The MIOTA token has lost against both USD and Bitcoin as sellers increase downward pressure

IOTA price has fluctuated heavily in the past 24 hours, recording values within the range of $0.97 to $1.13 as shown on crypto market data aggregator CoinGecko. The 48th ranked cryptocurrency is trading around $1.02 at time of writing, with a daily trading volume of over $90 million and market cap of $2.8 billion.

According to CoinGecko data, IOTA’s price is down 6.8% against the US dollar and 5.4% against BTC in the 24-hour timeline. Although bulls are battling to keep prices above $1 after today’s dip, the robust challenge they face at current prices suggests a fresh decline extending to 4 August lows of $0.82 is possible.

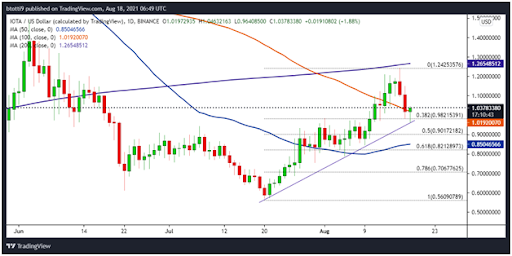

Here is how MIOTA/USD looks on the daily and 4-hour chart:

IOTA price technical outlook

MIOTA/USD 4-hour chart. Source: TradingView

On the 4-hour chart, MIOTA/USD is below the 50MA, but looks likely to attempt a new move after rebounding from an old horizontal support line. The contrary picture is nonetheless more likely given the RSI is languishing below 50 and a bearish crossover for the MACD suggests seller advantage.

The daily chart shows that IOTA price remains above a bullish trendline formed since the recovery from lows of $0.56 on 20 July. The uptrend saw bulls break above several crucial resistance zones, the first one being the 50-day moving average line. Price also moved past the 100-day moving average before bulls ran into headwinds near the 200-day moving average.

MIOTA/USD daily chart. Source: TradingView

The negative returns from the 200MA included a two-day plunge past the 100MA, with bulls’ attempts to keep shape thwarted by increased profit taking across the market. The outlook suggests that renewed downward pressure might finally push IOTA/USD beneath the support trendline. The scenario points to a potential retest of the 50% Fibonacci retracement level of the swing to $1.24, which would mean losses to $0.90.

From here, bulls are likely to regroup for another go, but if it fails, the 50MA ($0.85) and 61.8% Fib level ($0.82) should act as new demand zones.