Price is already bottomed and won’t drop below $6,000 analyst claims, and describes buying spree of Bitcoin by institutions as a “land grab.”

Adamant Capital founder, Tuur Demeester, has asserted that Bitcoin’s price has already bottomed out. According to him, there won’t be anything “insane” happening if the cryptocurrency’s price spikes to values between $50,000 – $100,000.

Bitcoin crashed to a low of $3,800 on March 12, but was able to recoup its the losses via a 150% rebound that saw it touch $10,100 pre-halving. A minor pullback sent it back to lows of $8,100, but in filling one of the largest CME Futures gaps in its history, Bitcoin climbed above $10k again.

Although bulls have struggled to reclaim the $10k apex, which incidentally has been breached twice in the space of a week, analysts say Bitcoin’s bullish sentiment has never been this strong, not since the run-up to its all-time high (ATH) in 2017. Many analysts and crypto personalities have bet on Bitcoin going on a major rally in the near term.

Now, Demeester has added to the voices predicting Bitcoin’s could soon hit a new ATH.

In a video posted on YouTube, Tuur Demeester says that Bitcoin already touched its bottom in the $3000 – $4000 range. He argues that the cryptocurrency is bullish again and that economic bailout plans, such as that by the Federal Reserve, have the potential to work in Bitcoin’s favour.

“I think a price target of like $50,000 is not insane at all… I would even say between $50,000 – $100,000,” he noted.

A “Land Grab” for institutional investors

Demeester’s forecast comes at a time when interest in CME Bitcoin options rose to their highest level at close to $150 million.

According to Demeester, interest from institutions meant Bitcoin was entering a “land grab phase.”

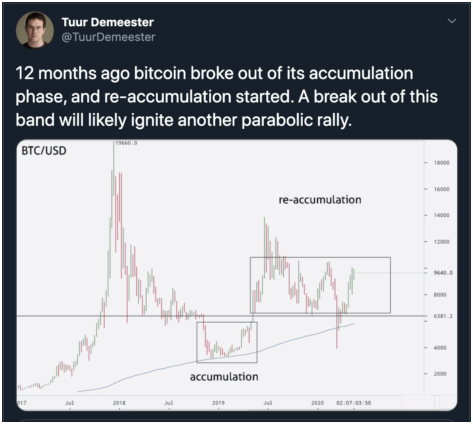

He noted on Twitter that “bitcoin broke out of its accumulation phase,” a year ago and that increased whale accumulation could see Bitcoin break out for another “parabolic rally.”

The crypto influencer also pointed to Bitcoin’s entry into a “deployment phase” that has already seen banking giant, JP Morgan Chase, make a U-turn regarding its view of cryptocurrencies to extend its banking services to two US-based cryptocurrency exchanges.

According to Demeester, it’s the increased interest from family offices, hedge funds, Wall Street billionaires, and other big-money investors that could see Bitcoin spike to prices above $50k per Bitcoin.

Last week, hedge fund pioneer and investment billionaire, Paul Tudor Jones, said that his company was buying Bitcoin and he was allotting 1-2% of his company’s portfolio to crypto holdings. The TIE, a crypto data platform, this week pointed out that Bitcoin’s post-halving sentiment had soared to new highs, aided by famous author JK Rowling, who took to Twitter to enquire about the cryptocurrency.