Bitcoin is a digital asset and a peer-to-peer payment network operating on a cryptographic protocol. The concept was first introduced in 2008 when Satoshi Nakamoto published the now famous “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Bitcoin is created and held electronically and no one controls it. Bitcoin has several important features: it is decentralized, easy to set up, transparent, with very little transaction fees, fast and non-repudiable.

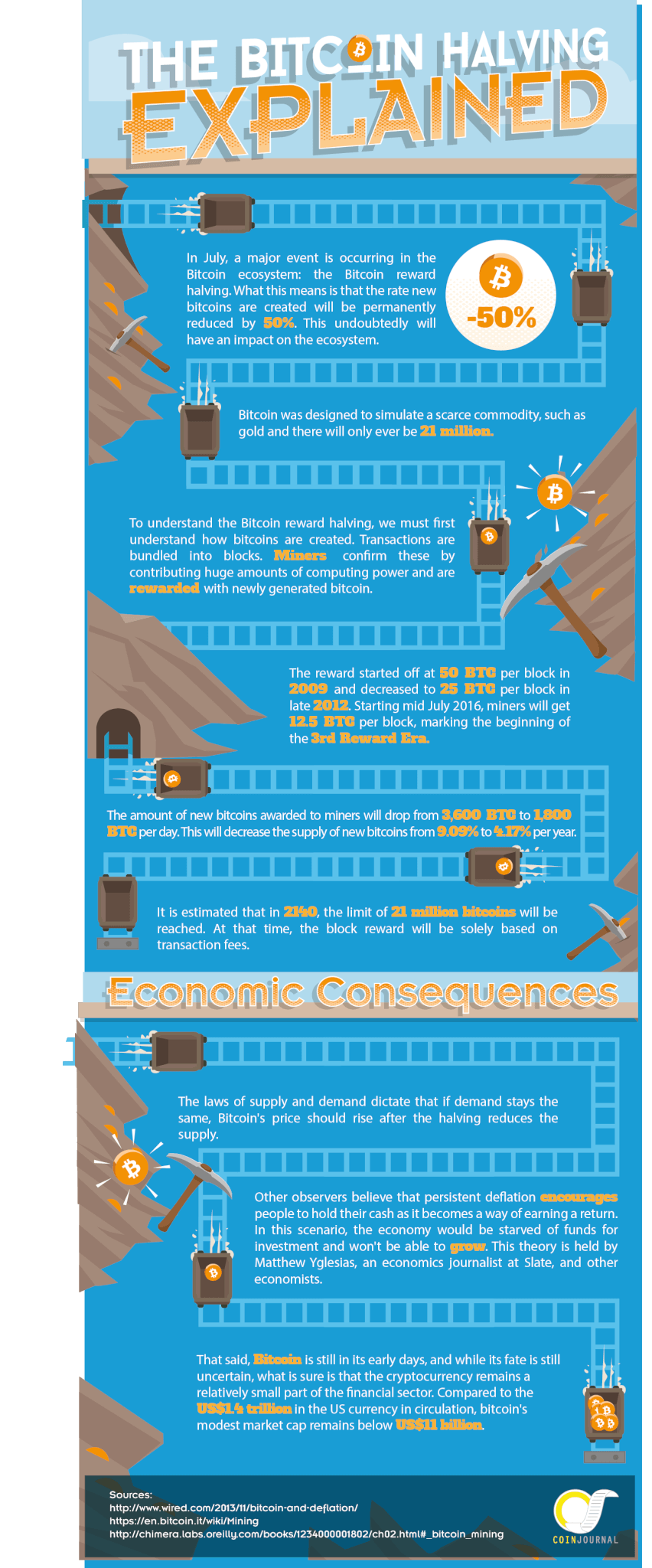

The Bitcoin protocol was designed to generate a defined number of units; 21 million bitcoins to be precise. The protocol dictates how much bitcoin will be released and when and how that supply is reduced over time. These attributes are aimed at reflecting those of a commodity such as gold.

How are bitcoin created

bitcoin are created through a process called “mining.” Mining consists in adding transaction records to Bitcoin’s public ledger of past transactions. This ledger is called the blockchain because it is a chain of blocks.

Mining is essentially a record-keeping service, and miners, who keep the blockchain consistent, complete, and unalterable by repeatedly verifying and collecting the newly broadcast transactions into new blocks, are rewarded with a set amount of newly created bitcoins and transaction fees.

Bitcoin’s code commands that every 210,000 blocks, the amount of new bitcoins created is cut in half. When Bitcoin was launched in 2009, miners were rewarded with 50 bitcoins per block. The reward was halved in November 2012 to 25 BTC/block when we entered the second reward era.

In a couple of weeks, the third reward era will begin implying that bitcoin reward will halve to 12.5 BTC/block. This event is called the Bitcoin reward halving, or “halvening.”

Since the Bitcoin protocol dictates that no more than 21 million bitcoins will ever be created, there is a point where miners will be solely rewarded by transaction fees.

Because the monetary base of bitcoins cannot be expanded, bitcoin has been widely classedas a deflationary currency. With the Bitcoin reward halving coming along, one may ask about the consequences of the event on the ecosystem.

Some observers believe that the shortage of bitcoins will ultimately lead to an increase of the price. Others argue that the Bitcoin reward halving will have no particular consequence since the event has been anticipated and that miners are well aware of it.

Miners stand to be impacted the most. The addition of new bitcoins comes at the expense of CPU time and electricity, but also business overheads, insurance and other charges that come along with powering a high-intensity data center.

Unless the price increases quickly, the halving would theoretically let miners stand to see their revenue fall by an equivalent amount, and could well result in some of them having to shut down their operations. One bitcoin mining firm has recently declared bankruptcy, citing the upcoming Bitcoin reward halving.

Read our Bitcoin halving explained infographic below: