Cryptocurrency markets could not get more volatile: only 5 days ago, bitcoin price was nearly reaching the $8,000 milestone; unfortunately, the ‘hard fork’ cancellation caused a massive crash of over $2,000. The bullish rally was partly boosted by the “Free Bitcoin SegWit2x (B2X)” that BTC owners were going to get after the fork was implemented. Most exchanges were supporting the hard fork (e.g., Bittrex and Coinbase), willing to credit an equivalent amount of B2X on a 1:1 basis to all the BTC holders by the time of the hard fork. Bitcoin didn’t fell to the ground, though, it has bounced back to 6,500 USD showing a strong support line.

SegWit2x News Hit Hard: Bitcoin Down to $5,500

It was quite unexpected, and bitcoin holders that were waiting to get some “free coins” started to dump BTC to get into… Bitcoin Cash? (We’ll be there later). It was only 5 days ago when bitcoin reached a new ATH of $7,776 (according to CoinMarketCap data), that very same day, Mike Belshe announced that bitcoin’s hard fork was suspended until further notice:

“Continuing on the current path could divide the community and be a setback to Bitcoin’s growth. This was never the goal of Segwit2x.”

Bitcoin price plunged by 29 percent when many BTC holders sold their bitcoins to get into the altcoins market while the uncertainty cleared out. Bitcoin has been very volatile ever since, showing some stability during the last 24 h (although this market is volatile by nature). However, after a price rally that’s been going up sustainably for 2 months, a market correction was predictable and healthy for a bullish continuation pattern.

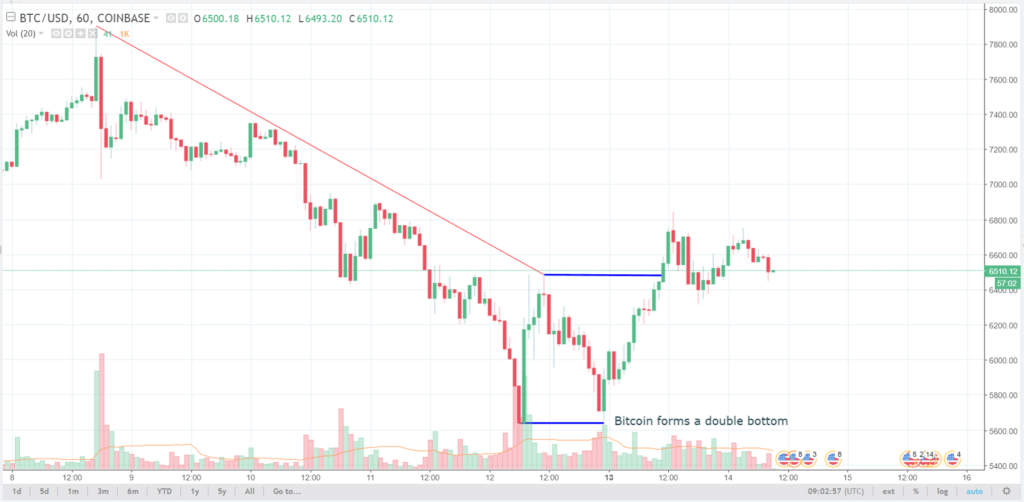

Bouncing back to $6500

This price dip was sharp, yet quick. According to the data analyzed on TradingView, bitcoin has fallen below $6000 twice: early in the morning of November 12th and 13th, during 2 and 5 hours, respectively. If you wanted to buy some BTC on this 5000-ish dip, you might have lost the chance. By observing the graph, it is clear that bitcoin has formed a double bottom around $5,500 and climbed back up to 6,700 USD:

A double bottom is considered as a bullish sign and it might mark a trend reversion. It is still difficult to foresee if bitcoin is going back into the parabolic pattern that it’s been experiencing for these past 2 years, but this behavior reveals a strong support nearby 5,500-5,600 USD.

Is it a good time to invest in bitcoin?

This is the one-million-dollar question that everybody’s expecting an answer to. Cryptocurrency market is still unpredictable, volatile, and risky, but it can be profitable as well. This year alone, bitcoin has gained more than 800%, maybe years of investments in the stocks market… or any other market known nowadays. If the bullish trend continues, bitcoin might be a great long-term investment, and yes, investors wait for these opportunities to get some bitcoin at reasonable prices.

