In times of crisis, businesses and projects that show the greatest adaptability often have the best chance for survival. In this report, we look at ways that Ethereum is continuing to innovate in the face of a slowed global economy

Smart Contracts can help global economies to keep moving

Ethereum’s smart contracts system allows legal contracts to be agreed upon, enforced and amended by using Ethereum’s blockchain – potentially an invaluable feature if this lockdown continues into the foreseeable future, allowing the global economy to keep moving.

As contracts are fulfilled through automated processes, businesses will be able to continue as normally as possible.

This will be important for agreements that relate to set-periods of payment, legal preconditions that have run their course, and the capacity to notarise documents without the need for in-person legal verification.

In addition, parties to a deal may agree they want to put their contracts on pause, allowing them to do without the involvement of lawyers that may be unavailable while the rest of us are in lockdown.

Delivering the US stimulus package

eThaler, a project built on the Ethereum blockchain, this week was discussed by US lawmakers in relation to the stimulus plan to pay every American adult $1,200.

The idea is to allow the Federal Reserve to distribute ‘digital dollars’ directly to American workers, potentially saving huge sums of money in administrative costs – as well as minimising physical contact for postal workers.

The news is polarising, however. On the one hand, US lawmakers talking about using a blockchain and mentioning the Federal Reserve in the same sentence is a significant moment for cryptocurrency projects, as it means that the technology is now being seriously considered as a means of monetary distribution.

However, the plan currently is to use central banks to distribute digital dollars. Crypto advocates will argue that the decentralised blockchains remove the need for a bank’s involvement at all.

Decentralised exchanges

In another exciting development, Ethereum has plans to launch a decentralised exchange (DEX) to allow for trustless swaps between Bitcoin and Ethereum.

Centralised exchanges are troublesome for crypto; they place power into fewer hands, and yet are the best place for traders to find reliable liquidity.

Vitalik Buterin, Ethereum’s founders, said “It’s embarrassing that we still can’t easily move between the two largest crypto ecosystems trustlessly.”

We should put resources toward a proper (trustless, serverless, maximally Uniswap-like UX) ETH <-> BTC decentralized exchange. It's embarrassing that we still can't easily move between the two largest crypto ecosystems trustlessly.

— vitalik.eth (@VitalikButerin) March 24, 2020

Suffice to say, Ethereum’s blockchain has already demonstrated its blockchain is capable of hosting an exchange, as seen this week by Uniswap’s announcement it is launching its V2, a DEX that has proven the liquidity issue can be solved.

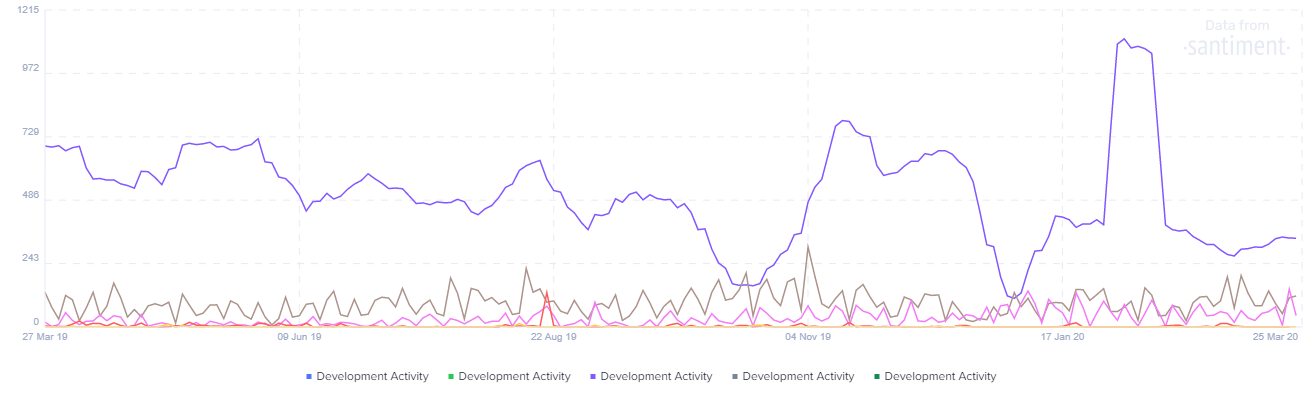

Ethereum’s Developer activity is much higher than other cryptocurrencies

Backers of Ethereum will be quietly confident that ETH will come out swinging after the virus slows down when looking at the above chart, from GitHub – the open source development tracker that cryptocurrency projects use to coordinate development.

The purple line shows Ethereum’s development activity over the last year. As can be seen, developer activity has been much higher than other cryptocurrencies – showing that the project has been advanced and refined to a greater extent than others.

Also significant for the second largest cryptocurrency, is that the recent outbreak of Covid-19 has not seen a significant decline in developer activity – showing there is resilience for the team to adapt to new situations.

Ethereum 2.0 audit reveals new development areas to pursue

Despite the outbreak and its team working remotely, Ethereum is still working hard on the second iteration of its protocol: Ethereum 2.0.

Recent developments are the conclusion of an audit by Least Authority, a security consultant specialising in cryptocurrency projects.

The audit claimed to have found some security issues related to the block proposer system and the P2P messaging system.

The development team have vowed to take the feedback forward for improving the stability of the protocol, as shown in this Tweet by 2.0 researcher, Danny Ryan:

Thank you! It was a pleasure to work with @LeastAuthority on this 🙂

Now time for multi-client testnets and our Phase 0 bug bounty program. More details very soon https://t.co/ng9wHqTE0V

— dannyryan (@dannyryan) March 24, 2020

Audits like this are important for developers and show a good maturity in development processes; good feedback from third parties can be crucial for ironing out problems.

The audit also pointed out some positive elements of the upcoming upgrade, finding the specs “very well thought out and comprehensive.” This highlights that Ethereum will soon be the first proof of stake protocol that uses sharding – a process that allows the blockchain’s database be broken down into smaller chunks.

In summary, the coronavirus has impacted many businesses in a myriad of ways, but Ethereum looks likely to steer the course and come out stronger at the other side.