Data from Bloomberg shows that institutional investors are more inclined to Bitcoin over Gold

The number of investors choosing Bitcoin over Gold has surged significantly lately, as per Bloomberg Intelligence findings. Bloomberg Intelligence’s senior commodity strategist Mike McGlone shared a Twitter post pointing out the same on Monday. McGlone’s post details a steep uptrend in the number of investors going for Bitcoin over Gold.

“Digital #Gold Pushing Aside the Old Guard – Gold will always have a place in jewellery and coin collections, but most indicators point to an accelerating pace of replacing the metal as a store of value in investor portfolios,” he wrote.

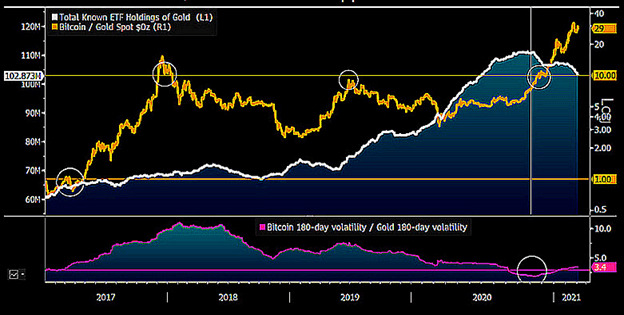

McGlone attached a snapshot of the technical, fundamentals support of the two assets.

The increasing influx to Bitcoin in recent months, as highlighted by McGlone, could be an indication that the flagship cryptocurrency is slowly taking over and could soon replace the precious yellow metal.

At present, the Bitcoin to Gold ratio is more than one. Meanwhile, Gold’s total known ETF holding has seen a gradual slump over the last few months. The volatility of Bitcoin to Gold, on the other hand, has recorded an uptick in the first quarter of the year.

Bitcoin remains to be one of the best performing assets globally. Earlier this week, Goldman Sachs revealed that the crypto’s 2021 returns had outstripped that of the stock market’s top-performing sector by a distance. The global investment bank reported that it had been keenly monitoring Bitcoin’s performance since the year started.

The bank further noted that Bitcoin’s year-to-date return figure (70%) was double that of Wall Street’s best performing sector, energy, whose return on investments stands at 35%.

In the last two months, the value of Bitcoin has leaped forward by a massive 75%. Several crypto analysts, including Anthony Scaramucci and Anthony Pompliano, believe the crypto asset is on its way to notch a price figure of 100k by the end of 2021.

Elsewhere, Gold is seeing losses for the second consecutive month this year. Last week on Thursday, the yellow metal market crashed as its price tumbled below $1700 for the first time in over nine months. The rising yield bond and stronger dollar provided bearish forces for the metal, which is currently trading at $1,712.19/oz.