The expression of support could signal a change in the country’s treatment of the nascent industry

The Ministry of Information Technology and Communications (MinTIC) in Colombia has released its landmark draft for a guide to demonstrate ways the public sector can adopt blockchain technology, as well as integrate crypto payment-related matters.

The draft, entitled the Guide For The Use And Implementation of Distributed Ledger Technology (DLT/Blockchain) In The Public Sector, lays down the advantages and the disadvantages of using DLT in projects related to public entities.

The MinTIC also highlighted that the country appears to be “lagging behind” in the adoption of blockchain technology. The Ministry pointed out the disparity between the progress achieved by Colombia versus China, the United Arab Emirates, Canada, the US and countries in the European Union.

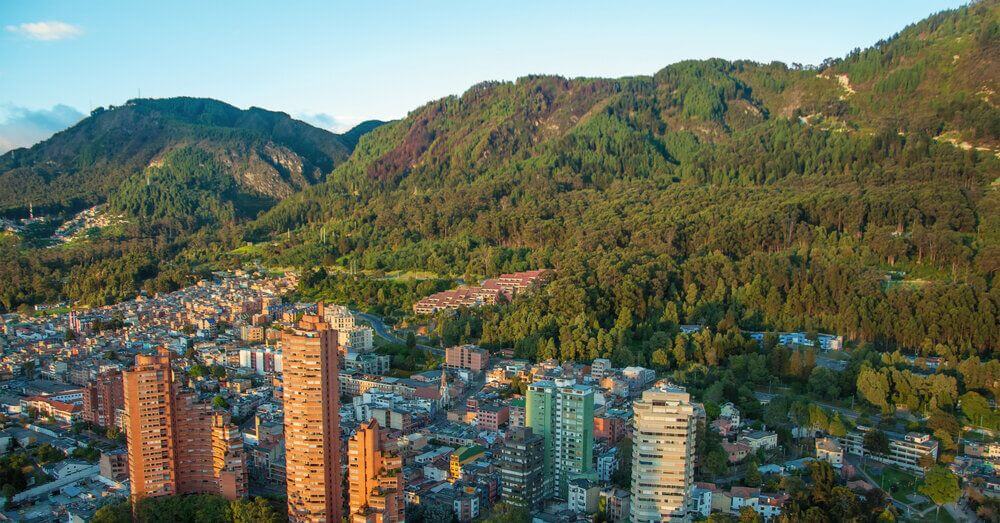

The guide, which was drafted by organisations such as ViveLab Bogota, Universidad Nacional de Colombia, Bogotá City Hall, and the National, proposed 10 solutions the country could work on.

The list includes the following sectors:

- Payments in crypto

- Land registration

- Voting

- Identity data management

- Supply chains

- Health records

- Business records

- Filing of academic degrees

- Management of taxes and public tenders

Solutions for these specific sectors would be geared towards removing the involvement of third parties within the security infrastructure and replacing them with blockchain technology. It is hoped that this would increase transparency and confidence with regards to data management.

The MinTIC has also devoted a section in the guide to cryptocurrencies, where the Ministry refers to Bitcoin’s whitepaper: Bitcoin: A Peer to Peer Electronic Cash System, first published in 2008 by Satoshi Nakamoto. The guide quoted that the solutions stated are meant to “ensure the consumers’ protection who invest in cryptocurrencies”.

The Colombian Government has made several attempts to regulate the local crypto environment; however, they appear to be struggling with its implementation. Some attribute difficulties in regulation to disdain for the digital assets, particularly within the Superintendencia Financiera de Colombia (SFC).

In 2018, the SFC released a series of notices that warned citizens about the risks of trading in cryptocurrencies. This announcement alarmed banks around the country, and accounts linked to cryptocurrencies were swiftly closed. It also crippled the capacity for cryptocurrency startup, Buda.com, to fully launch.

In 2016, a Colombian crypto exchange named Colbitex set up and shut down in less than a week, claiming that authorities had prevented them from operating.