Chainlink’s price has climbed back above $8.00 and could retest the area around its all-time high of $8.48

Chainlink is trading 12% up today, as it looks to accumulate gains above the $8.00 price level following a brief lull.

As of writing, LINK/USD is trading at around $8.02, with various analysts projecting an upward trend similar to the one that took it to a new all-time high on Monday.

On-chain data supports price growth

The cryptocurrency has amassed over 170% in gains since the start of the year, with its latest surge taking it into the top 10 largest cryptocurrencies by market cap.

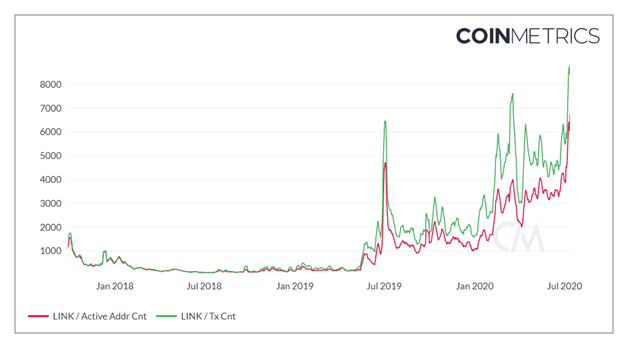

Data by CoinMetrics indicates that the number of active addresses has increased significantly to suggest growth in usage, while Sentiment shows that 64% of holders are in profit.

Chainlink is also benefitting from its use in the DeFi space, with increased demand likely to see the token’s price pump even further.

According to derivatives trader and Phemex.Trade partner, Cantering Clark, the only that will slow Chainlink’s momentum down will be a severe Bitcoin dump hard. In his opinion:

“If Bitcoin does not ruin the party, there is no reason why $LINK does not continue into double digits. It would be conservative even, considering we just broke out of a major range. 20$ + $LINK would not surprise me at all.”

Blackroots.com co-founder, Josh Rager, holds a similar view, stating that LINK/USD needs to hold support above $7.83, to make it possible for a retest of prices around the all-time high area. The support will see bulls rally to $9.00 and bring it closer to double digits.

“As long as Bitcoin holds, I don’t think LINK Marines stop until they get double-digit oracles,” he tweeted and shared the chart below.

Could a dump be on the way instead?

While many hold a short term bullish sentiment for LINK/USD and LINK/BTC, a section of the market is anticipating a move in the opposite direction.

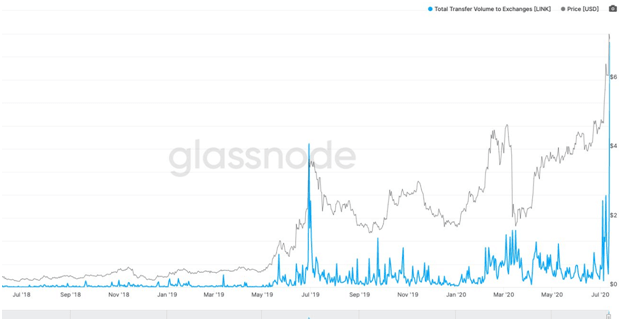

According to Cole Garner, Chainlink is likely to revisit prices in the $4-5 region. He points to the increased inflow of the token to exchange wallets, potentially a signal that large investors may be preparing for a pump before selling their holdings.

The trader shared the chart below by Glassnode.

The “off the charts” exchange inflows could thus see Chainlink prices jump to $8.50 before tanking to lows of $6.80 that formed support after the previous rejection above $8. A further decline puts sellers on course for a push to lows of $4.80.

Chainlink is currently the 9th largest cryptocurrency by market cap, surpassing Binance in 10th.