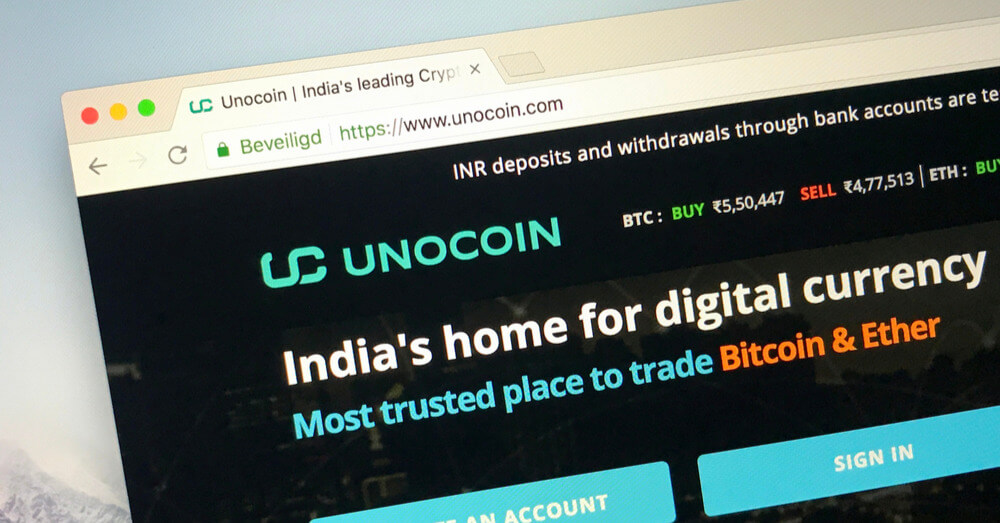

Unocoin claims to be the India’s first cryptocurrency exchange

Tim Draper, the American billionaire, has announced his decision to invest in the Indian crypto exchange firm, Unocoin.

Unocoin, which has made claims that it is the country’s first cryptocurrency exchange, is planning to give its offerings an upgrade after the Reserve Bank of India (RBI) repealed the nationwide ban on digital asset trading.

Sathvik Vishwanath, the CEO of Unocoin, highlighted the astronomical growth of the emerging industry in the months that followed the repeal.

“We’ve seen a dramatic increase of crypto adoption in India following the lifting of an industry-wide ban by the Reserve Bank of India enacted in 2018. Customer growth rates have surged by more than ten times in the month the Supreme Court verdict was announced, accompanied by a five times increase in trading volume in subsequent months,” Vishwanath explained.

Tim Draper’s Draper Associates, with the participation of XBTO Ventures and 2020 Ventures, led the $5 million round, and took the crypto exchange’s valuation to $20 million.

The startup crypto exchange already has an idea of where their funding will be funneled into. It is planning to use the funds to scale operations, build a stronger tech team and upgrade its product infrastructure.

“The funding will help us scale our business further and give us a strong financial foothold to expand our platform’s offerings. We will double down on our efforts to improve our product features and offerings, which will enhance the overall usability and functionality for our customers.”

Draper is one of the most prominent personalities of Silicon Valley. He is a billionaire entrepreneur who has invested in multiple tech giants, such as Twitter, Skype, Tesla and SpaceX. He is also in charge of the famous Draper University for entrepreneurs.

He recently expressed his excitement over the collaboration with Unocoin.

“We are so thrilled that the stars aligned and we could finally back Unocoin. Every Indian should have a Bitcoin account with Unocoin. It is a great way to do business in a currency that doesn’t devalue over time,” he explained.

Draper has other connections to businesses in India. The venture capitalist (VC) firm, Blume Ventures, had signed up with the Draper Venture Network.

Draper’s other VC firm, called Draper Fisher Jurvetson, previously had an Indian arm which invested in Reva, Cleartrip, and more. However, he sold the portfolio to NewQuest Capital Partners, a company based in Hong Kong, and exited the country in 2016.