BNP Paribas, a leading multinational bank and financial services company headquartered in Paris, has named the eight startups it had picked to join its fintech accelerator program run by L’Atelier BNP Paribas. The bank has selected blockchain startup CommonAccord in a hope to help grow the team’s solution into a “Center for Collaborative Law.”

CommonAccord is a project of James Hazard and Primavera de Filippi that aims at creating “a global template system of codified legal text” that integrates with smart contracts.

“The goal is to make the documents so modular that much of the text disappears, leaving parties with only specific deal points and clear relationships,” according to Primavera de Filippi, a research fellow at Berkman Center for Internet and Society at Harvard University. “These relationships can be ‘rendered’ at any time into full legal documents, for verification and enforcement.”

According to the CommonAccord website, “the legal code is part of a ‘distributed data model’ for transacting. Each participant has their own files stating their legal relationships and transaction histories with each of their partners. The files are private, under their control, shared and handled exactly as they want.”

“Participants transact by synchronizing files with partners. Synchronization can be done by git, blockchain, or any other method that the parties find satisfactory, even by email.

“Blockchain is a particularly important fit. Blockchain ‘smart contracts’ can automate routine transaction functions while the legal text provides a frame for legal enforceability.”

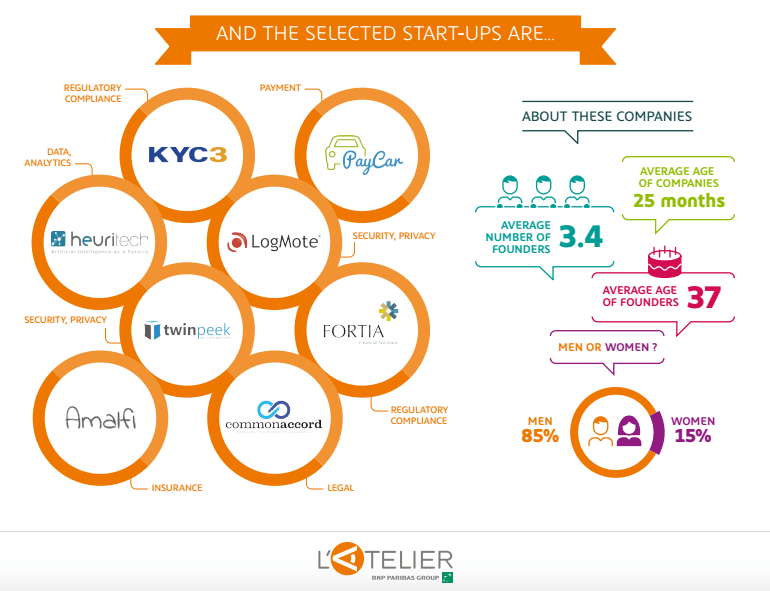

During the next four months, these eight startups will work in tandem with one of the bank’s businesses or service departments to develop products for the group. These products will need to meet specific needs expressed by the group’s various businesses in a number of areas including insurance, payments, customer experience, risk analysis and compliance.

Each of these startups are paired with one particular business or department of the group and will receive coaching in areas such as IT, marketing, business practice and fundraising from L’Atelier BNP Paribas Lab team. The teams each get 100k€ in funding.

According to Yoann Jaffré, Head of the Open Innovation Lab at L’Atelier BNP Paribas, 142 startups applied to take part in the program and almost one third of applicants were from aboard. This traction outlines that “banks and startups are natural allies in the process of rethinking banking and insurance services going forward,” Jaffré said.

Alongside CommonAccord, the selected startups and their pairing are:

Amalfi, France’s first peer-to-peer insurance broker, is paired with BNP Paribas Cardiff, the group’s international insurance company. Amalfi uses data-driven behavioral analysis and community management to enable customers to reduce their overall cost of insurance.

Fortia Financial Solutions, a French regtech company, is paired with BNP Paribas Securities Services. Fortia uses artificial intelligence, machine learning and collaborative intelligence to bring substantial changes in the way compliance is managed.

Heuritech, which is developing an easy-to-use platform of artificial intelligence solutions, is paired with BNP Paribas Personal Finance. Heuritech intends to design solutions to automatically turn all content (both multilingual texts and images) into actionable data.

KYC3, a startup that uses machine learning on unstructured Big Data to help businesses master regulatory and reputational risk, is paired with BNP Paribas Wealth Management.

LogMote, a startup that provides a unified authentication service that manages both legacy and cloud applications, is paired with BNP Paribas Retail Banking Division in France.

PayCar, a payment method designed to facilitate used car transactions, is paired with BNP Paribas Cardiff.

TwinPeek, a personal data protection and monetization platform, is paired with BNP Paribas Wealth Management. TwinPeek allows users to take full control of their online data and only share information they want to share anonymously and security while transacting, interacting or browsing on the Internet.