There are many “shorters” too, opening short positions by buying all the dips and selling all the peaks to get as many profits as possible. These operations are high-risk and are not recommended for newcomers. Finding the right time to invest in a project that you believe in is hard during a bull trend, and these might be great entry points right now (nothing really bad happened, after all).

Bitcoin Cash taking over Bitcoin?

Investors were expecting that the dumped money from bitcoin flowed into other altcoins, but something even more astonishing happened: a lot of money moved into Bitcoin Cash (the cryptocurrency that resulted from August’s bitcoin hard fork). BCH became the second most valuable coin at CoinMarketCap for a few minutes, overtaking Ethereum’s spot, surging up to $2477, and taking the crypto-world by storm.

Flippening or Market Manipulation

“Flippening” is just a term that’s been used by bitcoin community for a while, and it’s been called when the public “fear” that another coin might take bitcoin’s spot. What caused this BCH surge this weekend?

- SegWit2x hard fork didn’t happen. That only left one option to bitcoin detractors that do not agree with the current BTC consensus rules: Bitcoin Cash. This rapid migration of money from BTC to BCH created some controversy on the social network, between the people that assured that the ‘flippening’ was occurring and the other group that alleged a market manipulation. Bitcoin Cash introduces an on-chain scalability scheme, with an adjustable blocksize of up to 8 MB. This is meant to avoid high-fees, speed up transactions, and engage mining. Nonetheless, BCH will not use SegWit technology: “Bitcoin Cash was necessary as a pre-SegWit fork. Segwit will not be adopted.“

- Twitter was flooded with accusations from many cryptocurrency experts. They believe that this is a typical ‘‘Pump and Dump’ (i.e., inflating the price and selling later with high profits) strategy, but on a much larger scale. They proved themselves right, apparently. This euphoria didn’t take too long to be vanished by a 55% drop in BCH price. Bitcoin Cash is currently back at 1200-1300 USD (which is still a great increase from its price last week).

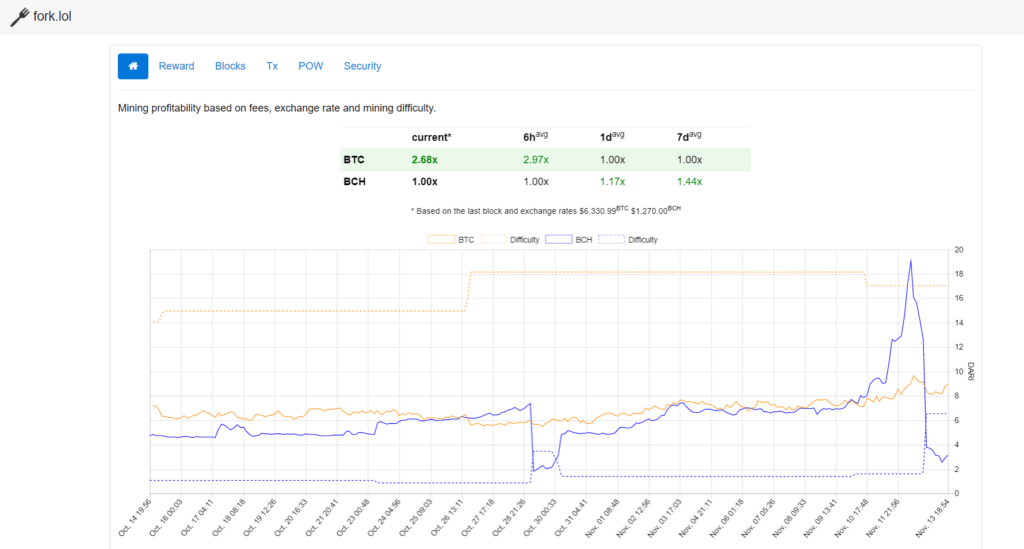

- The battle is on, and by the time this article is written, bitcoin is 2,68 more profitable to mine than bitcoin cash:

-

BTC vs. BCH mining profitability. Data obtained from fork.lol on November 13th.

Recent events are producing unsteadiness in the bitcoin market, which is something that cryptocurrency traders should manage wisely. Only 7 weeks left for the New Year’s Eve, will bitcoin surge over the $8,000; $9,000; and $10,000 milestones? Time will tell.