US regulators say BitMEX operated illegally and failed to implement AML rules on its Bitcoin derivatives platform

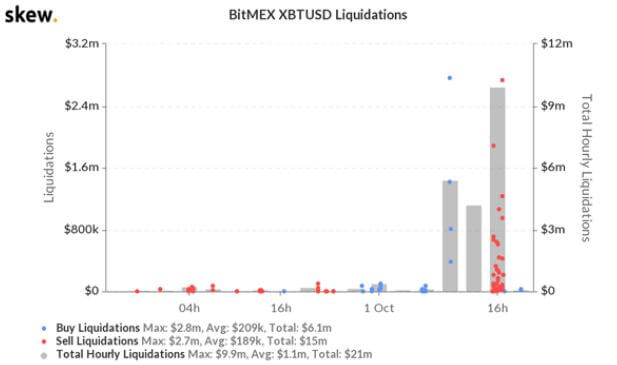

Bitcoin was trading around $10,854 on Thursday when news that US regulators had filed charges against BitMEX and arrested one of its founders broke. In less than two hours, BTC/USD plunged to lows of $10,420 on spot exchanges, pushed in part by over $15 million in sell liquidations on the crypto derivatives marketplace.

As of writing, 07:00 UTC on Friday, October 2, the top crypto has slipped underneath $10,400 before bouncing off to retest $10,500. BTC/USD is however still bearish and is about 3.30% off its 24-hour opening value.

The cryptocurrency is posting a 24-hour price range of $10,382-$10,669, with a week-long consolidation seeing it capped below the $10,600 line.

US regulators file charges against BitMEX

On October 1st, both the US Commodity Futures Trading Commission (CFTC) and the US Department of Justice (DOJ) filed separate charges against Hong Kong-based BitMEX. Also facing charges are the exchange’s founders Arthur Hayes, Ben Delo, and Samuel Reed.

The CFTC says BitMEX and its founders have been offering unregistered trading to US citizens, involving deposits worth over $11 billion and fee earnings exceeding $1 billion. Like the CFTC, the DOJ has accused the exchange of violating the country’s Bank Secrecy Act by willfully not implementing anti-money laundering (AML) rules.

But in a statement released shortly after the charges were announced, BitMEX said that it “strongly disagree[s] with the U.S. government’s heavy-handed decision to bring these charges, and intend to defend the allegations vigorously.”

The charges against BitMEX may well see other exchanges across the crypto industry face similar charges, something Arthur Hayes alluded to in a tweet tagged to Binance’s Changpeng Zhao, Tron’s Justin Sun, and SBF Alameda. Also likely to fall under the microscope are the many DeFi projects that recently zoomed into view with crazy earnings for enthusiastic crypto investors.

BlockTower Capital founder Ari Paul certainly believes so, though he said that DeFi might feel the heat 6-12 months down the line.

“The charges are serious and a half dozen other large exchanges are probably at risk of similar action. DeFi doesn’t win this short-term, but is very unlikely to face regulatory action in the next 6 months.”

He also believes that BitMEX could be the start of “negative regulatory” news for crypto.

“This will likely be the start of an ongoing string of negative regulatory headlines that scare new investors at the margin. But lots of value buyers are ready.”

BTC/USD capped around $10,600

Bitcoin price dropped from highs of $10,900 earlier in the week to trade around $10,600 before an extended reversal pushed it to lows of $10,382.

The sentiment is markedly bearish in lower time frames; with the 4-hour chart showing the price has dipped below the SMA 10 and SMA 50. These technical indicators are capping any potential upside, with bulls needing a break above the 100-day and 200-day moving averages at $10,699 and $10,750 to flip the trend.