BTC price rose to highs of $18,483 before cooling off, though fresh sell-side pressure could see bears retest the $17,000 area

Bitcoin bulls are having yet another good day after pushing BTC price to highs of $18,483 in the past 24 hours. Over the past seven days, BTC/USD has surged by more than 15%, with this rally coming in the days since BTC/USD broke above resistance at $16,000.

Although prices could still dip, the market outlook suggests the path upwards might not flip until price hits a new all-time high.

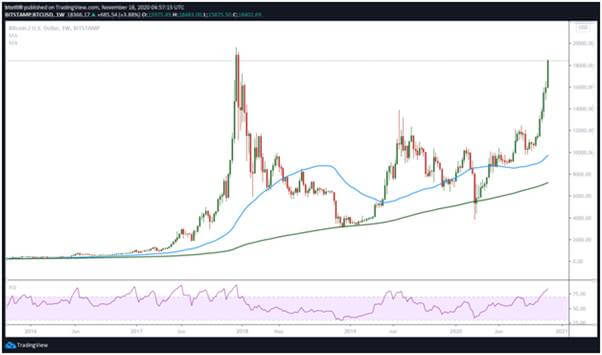

BTC/USD price weekly chart. Source: TradingView

BTC/USD daily chart

The daily chart shows that BTC/USD has broken above an ascending parallel channel. The next target is $19,000-$20,000.

But if downward pressure builds short term, Bitcoin price could drop to the 200-day simple moving average support. This outlook is strengthened by an overbought RSI, which means a pullback and then a period of consolidation could follow before the uptrend resumes.

Should bulls cave in to profit-taking deals, the immediate support line is at the 50-SMA near $15,000. Ceding further control to the bears will see bulls look to defend the previous breakout high near $12,000.

Bitcoin price daily chart showing BTC/USD breakout from ascending channel. Source: TradingView

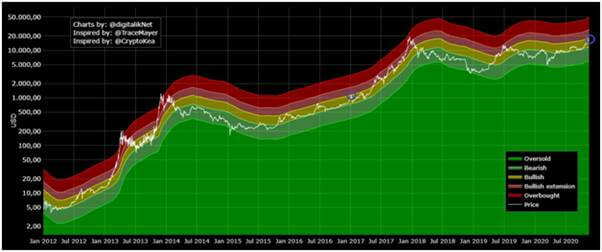

The Mayer Multiple metric, another indicator that places Bitcoin price in an oversold or overbought territory in relation to its 200-SMA, shows that the bellwether cryptocurrency is trending towards bullish overextension.

As per the chart below shared by one technical analyst, Bitcoin’s current Mayer Multiple value is 1.7 to suggest BTC/USD is trending near the top of a bullish band.

The analyst calls this price level “interesting,” noting:

“When BTC retested ATH in Jan 2017, the rejection was at 1,7MMayer (1156 usd): Top of bullish band. Today 1,7MMayer is at 18457 usd.”

Chart showing Bitcoin is trending towards bullish extension. Source: ParaboNICK on Twitter

But the current bull market for Bitcoin could be different from 2017 for one fundamental reason: the 2020 Bitcoin bull market is hoisted by an influx of institutional buyers as opposed to ‘FOMOing’ retail traders.

Therefore, while a pullback could yet see prices retreat to lows of $16,000-$15,000 short term, the fundamental strength indicates bulls will likely hit a new ATH before surrendering the initiative to the bears.

If BTC/USD rockets above $20,000, it could hit $22,000 short term before correcting lower.