Bitcoin and the entire cryptocurrency market hit new lows at the end of June with mainstream news outlets this weekend reporting the “Bitcoin bubble” had finally burst. But it hasn’t, Bitcoin appears to be back with a price rebound.

Some are saying the rally is due to Coinbase’s institutional product launch, the Coinbase Custody service. The new product aims to provide secure storage of crypto assets for institutions in the US and Europe initially.

One of CoinJournal’s favourite analysts Mati Greenspan of eToro is not so sure:

“As we know, markets don’t move on news. They move on volumes.”

Greenspan looked closer and found the surge experienced by Bitcoin coincided with volume surges in USD and Japanese yen “just before the opening bell on Wall Street.”

The analyst says it’s “not clear” how much the increase in Bitcoin trading volumes can be attributed to the news of the Coinbase Custody launch and how much is “simply a well-timed coincidence.”

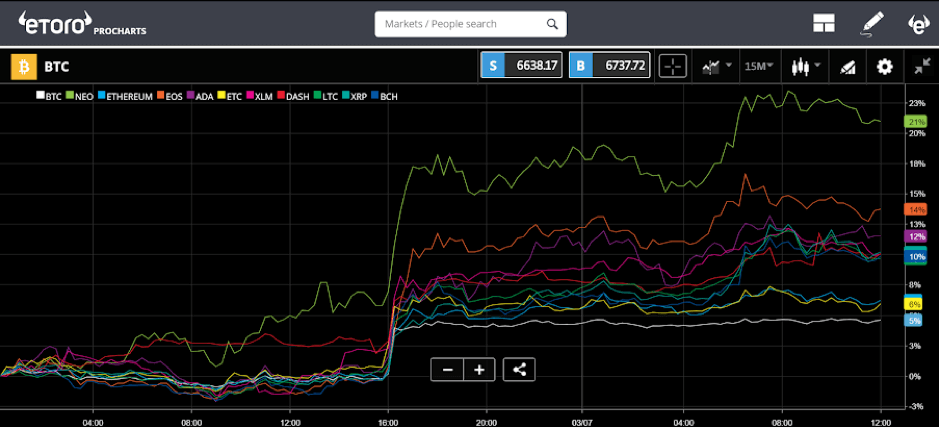

What Greenspan did find interesting was the surge in NEO price, though he didn’t offer an explanation. NEO is the green line on the graph below and the volume surge coincides with that of Bitcoin.

At the time of writing, Bitcoin is hovering around $6,500 USD. NEO is still seeing growth at just over 4% in the last 24 hours and a price of $37.05 USD, up from lows of $27.53 USD at the end of June.

At the time of writing, Bitcoin is hovering around $6,500 USD. NEO is still seeing growth at just over 4% in the last 24 hours and a price of $37.05 USD, up from lows of $27.53 USD at the end of June.

So, what is happening with NEO? Similar to Ethereum, NEO enables the creation of smart contracts and Dapps and has been called the “Ethereum of China”.

NEO’s community of open-source designers and developers are working hard to bring new NEO projects to market. Some believe that NEO’s blockchain is perfect for hosting decentralized exchanges. Such a development is much desired by the cryptocurrency community as it fits with cryptocurrency proponent’s decentralized goals.

NEO’s partner project Ontology launched a successful mainnet over the weekend. Ontology is supported by NEO and the move to its own blockchain certainly benefits Ontology, so it may be having a knock-on effect for NEO too.

Positive movements from the Chinese government towards blockchain, in the form of a number of state-funded research projects, may also benefit NEO long term as it’s one of the leading blockchain and smart contracts platforms in China.

The combination of news may well be prompting investors to buy NEO. It’s not all doom and gloom for other coins too. Right now, Cardano is still seeing over 6% growth after yesterday’s surge and many of the smaller coins by market capitalization are still showing green, with percentage price increases of anywhere between 0 and 9%.