- Crypto and stocks reacted negatively to comments about US inflation by Fed Chair Jerome Powell.

- Bitcoin traded to lows of $22,120 while the S&P 500 fell 1%.

- Investors are now likely to turn their attention to the next Fed meeting in March.

Cryptocurrencies fell early Tuesday, with Bitcoin trading towards support around $22,100 on broader market reaction to comments from Federal Reserve Chair Jerome Powell.

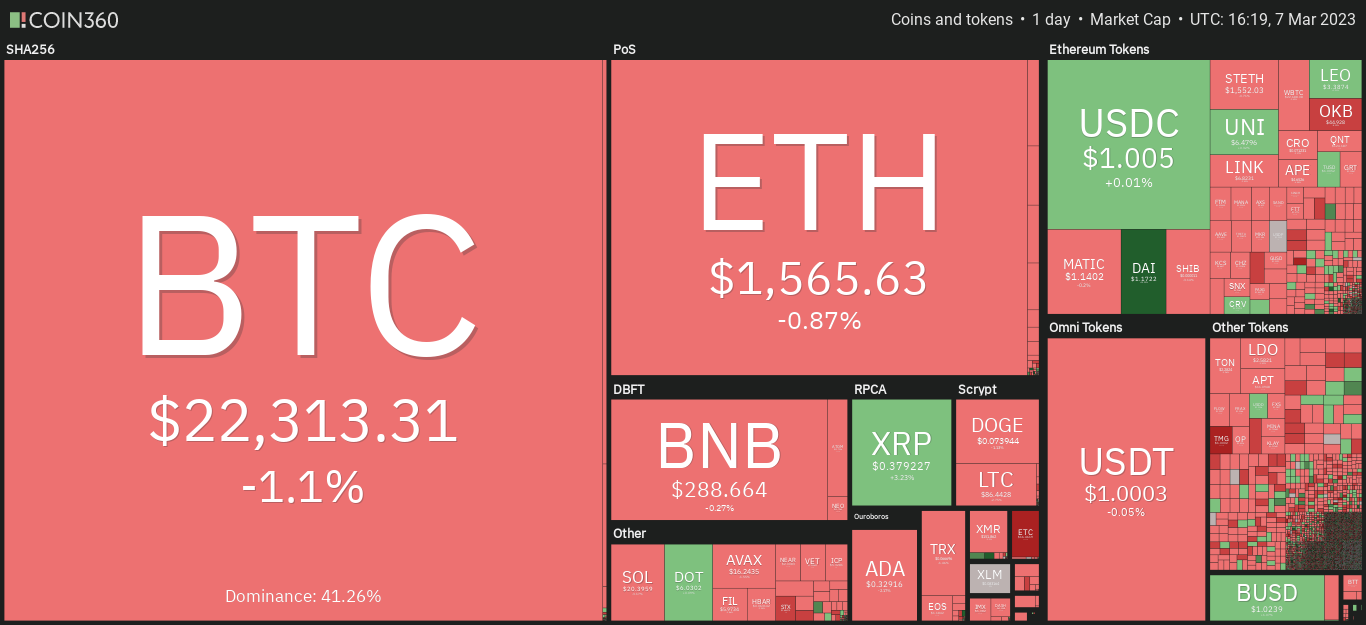

Coin360 crypto map showing price dump after Powell’s remarks. Source: Coin360

Coin360 crypto map showing price dump after Powell’s remarks. Source: Coin360

The reaction also saw US stocks slip after Monday’s gains, with investors appearing to have been spooked by Powell’s remarks on interest rates.

Crypto, stocks fall on Fed Chair remarks

Powell was on Tuesday making his first of two appearances before US Congress – first at the Senate Banking Committee and on the second day, at the House Financial Services Committee. The central bank’s monetary policy, particularly on inflation, is a key element of the Fed Chair’s prepared testimony.

Notably, Powell told lawmakers that it is possible the Fed will look to raise interest rates further given recent economic data that came in hotter than expected. According to the Fed, these sets of economic metrics suggest interest rates could still go up. This, he noted, will be warranted if outlook indicated there’s need for faster tightening.

Following the news, crypto, stocks and bonds reacted lower as the dollar index rose. Bitcoin touched 24-hour lows of $22,120, while Ethereum fell to support near $1,540. Across the stock market, the S&P 500 dropped by 1%, while the Dow Jones Industrial Average and the Nasdaq Composite shed 0.6% and 0.9% respectively.

Economist Mohamed El-Erian pointed out the market’s reaction and what Powell’s testimony projects.

So much for the repeated dovish mentions of disinflation at the last press conference#Fed Chair Powell's prepared comments now tilt to the hawkish side, including the quote below that will go viral#Stocks and #bonds sell off as they wait for his responses to Senators' questions pic.twitter.com/xOozIXczam

— Mohamed A. El-Erian (@elerianm) March 7, 2023

While markets might see a swift bounce from the losses, investors are likely to remain jittery ahead of the Fed’s next policy announcement expected on 22 March, 2023.