LLOYDS bank has stepped into prevent its customers from buying bitcoin and other cryptocurrencies on their credit cards as the markets tank amid a tightening of regulation.

Customers from Lloyds Bank, Bank of Scotland, Halifax and MBNA are being prevented from using their credit facilities to access the markets.

A spokesman for the bank refused to say whether the ban was likely to run for a long period insisting: “We continually review our products and procedures and this is part of that.”

Market Capital Plummets

The news comes as more than £130 billion was wiped off the cryptocurrency markets in the past week.

A flood of coins on the crypto exchanges combined with a tightening of regulation in China and South Korea has led to a massive devaluation.

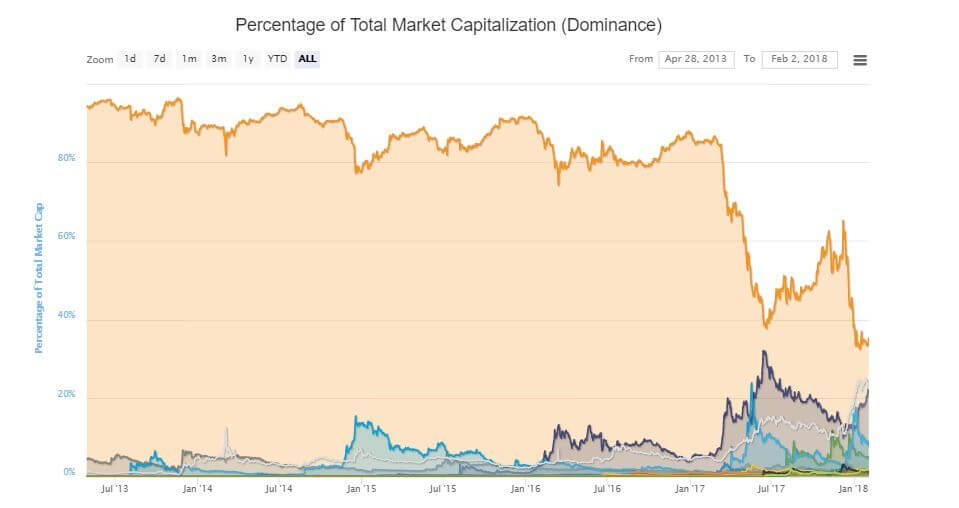

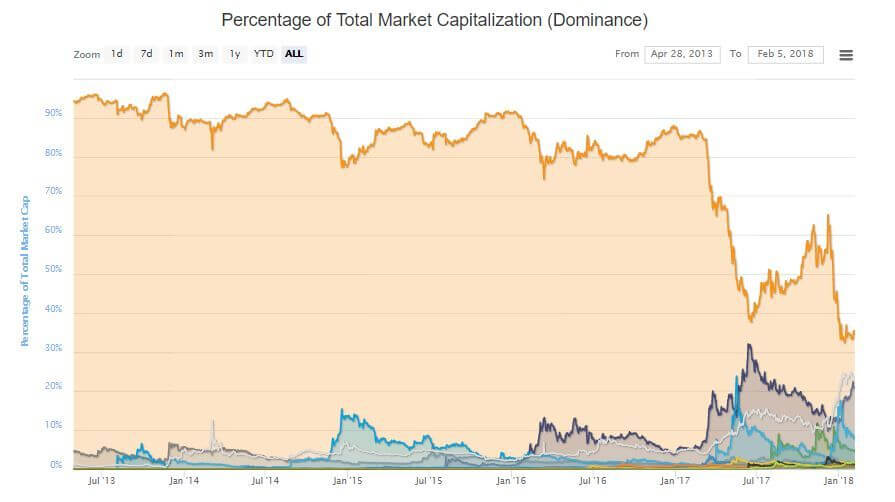

And while the markets are tanking across the board bitcoin is increasing its market share despite vast losses.

Bitcoin is increasing its dominance in the market and has gone up 1.5% over the past few days.

Total market capitalisation was $5.71 billion last week but has plummeted to £3.79 billion this week.

South Korea regulation weighs on markets

The news comes just days after South Korea stepped into prevent foreign customers from buying coins after China implemented new rules and regulations for its domestic market.

The Lloyds ban was implemented two weeks after UK banking customers are being forced to wait for weeks to recoup money after a German bank stepped in to prevent them from buying cryptocurrencies.

Commerzbank is blocking customers of the UK’s Nationwide bank from transferring funds to buy cryptocurrency from trading website Coinbase over its rejection of bitcoin.

Nationwide Bank uses Germany’s Commerzbank for SEPA transfers but has implemented a ban on bitcoin and other crypto transactions.

That’s left consumers furious that payments made from debit cards direct to the holding Estonian bank AS LHV Pank have not been returned.