Bitcoin bulls are now looking to defend $9,000 after a strong seller rejection at $9,500 saw prices drop to lows of $9,100 Friday morning

Bitcoin could drop to lows of $8,000 if bears have their way over the weekend. This picture comes into play following an attempt by bulls to break above $9,500 was met by stiff selling pressure, eventually pushing prices to lows of $9,100.

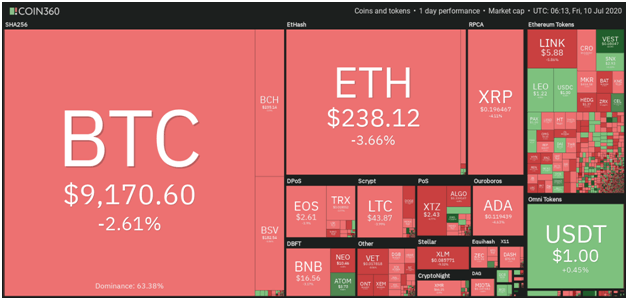

At the moment, Bitcoin is trending bearish as is most of the crypto market, as shown on the map below.

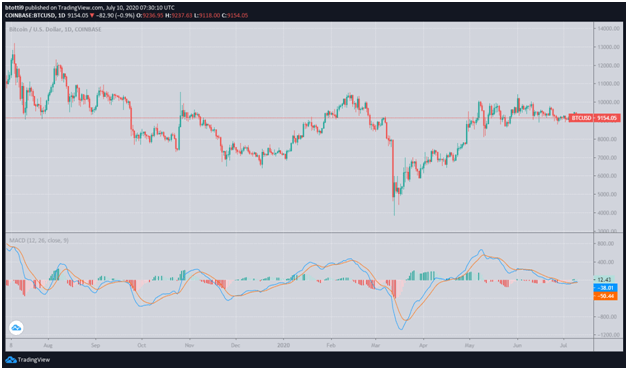

BTC/USD price will fall if bears break below triangle support

As observed on the weekly charts, Bitcoin’s Price surged to highs of $9,465 added to the optimism that sustained gains would bring $10k levels to the market.

Unfortunately, bears were having none of this, pushing the bulls back towards the all-important $9,000. With prices teetering just above $9,170 — a breakdown beneath a key symmetrical triangle will see bears take control.

Looking at the daily chart, Bitcoin bulls must prevent a break below $9,000, the lower limit of a symmetrical triangle pattern that has held prices in the $9,200-$9,500 range.

If the balance tips, increased sell-off pressure will likely see prices tank beyond $8,800. Failure to hold $8,600 could then see BTC/USD free-fall to lows of $8,000.

The bearish outlook will likely continue short term and the weekend could prove crucial to bulls. Working on thinning volume, the strategy is to defend the triangle boundary on the downside.

According to Bitcoin trader Polar Husk, bulls must hold the $9,200 support zone and look for a daily close above $9,300. If sellers have their way, the crypto risks descending into sideways trading, with a breakdown giving initiative to bears. It will also aid altcoins, which might begin to surge again.

Technical indicators that support the potential for a sideways trend include the flatlining RSI that is currently tracking the 50 line and the MACD, which is also trending the midline.

Traders are likely to benefit by keeping tabs on the volatility area, as rising levels may suggest the possibility of multiple traps by both the bulls and bears. For a bullish bias, traders should aim for sustained momentum, with higher lows to cut the bear advantage.