While many of the cryptocurrencies that exist today will vanish for lack of any real demand, state-sponsored cryptocurrencies will become reality in five years time, according to Deloitte.

In a new report, entitled ‘Banking reimagined: How disruptive forces will radically transform the industry in the decade ahead,’ Big Four consulting firm Deloitte details how it envisions the future of banking and capital markets in the next five to ten years.

The document addresses how innovations including artificial intelligence and machine learning, blockchain technology, collaborative ecosystems and cryptocurrencies, but also other demographic and customer behavior trends, will come together to influence the future of banking.

Deloitte, which qualifies blockchain technology as “possibly the most disruptive [innovation] of all,” argues that distributed ledger technology has the potential to transform many aspects of our financial architecture, and most particularly disrupt the US$26 trillion payments industry.

The technology promises vast efficiencies, notably by speeding up transactions, diminishing transaction cost, and cutting off middlemen. Deloitte predicts that private, permissioned blockchains could become common, with payment processors and banks owning and operating multiple private blockchains to facilitate a range of payments.

Blockchain-based payment systems should gain significant transaction volume by 2020, while an uber-blockchain industry utility, on the scale of The Automated Clearing House, will likely be a reality closer to 2025.

The firm argues that “bitcoin and other digital currencies will likely enter the mainstream.” However, mainstream adoption will need two prominent factors: the adoption of standards and compliance with global regulatory frameworks, and interoperability between blockchains.

The report echoes a document the firm released last month that named the eight tech trends the firm believes will fundamentally change how we conduct business. These technologies include the blockchain, augmented and virtual reality, the Internet-of-Things and Big Data.

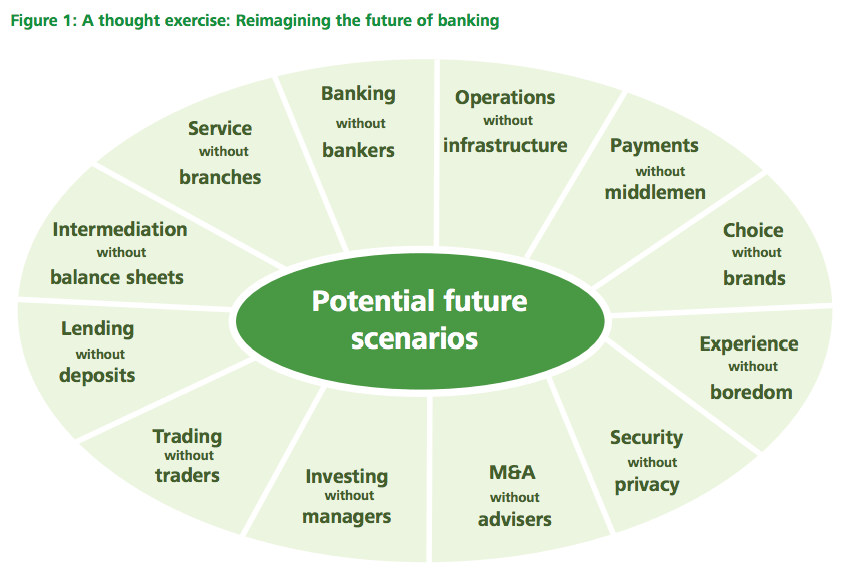

Banking is going to look a lot different in 10 years time, Deloitte says, and already, many traditional players face the choice of either being disintermediated or proactively disrupting their own business models to thrive in the future.

“No one can deny that many aspects of banking and capital markets are being attacked by new competitors, whose chief weapon is an ardent belief in the power of technology to upend conventional wisdom and transform banking,” it says.

“The scale of this assault on industry incumbents from different vantage points is quite staggering. There are literally thousands of start-ups all over the world focused on perceived vulnerabilities of traditional institutions.”

Deloitte envisions the financial services industry with a vastly different competitive landscape, with new entrants gaining prominence while many incumbent firms will have to change their strategies to compete and stay relevant.

“There will be greater industry fragmentation and blurring of industry boundaries, with financial service increasingly offered by an emerging breed of nonbanks,” it says.

All in all, increased competition and continuing technological advances will result in greater automation, greater efficiencies, and improved customer experience.

Other technological advances that should impact the banking and financial services industry include machine learning and artificial intelligence which, when combined with blockchain technology, have the potential to increase automation and enable faster clearing and settlement cycles.