the super delegates’ election. This is all part of the transition of Tron from the Ethereum blockchain to its own Tron blockchain.

This has led to an upsurge of volumes in Tron (TRX) in the last few days. In the very short-term, Tron (TRX), is at the very beginnings of a medium-term uptrend. This is clear in the last 12 hours, where Tron (TRX) has broken above last week’s low of $0.037, and looks set to test $0.049, which is the first resistance level.

If price rises above this level, Tron (TRX) is highly likely to test $0.05, which is a major resistance level along the 200-day moving average. This rise is also anchored on bitcoin (BTC)’s performance. If bitcoin (BTC) rises above $6500, Tron (TRX) could easily test $0.06 within the week.

NEO (NEO)

Looking at NEO’s weekly charts, it is clear that it is still deep in bearish territory. However, as bitcoin continues to rise, the momentum around NEO (NEO) is likely to change too.

That’s quite visible in NEO (NEO) daily charts, where it has shown a strong reversal to $32 after dropping to $28 yesterday. This reversal is likely to gain momentum now that bitcoin looks set to hold above $6200 and test $6500 in the short-term.

This can be confirmed from NEO (NEO)’s 12 hour chart, where buying volumes are on the rise. This indicates that investors are taking advantage of NEO (NEO)’s low prices to make long entries both for the short-term and the long-run.

For someone with a 24-hour target, NEO (NEO) is likely to test $40, which is the first resistance to the upside.

Disclaimer: This content is for information purposes only and is not intended as financial advice or any other advice. It is not an offer or solicitation to buy or sell nor is it meant as an endorsement or recommendation for any security. The information is general in nature and does not take into account your individual financial position. You should seek advice from a registered professional investment adviser and undertake due diligence before making investment decisions.