BTC/USD saw candle wipe off $900 after its recent gains to $12,485: analysts say it may drop to $11K first before climbing to new highs

Bitcoin bulls appeared to be preparing for a solid move above $12k with a consolidation phase around $12,100-$12,400, as prices stayed above the level for more than a session for the first time in a year.

However, bears had other ideas, and swung pretty hard to take BTC/USD to $11,569 causing a negative $900 candle.

Analysts suggest BTC/USD might drop further after the meltdown, although there’s a big chance a close around $12,100 will provide a foundation for higher gains.

Aggressive dump could take “digital gold” lower

Although the “digital gold” has slightly recovered from Wednesday’s crypto bloodbath to touch a 24-hour high at $11,907, its slide to $11,750 suggests sellers may attempt to correct its price further with more pullbacks.

According to some analysts, the 7% retracement might see bears bay for more blood if bulls buckle.

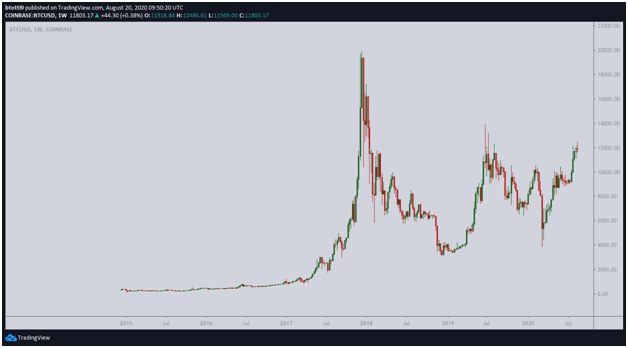

The chart below shared by crypto analysts DonAlt, points to the aggressive dump from $12,500 highs as a signal that bears have an appetite for more dumps. He suggests that selling pressure could see Bitcoin price revisit lows of $11,070.

However, if bulls manage a close around $12,100, DonAlt claims that the BTC/USD pair could be up for a $1,000 candle to the upside.

Highly respected technical analyst, Ali Martinez, holds the same view. According to him, the technical picture for Bitcoin on the 9-hour chart suggests the top cryptocurrency is trending “within an ascending parallel channel.”

He tweeted the chart above via Twitter, adding that the price of Bitcoin recently touched the lower boundary of the channel. In his view, “if the channel holds, [BTC/USD] would likely rebound to $12.3K-$12.8K. Otherwise, it’ll retrace to $11K”.