Bitcoin price jumped nearly 5% as reports emerged payments giant PayPal could soon support the buying and selling of cryptocurrencies

Bitcoin surged to a high of close to $9,800 on Monday as buyers pushed it 5% from lows of $9,266. Over the weekend, Bitcoin’s price had been stuck in a range below $9,400.

During the US trading session, however, an upside correction materialized, partly buoyed by an unconfirmed report suggesting PayPal is looking into integrating crypto and supporting direct sales and purchases of Bitcoin with PayPal.

The fintech giant is also reportedly seeking collaboration with several leading crypto exchanges, among them, US-based Coinbase and BitStamp.

The news helped a confident market send the BTC/USD pair to $9,793, the increase taking the leading cryptocurrency closer to its next major resistance level of $10k.Bitcoin has since traded lower, but retains an upside momentum.

Bitcoin price outlook

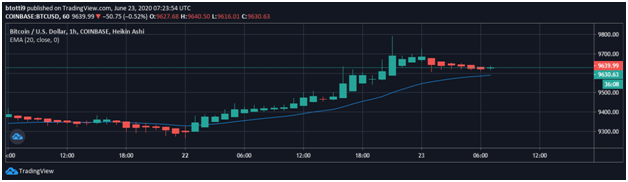

Bitcoin has pared some of the gains posted on Monday, with traders seeing the crypto drop to prices around $9,630 at the time of writing. The BTC/USD pair is 2.3% up on the day, and analysts are pointing to a probable run to $10,000 if bulls manage to hold support above current price levels.

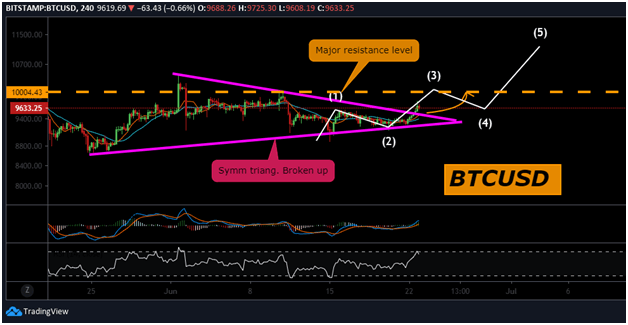

According to this analyst, Bitcoin could witness a significant upside in the short-term. If another leg up does move BTC/USD past $10k, then higher prices around $11,800 and then $14,000 could be achievable in this quarter.

Yesterday’s upward saw Bitcoin break above a symmetrical triangle, which is often indicative of an imminent rally.

The MACD and Relative Strength Index (RSI) are also bullish, though a pullback to the aforementioned levels is likely before breaching the long term resistance that holds a rally to new year-to-date price levels.

The downside for Bitcoin would be for high selling pressure above $9,700. The region has been a bogey range for Bitcoin more than once this year.

The cryptocurrency has touched highs of $10,500 but faced rejections multiple times to see the upsides melt away. Bitcoin price has traded in said range ($8,600-$10,000) since the start of May. A pullback could see prices level up around $9,300 to $9,600 if there’s a pennant breakdown.