Hash rate has slumped from 151 EH/s to 132 EH/s but Bitcoin price remains bullish around $13,000

Bitcoin continues to trade around the $13,000 level even as the network’s hash rate slumped to new weekly lows.

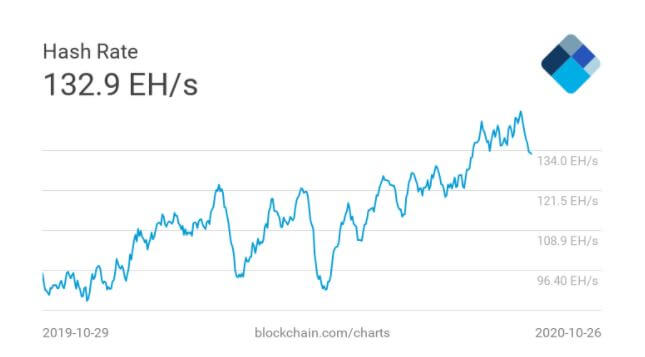

Data from Blockchain.com shows that Bitcoin’s seven – day moving average hash rate fell from 151.09 EH/s on October 24 to around 132.9 EH/s on October 26.

The decline in hash rate coincides with the end of Sichuan’s wet season, a region that attracts huge numbers of miners each year. It is estimated that over two – thirds of Chinese miners descend on Sichuan every rainy season, attracted by the availability of cheap hydroelectricity.

Bitcoin holding $13,000

Bitcoin’s steady action over the past few days contrasts with the picture seen across the global stock market.

For the stock markets, the US presidential election, lack of progress on stimulus talks, and reports of surging COVID-19 cases in the US and across Europe provide a bleak outlook.

On Monday, the 26th of October, the Dow Jones dropped 2.29%, the S&P 500 1.86% and Nasdaq 1.64% as financial markets on Wall Street tanked. The same trend registered in Europe, with the German DAX slipping 3.71% and FTSE lost 1.16% to leave investors nervous.

But as most stocks trend bearish on negative sentiment, investors are bullish on Bitcoin. The technical picture suggests that Bitcoin remains in the buy zone, with moving averages signalling a strong buy as oscillators hover around neutral on the daily chart.

As such, chances are BTC/USD pumps above $14,000 near term, with reasonable price targets around $16K medium term. However, technical analyst Cole Garner has suggested the price may fall sharply after another leg up.

“If we leg up — hammer falls right afterwards”, the analyst tweeted and accompanied his suggestion with the chart below that suggests Bitcoin is overvalued.

Other than the fall in total computational power, Bitcoin miners appear to be contributing to the slight sell – off pressure that has capped BTC/USD around $13K. As per data on Bitcoin terminal Byte Tree, miners rolling inventory (MRI) shows that the miners sold just 11% more bitcoin than generated this past week. The average over the past five and twelve weeks is 6%.

The data, however, suggests that MRI has jumped to 111% in the past 24 hours, with “first spend” figures at 1,293 BTC against 613 BTC generated (at the time of writing.)

If it tanks, BTC/USD will likely fall to lows of $11,300 — $11,500. The 100 – SMA and 200 – SMA are located at $11,168 and $10,050.