Bitcoin (BTC) price rose to $38,789 on Bitstamp where resistance has slowed down the bulls

Bitcoin has once again surged to prices above $38,000 and is looking to print consecutive green candles on the daily log for the first time since it plummeted from $42,000.

The price of Bitcoin climbed to aggregate highs of $38,708 on CoinMarketCap ($38,789 on Bitstamp), an impressive rebound after aggressive buying. As it stands, BTC/USD appears to have flipped the bearish outlook as confirmed by a potential Head and Shoulders (H&S) pattern.

The top cryptocurrency by market cap touched lows of $30,260 earlier in the week, and even looked set to dip below this crucial support level.

But the past 24 hours have seen bulls rally more than 15% to break above the critical resistance level around $36,000.

BTC/USD 4-hour chart. Source: TradingView

As we highlighted yesterday, a dip below the neckline of the H&S pattern and the $30,000 support line would have seen bears target $20,000. The opposite has happened and the latest bounce confirms an ascending triangle pattern, suggesting the breakout could add another leg to $40,000.

Prices closer to record highs around $42,000 can be logged this week if bulls manage a daily candle close higher than the previous resistance line around $37,700. The daily RSI is looking to turn into the overbought territory, suggesting bulls have the room to manoeuvre.

BTC/USD daily chart. Source: TradingView

On the downside, the 20-day EMA ($33,560) and the 50-day EMA ($27,450) on the daily timeframe are potential areas of interest for the bears.

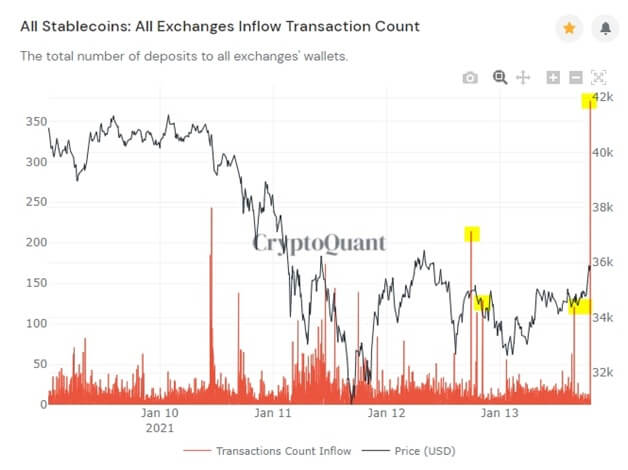

Stablecoin deposits spike

One on-chain metric that aided the choppy start to the week for BTC was the lack of stablecoin inflows to exchanges.

That metric shot straight up Wednesday, according to a chart from blockchain analytics firm CryptoQuant. From it, it can be seen that crypto exchanges witnessed a major surge in stablecoin deposits as BTC/USD began to climb towards $35,000.

The boom in buy-side pressure saw bulls level off the neckline of the H&S shoulder, and eventually surging past $37,000 to briefly top $38,500.

Chart showing a spike in stablecoin deposits to exchanges. Source: Alex Saunders (courtesy of CryptoQuant)

On-chain analytics platform Santiment also shows the same trend, with the number of stablecoins being sent to exchanges exploding as the BTC price rose. According to the firm, a lot more stablecoins are going onto exchanges as traders seek to capitalise on the high volatility in the market.

Bitcoin currently trades at $38,385 at the time of writing and remains within reach of the critical $38,800 resistance line.