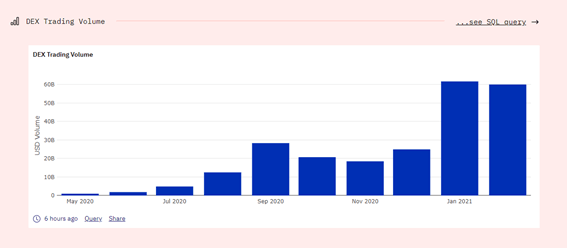

February’s DEX volume figures are looking likely to surpass January’s $3 billion high

Decentralised exchanges are set to record higher monthly volumes this month than they did in January. The monthly volume figures are currently closing in on the January high with a few days still left to the end of the month. The DEX volume will set a new high if it exceeds last month’s.

DEX trading volumes on Ethereum reached $63 billion in January – breaking the previous high that was less than half the current figure at $28 billion. The uptrend in trading volumes has continued this month, notwithstanding, the high gas fees on the blockchain. It seems, in all probability, the Ethereum-powered decentralised exchanges will set a new record.

As of writing, decentralised exchanges have processed more than $60 billion. Blockchain analytics firm, Dune Analytics, foresees February’s DEX volume hitting $67 billion. This would translate to a 6.35% rise if the numbers pan out according to the prediction.

The collective January and February [so far] trading volume sum up to more than $123 billion. This is more volume than has been processed during all previous years combined according to the analytics firm.

Uniswap and Sushiswap account for the largest portion of the trading volume; collectively representing 65% of the current volume. Of the two, Uniswap is dominant, having posted a monthly volume figure north of $30 billion for the second consecutive month. It makes up for almost 50% of the market share, which is over twice of Sushi’s.

Uniswap retains this dominance even in the number of addresses that have made trades over the last seven days. More than 143,000 addresses have traded on the decentralised on-chain protocol. Its fork rival Sushiswap has recorded less than 9,000 addresses in the same period.

Many users have left Ethereum-powered decentralised exchange lately due to increasing transactional costs. The sector is, however, still going strong with the total value locked in DEXes still rising. Some of the migrating users have turned to Binance Chain’s Pancake Swap. PancakeSwap already hit a $1 billion market cap last week despite being in its early stages. The project is attracting a lot of attention thanks to the lower costs on the Binance Smart Chain.