It’s been a chaotic week in the cryptocurrency space, with yet another centralised firm – this time FTX – going under.

Against this backdrop, the all-important issue of custody of assets has been thrown into the limelight. I wrote a piece yesterday analysing how funds were flowing out of exchanges off the back of this, as investors have been spooked and run for the exits.

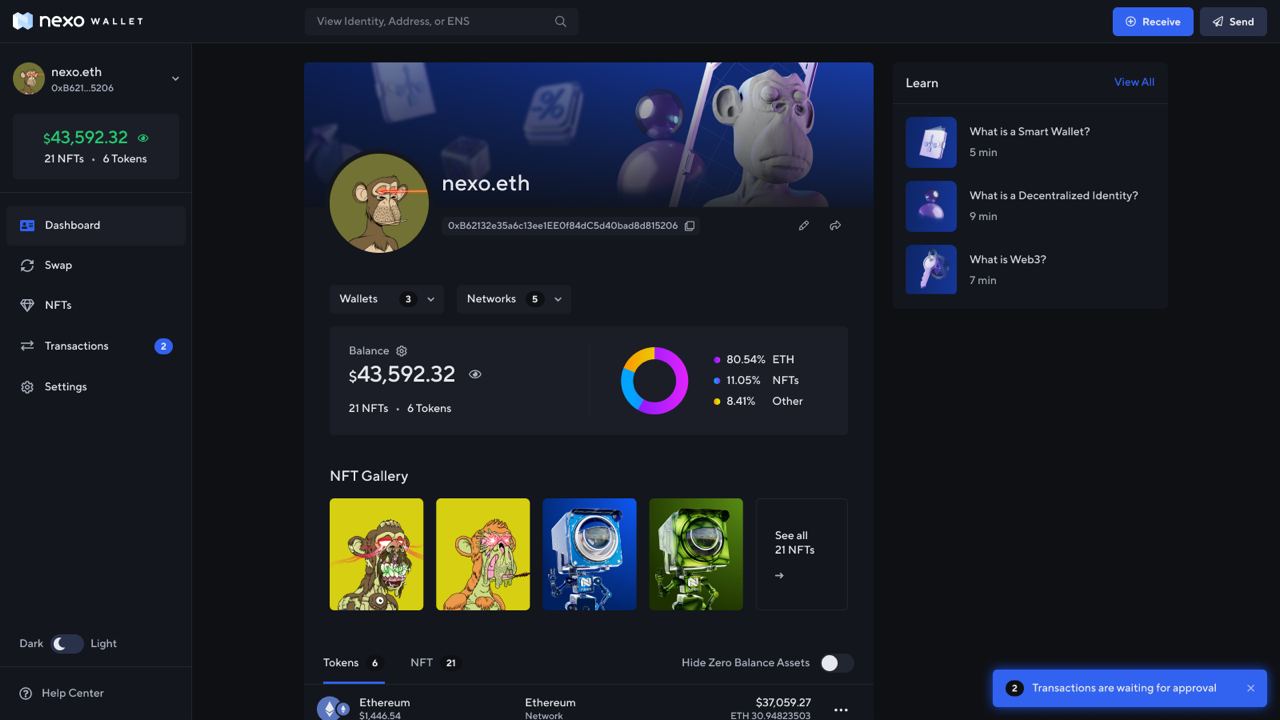

It is therefore interesting in this climate that Nexo, a crypto lending platform, has launched a non-custodial smart wallet. Currently in its pre-launch phase, the product is a self-governed option to send, receive and store and swap digital assets, and operates across five chains: Ethereum, Polygon, Binance Smart Chain, Fantom, and Avalanche-C.

We interviewed Product Owner Elitsa Taskova to get some answers on the announcement.

CoinJournal (CJ): Custody of crypto is obviously a hot topic following recent events in the industry. Do you think this may encourage adoption of this non-custodial wallet?

Elitsa Taskova (ET): Sure, definitely. Naturally, the Nexo Wallet has been in development since the beginning of the year. Аt Nexo, we wanted to make sure clients could choose the level of centralisation and decentralisation they wish to have when managing their funds.

We’re shooting for the stars and want to create Nexo 360º – an all-around offering that contains anything a person could need to manage their money. Secure, user-friendly, and non-custodial access to DeFi is a part of this package, as is the ability to manage your own digital identity without the need for an intermediary.

CJ: It is interesting that this wallet is launched to be compatible with multiple blockchains. How difficult was this to develop as opposed to, say, only launching on Ethereum?

ET: We will start by supporting a couple of EVM-compatible chains – that somewhat reduces the initial complexity, but we are also definitely looking into supporting other chains with the upcoming product releases, Bitcoin included. Moreover, we are currently assessing whether providing a multichain bridge is something we want to tap into to facilitate users’ needs when hopping around chains.

CJ: At the same time, Nexo is a centralised company. Many of your competitors have gone under in the last year. While this has nothing to do with Nexo, do you fear that capital will leave this space entirely, with Nexo – like a lot of crypto firms – suffering from a hit to crypto’s reputation overall?

ET: We believe that the capital is not what makes this industry valuable and worthwhile – it’s the innovation and blockchain’s potential to solve inefficiencies across various industries, including and primarily in finance, that brings value to the world. The space received numerous wake-up calls alluding to this throughout the year, and while we recover, what’s left is to do better, do more, and bring that innovation into our everyday lives.

Indeed the high levels of fear in the space are causing a lot of users to cut back on their crypto investments, but as always, once the volatility settles down, they will return. Just as they have done throughout former turbulences, for example, the initial COVID panic in early 2020. In the meantime, we’ll keep building the necessary infrastructure for them.

CJ: How frustrating is it to see overleveraged and mismanaged firms bring so much damage to the space, while you are trying to build and innovate?

ET: It is frustrating, but it hasn’t affected our zeal to keep building. If anything, it has fuelled our work for sustainable and compliant practices and products. It has eroded trust in cryptocurrencies and cast a serious shadow on the lending and financial management sectors within the digital assets space.

My colleagues and I naturally have sympathy for the numerous retail users affected by the recent concussions in the space. And yet, at the same time, Nexo’s fundamental business practices, risk management, and sustainable model have once again proven they can withstand such turbulence.

CJ: With both the wider economy and the cryptocurrency space struggling, how challenging is it to launch new products into such a market?

ET: In these moments, you have to be focused and keep on building, otherwise, we risk the long-term vision being obscured by short-term stressors. Аnd that’s an unhealthy way to build anything sustainable.

While participation in the crypto space can be hindered in severe market downturns, this hardly eliminates the need for and viability of a product like the Nexo Wallet. In other words, we’re never afraid of facing temporarily slower adoption when creating something that will outlive the current market cycle and bring immense value to end users.