Bitcoin touched highs of $15,968 and looks locked for another high on the weekly close

Bitcoin has steadily increased its value against the US dollar, jumping above $15,000 to hit a high of $15,968 in the past 24 hours.

The impressive rally comes despite the uncertainty surrounding the 2020 US presidential election. Vote counting shows that Joe Biden is headed for victory against the incumbent Donald Trump, who has alleged voter fraud in key battleground states.

But Wall Street is rallying ahead of what analysts say will be a split US Congress. According to Reuters, this will likely curb any excessive government borrowing, an outcome that could see the need for an even bigger money printing scheme.

The Dow Jones Industrial Average and the S&P 500 both climbed nearly 2% to settle at 28,390 points and 3,510 points respectively. Bitcoin surged more than 12% in the past 24 hours.

BTC/USD strong above $15,500

Bitcoin has touched highs of $15,968 in early Asian trading this Friday, coming so close to breaching the $16,000 level. By all accounts, it’s looking like a good day for BTC/USD as the price hovers above $15,700. This week, Bitcoin is up more than 17%, adding roughly $2,000 to its value against the US dollar.

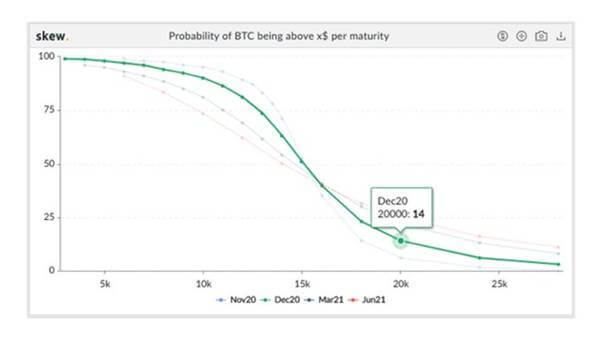

According to on-chain data analysis platform Skew Analytics, the probability that BTC/USD crosses the $20k mark by December 31, 2020, is 14% at current price levels. Notably, just a month or so ago, the odds of a run to the 2017 high happening this year were nearly 80% off.

From a technical perspective, Bitcoin looks overextended with the RSI pointing north of 80.00. However, interest in the asset is showing little signs of wavering with entities holding 100-1000 coins increasing their holdings to 13,990 unique addresses.

It is this increased buy-side pressure that initially saw BTC/USD break above a weekly range capped by the $12,000 resistance level earlier last month. As can be observed in the weekly chart below, the cryptocurrency has since printed higher-highs and looks unstoppable heading into the weekend.

If bulls achieve a higher close on the daily time frame, another leg up on the weekly close will be an encouraging signal that could see a decent run to a new all-time high crystallised.

On the downside, the 100 hourly simple moving average at $14,111 provides support. Bulls appear strong here, but any further dip should see the wall at the 100-SMA on the 4-hour chart at $13,433 absorb the downward pressure.