Colu, a startup headquartered in Tel Aviv that develops localized digital currencies based on blockchain technology, has launched its second currency in the UK, the Local Pound, East London.

The launch follows the introduction in late-2016 of the Local Pound, Liverpool, which has allowed 16,000 residents to make purchases at local businesses including restaurants, fitness clubs, beauty shops and bars more conveniently via the Colu mobile app.

Like the Local Pound, Liverpool, the new digital currency aims at complementing the British Pound Sterling and provide locals with a medium of exchange that “facilitates a stronger and more sustainable local economy and community.”

Explaining what led Colu to pick these locations in the UK, Amos Meiri, CEO and co-founder of Colu, said:

“It’s because these areas have a unique combination of intense community pride, trendy new businesses and a bustling tech scene, making them the perfect places to build a new digital, local economy.”

He said that Colu was “about building communities from the wallet up, offering a way for locals to infuse their money with meaning by supporting local businesses — a win-win for everyone.”

“Small businesses are the backbone of the UK economy, and an investment in local businesses is really an investment in the residents of East London. By introducing the Local Pound, East London, we plan to change the way people think about money in the heart of the UK.”

Colu offers peer-to-peer and peer-to-merchant app-based payment platforms aimed at facilitating digital financial transactions at local businesses. It creates a closed-loop economy intended to bolster both the economic well-being and social fabric of the community, and strengthen the local economy.

Outside of the UK, Colu has created similar digital currencies in several places in Israel. It has also provided its technology to Bitt, a Barbados Bitcoin startup.

The partnership, formed in 2016, enabled Bitt to digitalize the local currency of Barbados by “coloring” a small portion of a bitcoin to create a digital asset that inherits all the technological benefits of the blockchain. This results in a fiat currency that has a digital equivalent that is linked in a 1:1 ration with a central bank issued currency.

Colu specializes in Colored Coins technology, a protocol introduced in 2013 that facilitates the creation and transfer of digital assets on the Bitcoin blockchain.

The method consists in associating real world assets with addresses on the Bitcoin network by “coloring” coins. Throughout the years, the technology has been applied to a broad range of use cases including crypto shares, real estate, healthcare, copyrights and government ledgers.

Earlier this month, Colored Coins introduced a new open source solution targeted at digital currency and token issuers. Called Bankbox and developed by Colu, the solution allows for the issuance and management of blockchain-based tokens and is intended at serving the growing community of developers and startups that are looking to raise funding through initial coin offerings (ICOs) and issue their own cryptocurrencies.

Bitcoin vs. altcoins

There are over 850 blockchain-based currencies and assets in circulation totaling a market capitalization of over US$112 billion, according to Coinmarketcap.

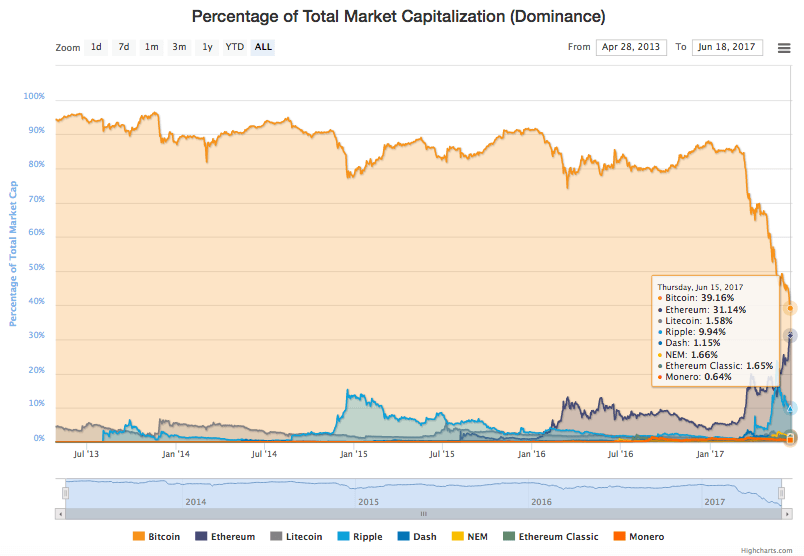

Since late-February, Bitcoin’s dominance in the cryptocurrency market has significantly declined as developers and startups are increasingly turning to Ethereum to launch their projects, fueling the price of ether, the native cryptocurrency of the network, to surge by over 6,500% since the beginning of the year.

Bitcoin’s market share shrank 63%, dropping from the 80-95% range of between 2013 and early 2017, to about 39% as of June 2017. Ethereum, which was introduced in mid-2015, is not far behind and currently accounts to 31% of the global cryptocurrency and crypto-based asset market.