Glassnode data shows that the hash rate on the Bitcoin network has reached a new peak

Bitcoin miners are having a good run at present as data from Glassnode shows the hash rate on the network is swinging around a new all-time high. The on-chain analytics provider pointed out that the average hash rate peaked this week, crossing 178 Ehash/s (exa hashes per second).

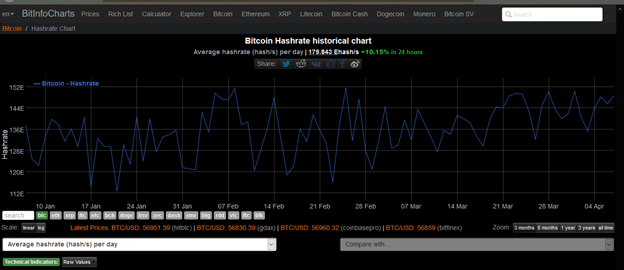

It is the first time the hash rate has touched a figure this high in Bitcoin’s history. Glassnode is backed by the crypto data aggregator site Bitinfocharts, which shows Bitcoin’s average hash rate is pacing a record high. The average hash rate on Bitinfocharts as of writing is 179.792 Ehash/s – up 10.15% in 24 hours.

The hash rate has only crossed 150 Ehash/s a couple of times this year prior to this current rise. The first time was on February 8th when it reached 151.32 Ehash/s and later on February 25th when it set a new peak of 151.5 Ehash/s. Last month, the hash rate topped the 150 Ehash/s mark once on March 28th when it shot to 150.8 Ehash/s.

Glassnode’s CTO Rafael Schultze-Kraft was first to point out the peaking hash rate among many other Bitcoin miner metrics, which he shared through a Twitter thread. Schultze-Kraft also revealed that Bitcoin mining had increased to a new high at the end of last week.

“In fact, #Bitcoin mining difficulty increased by 5.8% last Friday – to a new ATH as well. Difficulty is up 66% over the past year, and 24% YTD,” he wrote.

The on-chain analyst disclosed that miners raked in north of $50 million daily in March. He explained that they had been enjoying huge rewards as the current earnings are four times what they earned at the same time last year. Keep in mind, block rewards were reduced by half in May last year as a result of Bitcoin’s halving.

Schultze-Kraft further pointed out that miners are not selling their holdings; instead, they are hodling the mined coins.

“Are #Bitcoin miners selling? I don’t think so. We saw increased outflows in the run up to $40, but the miner position change has turned back positive. […] The #Bitcoin unspent supply has started to increase again after a quick and sharp drop of around 15k BTC at the beginning of the year. More hodling than spending.”