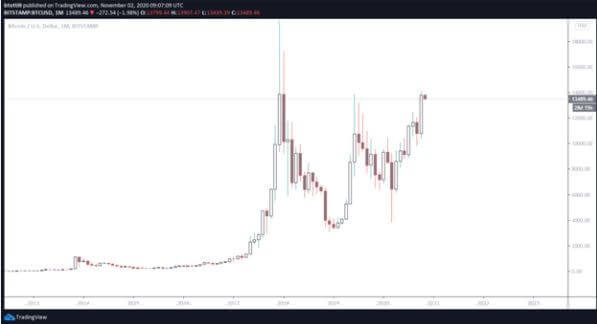

BTC price touched highs of $14,100 — the highest price point in more than 32 months

Bitcoin is trading just under $13,800 on the day, slightly lower than the $14,100 highs reached over the weekend. While the top cryptocurrency looks to rebound above the key resistance area, all eyes are on how the legacy markets perform in the coming days, a scenario likely to impact the crypto market basket as risk aversion hits traders in the traditional market.

BTC/USD hits the highest price in nearly 3 years

After struggling with a marginal sell – off last Friday that saw its value drop below $13,000, BTC/USD raced to its best price level in over two and a half years. The last time Bitcoin traded at highs of $14,000 was in January 2018.

As such analysts are pointing to the level as the main barrier to Bitcoin seeing a new bull run that would take its price beyond the 2017 all – time high of $20,000.The technical outlook is also largely bullish with the price hitting a new high on both the weekly and monthly candles. Bitcoin closed October at $13,816, the first time it’s closed higher since BTC/USD began its descent from the peak of December 2017.

Bitcoin’s bullish outlook is also strengthened by the price action on the daily chart. As we can observe below, the likelihood of another blast upwards remains intact as the daily candlestick hugs the upper boundary of bullishly divergent Bollinger Bands.

The picture suggests that the bulls are likely to stay in control if they buy any dips and send the price back above the immediate barrier at $14000. Again, a weekly close above the hurdle could see a spike in buying pressure and aid the push for more gains.

However, as we highlighted earlier, the short – term technical picture also features a fractal pattern that suggests that the bears are not entirely out of the reckoning. As per the pattern, BTC/USD is likely to register a major pullback to prices near $12k before resuming the uptrend to a new ATH.

The key price levels to watch this week are $14,000 – $13,800 and $13,800 – $13,000. Staying at or breaking above the former maintains Bitcoin’s uptrend while retreating below the upper limit of the latter would invite more selling pressure and send the prices lower.