Filipino bitcoin startup Satoshi Citadel Industries (SCI) has announced a new blockchain-powered product that allows people to send and receive money digitally without an Internet connectivity.

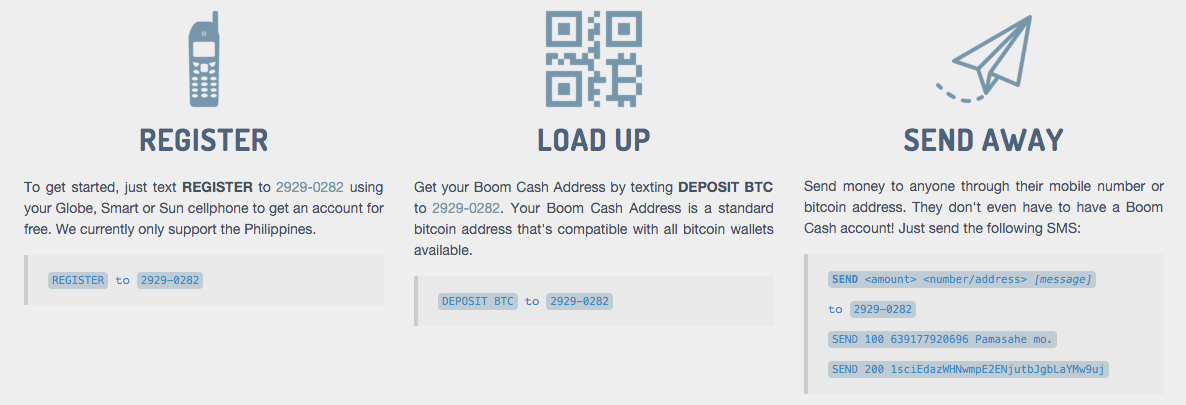

Called Boom Cash, the new service is the result of an internal hackathon and the latest project to graduate out of SCI’s labs. With Boom Cash, SCI seeks to enable offline populations to easily send and receive payments via an SMS-based wallet.

Powered by blockchain technology, Boom Cash, currently on Alpha version, sends and received in bitcoins, and keeps one’s funds in Philippine Pesos.

According to John Bailon, SCI’s co-founder and CEO, “Boom Cash combines the latest in payments technology with the tried and tested communication medium, which is SMS,” he told DealStreetAsia.

“Using the latest technology and our extensive hands-on experience on the field, this new product is the result of our desire to find solutions for every problem we encounter in our market,” Bailon said.

The Philippines has been slow off the mark when it comes to mobile Internet penetration. According to a survey conducted by On Device Research, smartphone penetration in the country is still at a low 15%. Although it is expected to reach 50% in 2015, the majority of Filipinos are still solely relying on basic cell phones.

‘Rebittances’

SCI is the largest bitcoin service provider in the Philippines. Its flagship product, Rebit.ph, is a remittance service that leverages the Bitcoin blockchain to allow users from all around the world to send money to their families and relatives in the Philippines.

In September, Rebit.ph teamed up with California-based global transaction network and mobile money transfer app ZipZap to tap into the US$2 billion Canada to the Philippines remittance market.

Unsurprisingly, SCI isn’t the only startup wanting to tap into the Philippines’ juicy remittance market. According to the World Bank, the Philippines is the world’s third remittance recipient in terms of volume, and received an estimated US$28 billion from abroad in 2014.

Another bitcoin remittance service is Abra, a California-based startup that raised US$12 million in a Series A funding round in September. Investors in Abra include American Express Ventures, Ratan Tata, Arbor Ventures, RRE Ventures and First Round Capital.

Led by Netscape’s former director Bill Barhydt, Abra’s money transfer technology leverages the bitcoin blockchain to provide users with a cheap and easy way to send and receive money using their smartphones.

Its remittance app is set to launch in the coming weeks to customers in the US and the Philippines, targeting most particularly the underbanked populations.

“Billions of consumers can’t easily access debit and credit networks for payments and money transfer,” Barhydt said in a statement, adding:

“Either they don’t have a bank account, they can’t use their bank or card details for online international transactions, they may be traveling to a place where they can’t use the local banking networks, or they are simply concerned about privacy and theft of their banking and payment credentials.

“Abra foresees the convergence of payments and money transfer for these consumers into a single, global digital cash network that addresses all of these problems.”

Image credit: Send money, Shutterstock.com.